Life insurance is a fundamental part of securing your personal and business future.

But what are the key ways life insurance benefits small business owners?

This comprehensive guide will walk you through the essential types, benefits, and strategies for life insurance tailored to small business owners.

Some are unaware that life insurance can protect against business debts.

Some are surprised that certain policies build cash value you can access while alive.

Some find that life insurance supports smooth ownership transitions.

Some understand it can fund key person protection, safeguarding operational continuity.

Some learn it offers group benefits that enhance employee retention.

Let’s dive right in.

TL;DR Quick Summary

Life insurance for small business owners secures both family and business interests. It can cover debts, protect key staff, fund buy-sell agreements, and provide living benefits.

Table of Contents

- Why Do Small Business Owners Need Life Insurance?

- Types of Life Insurance for Small Business Owners

- How Life Insurance Protects Your Business

- Living Benefits and Cash-Value Building Policies

- Group Life Insurance for Employees

- Using Life Insurance for Business Succession Planning

- Integrating Retirement Planning with Life Insurance

- Choosing the Right Policy for Your Business Needs

- Common Mistakes to Avoid

- Frequently Asked Questions

- What’s Your Next Step?

Why Do Small Business Owners Need Life Insurance?

Running a small business comes with unique risks and responsibilities. As a small business owner, you have personal and business debts, employees depending on your leadership, and a legacy you want to protect. Life insurance is often overlooked but plays a critical role in managing these risks.

First, life insurance ensures your loved ones are financially secure if something happens to you. According to recent studies, owners with life insurance feel significantly more financially secure than those without (source).

Second, life insurance can cover outstanding business loans or debts, protecting your family from being burdened with repayment responsibilities. Mortgages, credit lines, or startup loans can be substantial, and life insurance proceeds can help repay these obligations.

Third, life insurance supports business continuity. The loss of a key owner or employee can disrupt operations and cash flow. Life insurance can provide the liquidity needed to maintain business operations smoothly during such times.

Finally, life insurance can fund buy-sell agreements between partners, ensuring a fair and orderly transfer of ownership shares without financial hardship for surviving owners.

Are you confident your business could survive the unexpected loss of a key person?

Types of Life Insurance for Small Business Owners

Small business owners have several life insurance options. Understanding the difference helps you select coverage tailored to your needs.

1. Term Life Insurance

Term life insurance provides coverage for a fixed period—usually 10, 20, or 30 years. It’s the most affordable option and works well for temporary risks such as business loan repayment or young families’ needs.

This coverage can protect your business during critical growth phases or while loans are outstanding. However, it does not build cash value and expires at the end of the term.

2. Whole Life Insurance

Whole life insurance offers lifelong protection with a guaranteed death benefit. It also builds cash value over time, which you can borrow against or withdraw. This makes it a dual-purpose tool: protecting your family and providing financial flexibility for your business or personal needs.

Whole life policies usually come at higher premiums but offer stability and savings opportunities.

3. Indexed Universal Life (IUL) Insurance

A more flexible permanent life insurance option is Indexed Universal Life insurance. IUL offers adjustable premiums and benefits, plus potential cash value growth linked to an equity index like the S&P 500.

This policy can be an excellent choice for small business owners wanting to combine protection with investment growth and access to living benefits.

4. Key Person Insurance

Key person insurance is a policy taken out by the business on critical employees or owners whose loss would significantly impact the company’s operations. The business is the beneficiary. Proceeds can be used for hiring, training replacements, or offsetting lost revenue.

5. Group Life Insurance for Employees

Providing group life insurance as an employee benefit improves recruitment and retention. It also reflects your commitment to employee well-being.

(Verified with sources as of 2025-09-29)

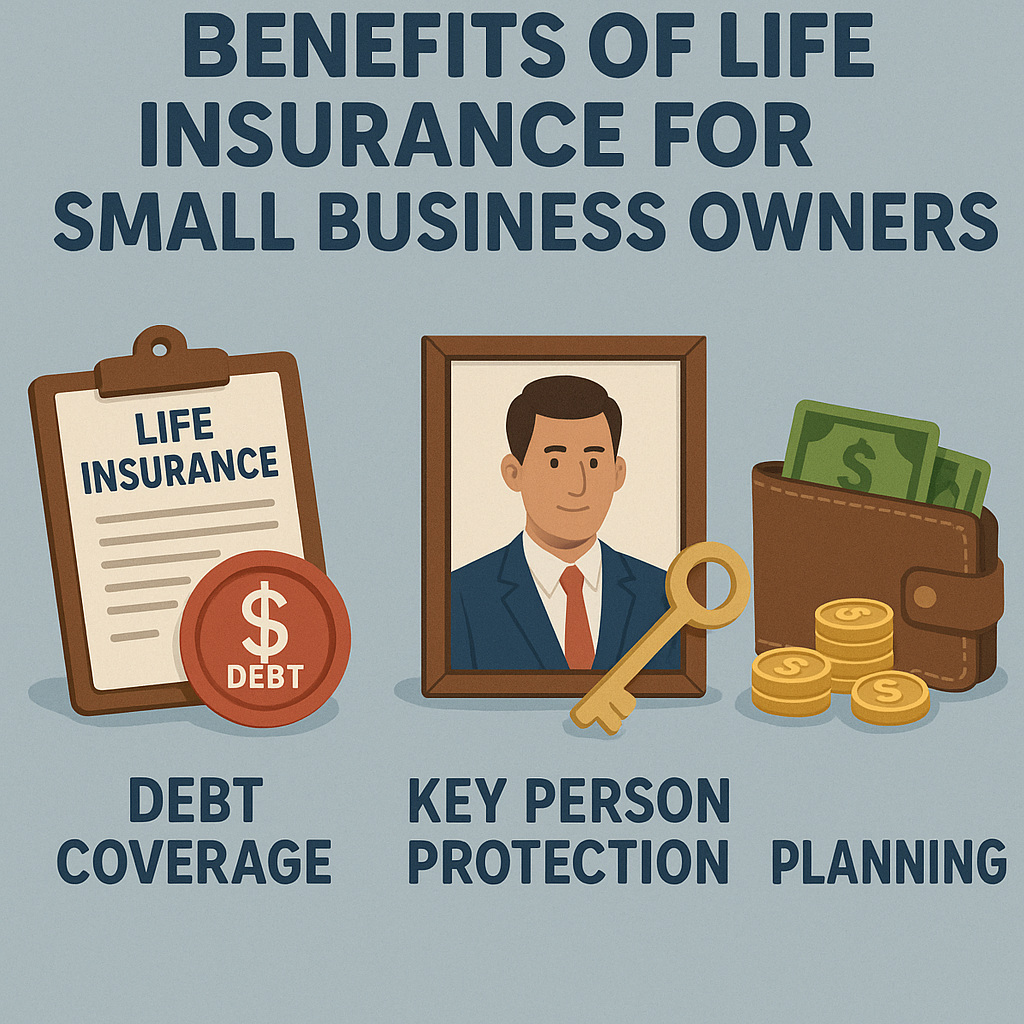

How Life Insurance Protects Your Business

Life insurance is more than a personal safety net. It’s an essential business tool to preserve financial stability.

Debt Coverage and Loan Security

If your business has loans or outstanding debts, life insurance proceeds can ensure these debts are repaid if you or another insured key person passes away. This protects your family and business from financial strain.

Key Person Protection

Consider that some employees possess specialized skills critical to your operations. For example, the head technician or lead sales executive. Losing them unexpectedly can cause revenue loss and disrupt client relationships.

Key person insurance provides a financial cushion to keep business running while you find and develop a replacement. This insurance is often funded and owned by the business itself.

Buy-Sell Agreement Funding

If you co-own a business, buy-sell agreements spell out how a deceased owner’s shares are handled. Life insurance funds these agreements, ensuring surviving owners can buy out the deceased’s interest without family disputes or financial hardship.

Maintaining Business Continuity

When the unexpected happens, maintaining smooth operations is critical for client confidence and future growth. Life insurance funds can be used to cover ongoing expenses like payroll, supplier payments, or marketing costs, giving your business breathing room.

Can life insurance really save your business from collapse?

Absolutely. It acts as a financial bridge through uncertainty. Many entrepreneurs rely on tailored life insurance to safeguard their legacy and their employees’ welfare.

Living Benefits and Cash-Value Building Policies

Not all life insurance policies just pay out after death. Some offer living benefits and cash-value components that you can access during your lifetime—a critical feature for small business owners.

What Are Living Benefits?

Living benefits allow policyholders to access a portion of their death benefit if diagnosed with critical illnesses or under financial hardship. This flexibility can be a lifesaver for business owners needing funds to keep operations afloat without taking on more debt.

Cash Value Growth

Permanent life insurance policies such as whole life and IUL accumulate cash value over time. This is essentially a savings component within the policy.

- You can borrow against this cash value at relatively low-interest rates.

- Use it for emergency business expenses, investments, or supplement retirement income.

- Keep in mind, withdrawing cash value reduces the death benefit if not repaid.

Example Scenario

During the 2008 financial crisis, many small business owners faced cash flow problems. Mike Jaap, a small business owner, used his life insurance policy’s cash value to sustain operations during hard times (source).

Tip: Consider policies with living benefits if you want access to funds without traditional loans or investors.

Group Life Insurance for Employees

Extending life insurance benefits to your employees can be a powerful tool for attracting and retaining quality talent. It also shows you care about their families’ futures.

Benefits for Employees

- Peace of mind knowing their families are protected.

- Usually offered at lower group rates compared to individual insurance.

- Can include additional benefits like disability and critical illness insurance.

Benefits for Employers

- Improves company reputation and employee satisfaction.

- Helps retain key employees and reduce turnover costs.

- Tax advantages when combined with group health insurance plans.

Group policies cover employees as long as they remain with the company, creating a sense of security and loyalty.

Using Life Insurance for Business Succession Planning

Succession planning addresses what happens to your business ownership when you or partners unexpectedly pass away.

Buy-Sell Agreements Explained

A buy-sell agreement is a legal contract among business owners stipulating how shares will be transferred upon death, disability, or retirement.

Funding this agreement with life insurance provides the cash to buy out deceased owners’ shares without draining business resources or causing conflicts with heirs.

Wait-and-See Agreements

An increasingly popular hybrid option, wait-and-see buy-sell agreements give owners flexibility to decide on ownership transfer terms later, using life insurance as the financial backstop (source).

How to Choose and Structure Policies

- Policies should be owned by the business or in a trust to avoid estate complications.

- Choose coverage amounts based on business valuation and outstanding obligations.

- Regularly update policies and agreements to reflect business changes.

Integrating Retirement Planning with Life Insurance

Life insurance can also complement your retirement plan, especially if you are a small business owner managing both personal and business finances.

Using Indexed Universal Life (IUL) Policies

IUL policies allow you to accumulate cash value with growth tied to equity indices but with downside protection. This gives potential for cash value growth while safeguarding principal.

You can borrow against this cash value tax-free to supplement retirement income or fund business needs.

Combining with Other Retirement Options

Your business might offer defined contribution plans like a SEP IRA or 401(k), but permanent life insurance can offer additional tax-advantaged savings and death benefits for your heirs (source).

Choosing the Right Policy for Your Business Needs

Deciding on a life insurance policy depends on your business size, stage, financial goals, and risk tolerance. Here is how you might decide:

| Business Stage | Policy Recommendation | Reasoning |

|---|---|---|

| Startup/Small (<$500K revenue) | Term Life Insurance | Affordable coverage for debt repayment and family protection. |

| Growing/Established | Permanent Life (Whole Life or IUL) | Builds cash value, offers living benefits, and supports retirement planning. |

| Multiple Owners/Partners | Key Person Insurance + Buy-Sell Funding | Ensures business continuity and smooth ownership transfer. |

| Employee Retention Focus | Group Life Insurance | Attracts and retains talent by offering valuable benefits. |

Remember: Policy ownership matters. Some prefer personal ownership for flexibility; others opt for business ownership for tax and operational benefits. Consult an expert to maximize benefits.

Common Mistakes to Avoid When Choosing Life Insurance

- Underestimating Coverage Needs: Not accounting for all debts, employees’ needs, and business obligations can leave gaps in protection.

- Ignoring Living Benefits: Overlooking cash value and living benefits reduces the policy’s usefulness during your life.

- Failing to Update Policies: Business growth, new partners, or changing debts require policy reviews to stay adequate.

- Not Funding Buy-Sell Agreements: Agreements without funding mechanisms can lead to disputes and business disruption.

- Choosing the Wrong Policy Type: Selecting term when permanent is needed (or vice versa) can limit your long-term options.

Taking time to plan life insurance as part of your overall business strategy builds resilience and peace of mind.

Frequently Asked Questions

Can a small business owner personally own their life insurance policy?

Yes. Personal ownership gives flexibility to use the policy for personal and business needs. Alternatively, the business can own the policy for tax and operational reasons.

Is life insurance for business owners tax-deductible?

Generally, premiums are not deductible. Some exceptions apply, particularly if used as collateral or employee group plans. Consult a tax professional for specifics.

How much life insurance does a small business owner need?

Coverage should consider family financial needs, business debts, buy-sell agreement amount, and key person value. A personalized assessment is best.

What happens to the life insurance if I sell my business?

Policies linked to business ownership or key person insurance may be transferred or terminated depending on the sale terms.

How soon can I access cash value in a permanent life insurance policy?

Cash value typically builds over several years; terms vary by policy. Some allow partial access for loans or withdrawals during your lifetime.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your life insurance planning? For personalized advice, explore our tailored insurance solutions at Life Care Benefit Services.

Ready to protect your business and family? Consider scheduling a consultation to discuss your unique needs and discover the best life insurance solutions tailored for small business owners.

With the right coverage, you can build a resilient future, safeguard your legacy, and ensure business continuity no matter what life brings.