Affordable group health insurance for small businesses is often seen as a luxury reserved for larger companies with deep pockets.

But what options truly deliver cost-effectiveness and flexibility for small business owners?

This comprehensive guide covers affordable solutions, including modern alternatives to traditional group health plans.

Some are traditional group policies with competitive premiums and robust coverage.

Some are innovative approaches like Health Reimbursement Arrangements (HRAs) that place spending control in employers’ hands.

Some are tailored benefits packages designed to match diverse employee needs.

Some leverage tax advantages and customizable allowances to keep budgets predictable.

Let’s dive right in.

TL;DR: What Makes Group Health Insurance Affordable for Small Businesses?

Small businesses can secure affordable group health insurance by exploring flexible options such as HRAs and customized plans that control costs while offering meaningful employee benefits.

Understanding the types of group coverage and the modern alternatives empowers business owners to choose plans that fit budgets and workforce needs.

What Exactly Is Affordable Group Health Insurance for Small Businesses?

Group health insurance is a health coverage plan that a business offers to its employees as a shared policy, often at a lower cost than individual insurance.

For small businesses, “affordable” means getting a plan or approach that balances coverage quality, employee satisfaction, and cost control.

This can be tricky since small businesses lack the purchasing power of large corporations, which often enjoy lower rates through volume discounts. However, today’s market offers diverse options that weren’t widely available even a few years ago.

Some of the most popular solutions include traditional group health insurance plans, Health Reimbursement Arrangements (HRAs), and voluntary benefits like wellness stipends.

Understanding these can help business owners create benefits packages that attract talent without straining budgets.

Traditional Group Health Insurance Plans

These plans are offered through insurance carriers and cover multiple employees under one contract.

Typically, employers pay a significant portion of premiums and sometimes share deductibles and coinsurance costs.

While traditional plans provide comprehensive coverage, they may present challenges for small businesses because premiums can increase annually, and plan selection is often limited by regional availability.

Health Reimbursement Arrangements (HRAs)

HRAs allow employers to reimburse employees tax-free for eligible medical expenses, including insurance premiums, up to a defined allowance.

There are different types of HRAs, such as Qualified Small Employer HRAs (QSEHRA) and Individual Coverage HRAs (ICHRA), designed specifically with small businesses in mind.

The flexibility of HRAs lets employers customize spending limits, control overall costs, and encourage employees to select insurance plans that best suit them on individual marketplaces.

This approach can lead to increased employee satisfaction by offering personalized choices while keeping employer costs predictable.

Why Is Affordable Group Health Insurance Critical for Small Businesses?

Providing affordable health coverage is not just a nice-to-have perk; it’s a strategic investment for small businesses.

Access to health benefits:

- Helps attract top talent in a competitive labor market.

- Improves employee retention, reducing turnover costs.

- Supports workforce health and productivity.

- Can offer tax advantages for both employer and employees.

According to a 2024 Employee Benefits Survey, 92% of employees prioritize health insurance when evaluating job offers. Not offering a competitive health benefit can mean losing valuable team members to competitors or facing higher recruitment costs.

Moreover, employers with 50 or more full-time equivalent employees are legally required under the Affordable Care Act to offer minimum essential coverage or face penalties, making affordable solutions essential for regulatory compliance.

Choosing the right affordable group health insurance plan or alternative benefits package allows small businesses to remain competitive without sacrificing financial stability.

How to Find Affordable Group Health Insurance for Your Small Business

Finding an affordable plan requires intentional research and understanding of both your company’s needs and the available options.

Step 1: Assess Your Business and Employee Needs

Begin by evaluating your workforce size, demographics, and their healthcare preferences.

Are your employees younger and healthy, or do they often utilize specialists? Are spouses and dependents typically covered?

Gather feedback through surveys or informal discussions. Knowing what matters most to your employees helps tailor benefits that they value and actually use.

Step 2: Explore Multiple Plan Types Including HRAs

Do not limit your search to traditional group plans only. Health Reimbursement Arrangements provide an opportunity to offer health benefits with more budget control and employee choice, as they let employees select individual plans on the marketplace.

Understand the types available:

- QSEHRA – Best for small employers with fewer than 50 employees who don’t offer group health plans.

- ICHRA – Allows larger small businesses to offer more flexible and varied reimbursements.

Learn more about how these HRAs work and how they can fit your business model through official government resources.

Step 3: Compare Quotes and Benefits Carefully

Don’t just focus on premiums. Review deductibles, co-pays, out-of-pocket maximums, network coverage, and exclusions to understand total potential costs and value.

Request quotes from various carriers and consider working with an independent insurance agency, such as Life Care Benefit Services, which partners with over 50 top-rated insurers to provide personalized options tailored to your budget and employee profile.

Step 4: Factor in Tax Implications and Legal Compliance

The tax advantages of group health insurance and HRAs can reduce costs significantly.

Employer contributions to employee health plans are usually tax-deductible. HRAs offer reimbursements without being counted as taxable income for employees.

Understand the minimum coverage requirements of the ACA if applicable to your business size, which can be supported by certain HRAs.

What Are Alternatives to Traditional Group Health Insurance?

Small business owners seeking affordable options often find traditional plans costly and inflexible.

Here are some alternatives:

Health Reimbursement Arrangements (HRAs)

We’ve discussed HRAs, but it’s worth emphasizing their benefits.

HRAs let employers set a fixed monthly allowance. Employees then purchase coverage that fits their personal needs. This personalized choice leads to higher employee satisfaction because coverage comes with flexibility.

HRAs also shield employers from the unpredictable premium hikes characteristic of traditional plans while still offering valuable health benefits to employees.

Voluntary Benefits and Wellness Stipends

Supplement traditional or HRA plans with voluntary benefits that often appeal to employees.

For example, wellness stipends can reimburse gym memberships, fitness classes, or wellness apps, promoting overall health and morale.

Health stipends may cover supplemental dental, vision, or prescription drug plans, allowing employees to fill gaps in primary coverage.

This approach helps employers offer meaningful perks without the full cost of comprehensive coverage.

High Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

A HDHP combined with employee HSAs is another affordable option that encourages employees to manage routine healthcare spending while providing a safety net for major expenses.

This pairing often lowers premiums, making it attractive for budget-conscious small businesses.

How Can Small Businesses Maximize Value From Group Health Insurance?

Offering group health insurance isn’t just about selecting the cheapest plan. It’s about maximizing value for your business and employees.

1. Emphasize Employee Education and Choice

Help your employees understand the coverage options available. If you offer HRAs, guide them on how to choose marketplace plans best suited for their needs.

Empowered employees make better decisions that improve satisfaction and lower overall costs.

2. Customize Benefits Packages

Offering a one-size-fits-all plan may leave some employees underinsured or overpaying for unused benefits.

Consider combining a group plan with voluntary benefits like dental, vision, wellness stipends, or even life insurance options with living benefits to build a tailored package.

3. Monitor and Review Annually

Health insurance markets change yearly. Reviewing your plans and employee feedback regularly helps you adjust offerings, ensuring continued affordability and relevance.

This will keep your benefits competitive and aligned with your business goals.

4. Leverage Technology and Expert Help

Use benefits administration software designed for small businesses to streamline enrollment, claims, and reimbursements.

Experts from agencies like Life Care Benefit Services can analyze your business profile and employee needs to recommend optimal solutions.

What Are Common Pitfalls to Avoid?

Even the best intentions can fall short without careful attention.

Don’t assume that the lowest premium is the best deal. Plans with low monthly costs might have high deductibles or limited coverage that shifts costs to employees.

Avoid offering benefits employees don’t value; solicit feedback often.

Watch out for compliance issues—your health plans must meet federal and state regulations to avoid fines.

Failing to explore alternative options like HRAs can lead to overpaying and missing out on tax advantages.

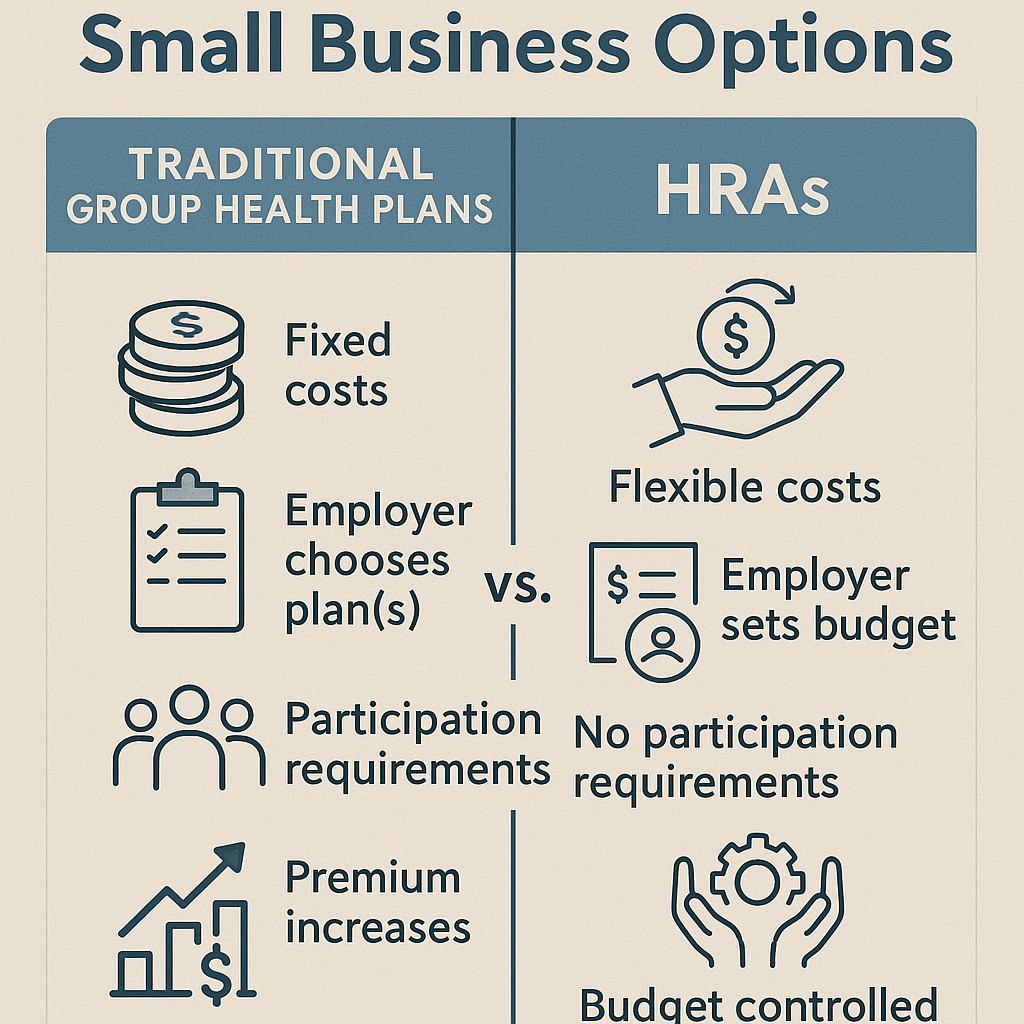

How Do HRAs Differ from Traditional Group Health Plans?

HRAs provide a fundamentally different approach. Instead of a pooled group plan with fixed premiums and limited choices, HRAs allocate a set spending allowance to each employee.

Employees can select personal insurance plans or pay for eligible expenses directly.

This shifts decision power from employer to employee while the employer controls costs.

A key benefit is that HRAs maintain the tax advantages of group health insurance but with significantly more flexibility for small businesses and their employees.

How Can Small Business Owners Get Started?

Start by assessing your workforce’s specific healthcare needs and budget limits.

Contact an experienced agency like Life Care Benefit Services to explore your options. They can explain the pros and cons of traditional plans, HRAs, and voluntary benefits based on your business size and goals.

Consider surveying your employees to identify which benefits they value most.

Once you have a clear picture, request multiple quotes to compare coverage, costs, and flexibility.

Finally, review legal compliance requirements such as the Affordable Care Act mandates and take advantage of tax benefits offered by different plan types.

Which Benefits Boost Employee Retention the Most?

Health insurance tops the list by a wide margin, cited by over 90% of employees as critical in their decision to join or stay with a company.

Offering tailored health benefits, including HRAs or group insurance plans, demonstrates that you value your team’s well-being.

In addition to health plans, wellness stipends, retirement options, paid time off, flexible schedules, and family-related perks are proven to increase employee satisfaction.

According to PeopleKeep’s 2024 survey, these benefits rank highly in improving loyalty and morale.

How to Choose the Right Insurance Agency for Your Small Business

Pick an independent insurance agency that offers:

- Access to multiple top-rated carriers, increasing plan options and competitive pricing.

- Personalized service focused on your unique business needs.

- Knowledge of tax and legal compliance issues relevant to small business owners.

- Support with enrollment, administration, and claims assistance for a smooth employee experience.

Life Care Benefit Services exemplifies these qualities by providing tailored group health insurance options and retirement planning for small businesses and families alike.

What Questions Should Small Businesses Ask Health Insurers?

- What plans do you offer that cater specifically to small businesses with varying employee needs?

- What are the premium costs and how do they change annually?

- Are there options to customize benefits or offer voluntary add-ons?

- How are prescription drugs, specialist visits, and emergency care covered?

- What support do you provide for compliance with ACA regulations?

- Do you offer plans compatible with HRAs or wellness stipends?

- Are life insurance or disability products available as part of the package?

How Does Affordable Group Health Insurance Impact Your Bottom Line?

Paying for employee health benefits can seem costly upfront, but smartly designed and affordable plans yield long-term savings.

Lower turnover rates reduce hiring and training costs.

Healthy employees take fewer sick days and are more productive.

Tax advantages mean the true cost is often less than the headline premium.

Furthermore, offering health benefits strengthens your company’s reputation, attracting skilled workers and clients who value social responsibility.

Ever wonder how a small business with just ten employees can compete for talent against big corporations? Offering an affordable and flexible health benefits package is a powerful answer.

Top Tips for Small Business Owners Offering Affordable Group Health Insurance

- Start Early: Begin planning your health benefits well before open enrollment to allow time for research, employee input, and vendor comparisons.

- Educate Employees: Provide resources and coaching so employees understand how to use their benefits effectively.

- Consider Hybrid Models: Combining affordable group insurance with HRAs and voluntary benefits delivers tailored solutions.

- Leverage Technology: Use benefit management tools to reduce administrative burden and enhance enrollment accuracy.

- Plan for Annual Reviews: Regularly revisit your benefits strategy and fees to maintain affordability and competitiveness.

- Partner with Experts: Independent agencies with a broad carrier network and small business focus bring invaluable guidance.

Frequently Asked Questions

- What qualifies as a small business for group health insurance?

- Generally, businesses with fewer than 50 full-time equivalent employees are considered small businesses under the ACA and can explore various group health insurance options, including HRAs.

- Can I offer health benefits without providing a traditional group health plan?

- Yes. Options like HRAs allow you to reimburse employees for individual plans and medical expenses, offering flexibility without a formal group plan.

- How do HRAs help with cost control?

- By setting fixed monthly dollars that employers reimburse for eligible expenses, HRAs cap the employer’s financial exposure and allow employees to choose plans that fit their needs.

- Are there tax benefits for offering group health insurance?

- Yes. Employer contributions are typically tax-deductible, and employee reimbursements via HRAs are generally not taxable income.

- What are some strategies to ensure employees actually value the benefits?

- Solicit employee feedback, provide educational resources, and offer customization options like wellness stipends and voluntary add-ons.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your small business’s health benefits strategy? For a deep dive into personalized insurance solutions, explore options with trusted professionals who understand your unique needs.

For more helpful advice and insight, visit our resource page to stay informed on health insurance and retirement planning topics.

Remember, affordable group health insurance small business owners can provide is within reach with the right knowledge and partners.

Start building a benefits strategy today that protects your employees and your bottom line.

To learn more about enhancing your small business benefits package with cutting-edge strategies, check out expert insights here on innovative content and planning approaches that might inspire broader business success.