Choosing the right Medicare supplement plan can be a game changer in managing your healthcare costs after turning 65.

But what are Medicare supplement plans, exactly?

This comprehensive guide will serve as your complete cheatsheet for how to choose Medicare supplement plan wisely.

Some are designed with extensive coverage but higher premiums.

Some plans simplify payments but limit flexibility.

Some cover foreign travel emergencies, others don’t.

Some are more popular for good reason, while others may suit particular circumstances.

Some options vary by state and carrier, making your choice a personalized decision.

Let’s dive right in.

Why Do I Need a Medicare Supplement Plan?

Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), covers many healthcare costs but leaves gaps. These gaps can mean unexpected out-of-pocket expenses for deductibles, copayments, and coinsurance.

A Medicare supplement plan, also called Medigap, fills these gaps, helping you avoid high medical bills. These plans are sold by private companies and must follow federal and state laws.

Having the right Medigap plan can offer peace of mind by covering costs that Medicare alone does not, ensuring you focus on your health instead of finances.

According to the official Medicare website, Medigap plans work alongside your Original Medicare coverage to pay for costs like deductibles and copayments.

What Are the Types of Medicare Supplement Plans Available?

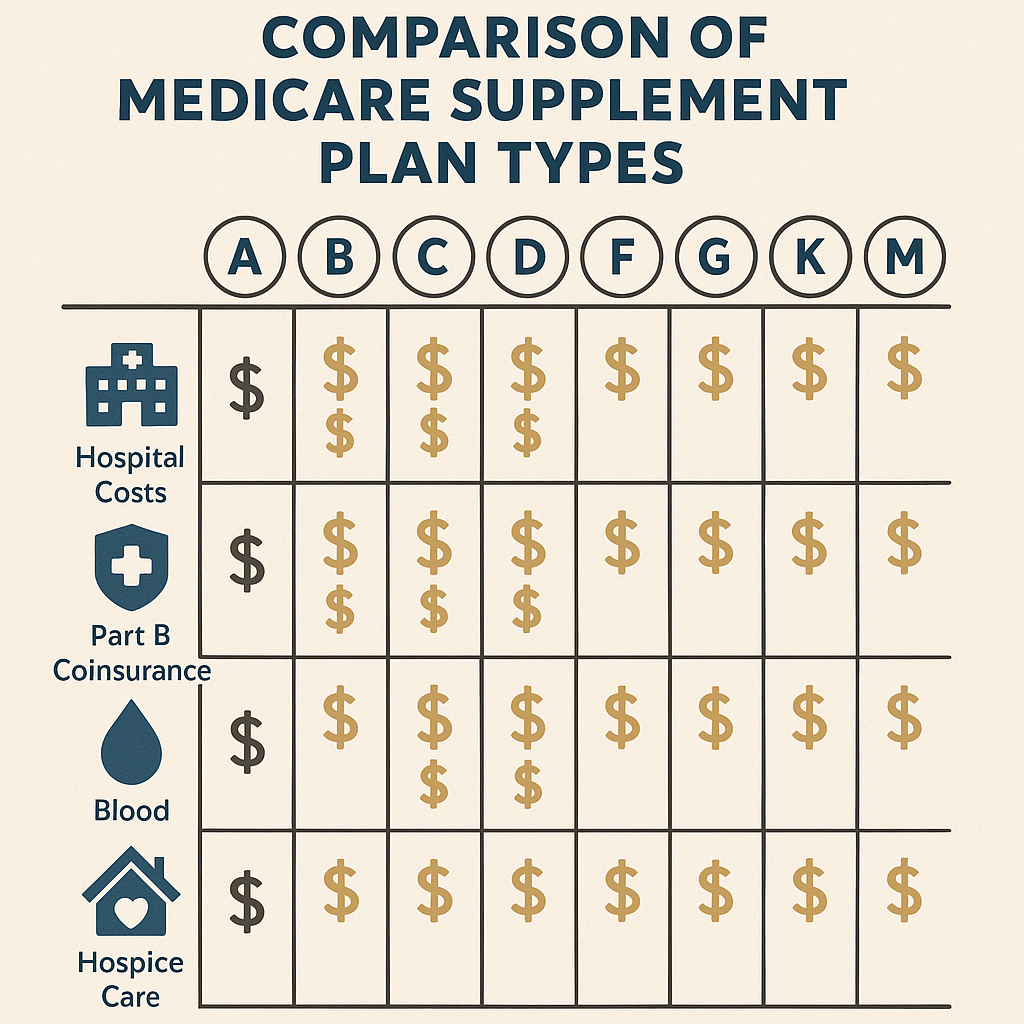

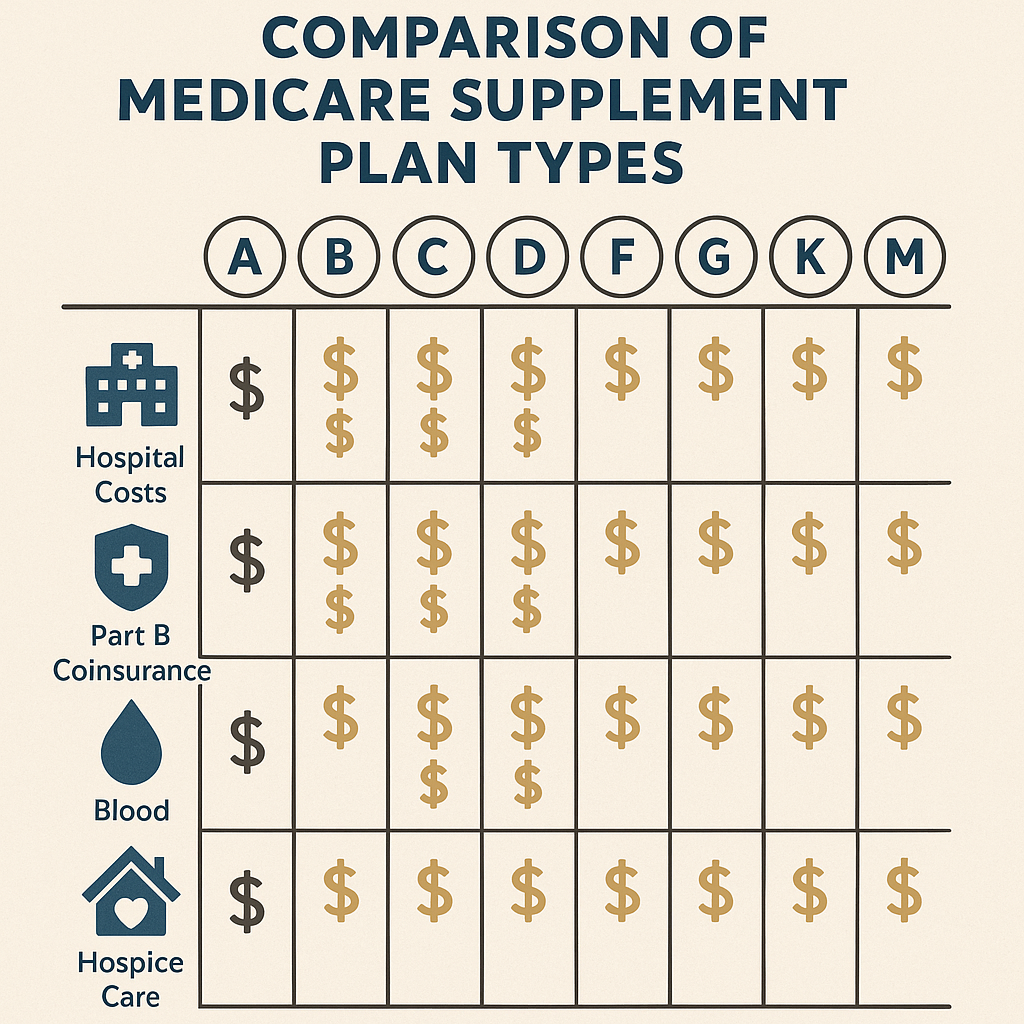

There are ten standardized Medigap plans identified by letters A through N (available in most states). Each plan offers a different combination of benefits but the same plan letter means the same coverage, regardless of the insurance company.

Here’s a summary table to help distinguish the options:

| Plan | Coverage Highlights | Premium Level |

|---|---|---|

| Plan A | Basic benefits: Covers Part A coinsurance, Part B copayments, and some hospital costs. | Low to Moderate |

| Plan G | Nearly full coverage except Part B deductible; covers most copayments and foreign travel emergency. | Moderate |

| Plan N | Similar to Plan G but with some copayments and no coverage for Part B excess charges. | Moderate |

| Plan F (no longer sold to new enrollees after 2020) | Full coverage including Part B deductible. | Higher |

| Plan C (no longer sold to new enrollees after 2020) | Similar to Plan F but not covering foreign travel. | High |

Each plan’s coverage is standardized, but premiums vary by insurer and location.

Note: Plans F and C were discontinued for new Medicare enrollees in 2020 but remain available if you qualified before then.

Seven Crucial Factors to Consider When Choosing Your Medigap Plan

Choosing the right Medicare supplement plan requires more than just picking the lowest premium.

Here are seven essential factors to guide your decision-making process:

1. Assess Your Healthcare Needs

Consider how often you visit doctors, hospitals, or need prescriptions. If health needs are frequent, more comprehensive coverage like Plan G can save money over time.

Example: Martha, 68, visits specialists frequently due to a chronic condition. She chose Plan G to avoid high copays and deductibles, offering her budget predictability.

2. Location Affects Plan Availability and Cost

Medigap plans vary by state. Check which plans insurers offer in your area, and how premiums differ. Urban areas often have more options and competitive pricing.

Always provide your zip code when shopping for plans to get accurate comparisons.

3. Compare Premiums and Out-of-Pocket Costs

While some plans have higher premiums, they might lower your financial risk by covering more expenses. Analyze total expected annual costs, factoring in both premiums and co-pays.

Some insurers offer discounts for non-smokers or if you pay annually.

4. Consider Coverage Beyond Medicare

Many Medigap plans include foreign travel emergency coverage, an essential benefit if you travel abroad.

Some plans cover Part B excess charges, which can occur if your provider charges more than Medicare-approved amounts.

5. Evaluate Insurer Reputation and Customer Service

Check insurers’ ratings for customer satisfaction and claims processing. Life Care Benefit Services partners with over 50 top-rated carriers to give you trustworthy choices.

Reliable service means fewer hassles when you need care.

6. Check Enrollment Periods and Medical Underwriting

The best time to buy a Medigap plan is during your open enrollment, typically the 6-month period starting the month you turn 65 and enroll in Medicare Part B.

During this period, insurers cannot deny you coverage or charge more based on health conditions.

Outside open enrollment, providers may require medical underwriting, potentially increasing costs or denial of coverage.

7. Understand Tax Implications and Premium Deductibility

Are your Medigap premiums deductible? For many, Medicare premiums can be deductible as medical expenses if you itemize deductions on your tax return, exceeding 7.5% of adjusted gross income.

Self-employed individuals may deduct premiums as a business expense on Schedule 1 of the 1040 form. For detailed guidance, resources such as this Medicare resources page provide helpful insight.

How Do I Purchase and Switch Medigap Plans?

Purchasing a Medigap plan involves choosing among private insurers offering standardized plans. A licensed insurance agent from an independent agency like Life Care Benefit Services can help navigate options without conflict of interest.

Many people ask if switching plans later is possible. Yes, but watch for medical underwriting if switching outside your open enrollment period.

Keep in mind that Medicare supplement plans only work with Original Medicare, not Medicare Advantage plans.

Some beneficiaries combine Medicare Advantage (Part C) with Medigap, but this usually isn’t allowed, so review your current coverage carefully.

What Common Mistakes Should I Avoid When Choosing a Medigap Plan?

- Choosing the cheapest plan without considering coverage gaps.

- Waiting too long to enroll and risking higher costs or denial due to health underwriting.

- Ignoring the reputation of the insurance carrier.

- Failing to review plan options based on geographic availability.

- Confusing Medicare Advantage with Medigap plans.

- Not accounting for tax implications and potential premium deductibility.

- Overlooking benefits like foreign travel emergencies and Part B excess charges.

What’s the best way to ensure you don’t fall into these pitfalls? Working with a trusted advisor.

Can I Save Money on Medicare Supplement Premiums?

Yes! Here are strategies:

- Compare quotes from multiple insurers — premiums vary widely.

- Check for discounts—some insurers offer reduced rates for non-smokers or seniors under certain plans.

- Consider high-deductible Medigap plans for lower premiums if you’re healthy.

- Pay annually instead of monthly if possible.

- Consider your state’s regulations—some states regulate premium freezes or community rating.

Keep in mind, some savings might come with higher out-of-pocket costs. Balance premium vs. coverage carefully.

Did you know you can use Health Savings Account (HSA) funds tax-free to pay for Medicare Part B, C, or D premiums, but not for Medigap premiums? This subtle distinction can affect your budget strategy.

How Do I Compare Medigap Plans Effectively?

Start by listing your priorities: desired coverage, budget, travel habits, and preferred insurers. Use the standardized plan letter as a base.

Next, obtain quotes from different carriers in your area for those plan letters.

Evaluate:

- Monthly premiums

- Covered benefits

- Customer reviews and claim services

- Financial stability of the insurer

- Flexibility to switch plans later

Insurance agents at Life Care Benefit Services can tailor recommendations to fit your unique needs, leveraging our partnerships with over 50 leading carriers.

What Are the Tax Advantages and Deductions Related to Medicare Supplement Plans?

For those self-employed or who itemize deductions, Medicare supplement premiums might be deductible as medical expenses, helping reduce taxable income.

Since 2012, the IRS allows self-employed individuals to deduct all Medicare premiums (including Plans A, B, D, Medigap) on Schedule 1 of Form 1040. This above-the-line deduction lowers adjusted gross income (AGI).

However, to qualify:

- You must have net profitable self-employment income

- You cannot participate in employer-sponsored health plans

- Deductions cannot exceed your business income

This resource provides detailed guidance on tax filing strategies related to Medicare costs.

Another option is itemizing medical expenses on Schedule A, but only expenses exceeding 7.5% of AGI count, and it may not be beneficial due to increased standard deductions enacted in recent years.

Tax professional advice is highly recommended to optimize your personal tax situation.

Can I Switch Medicare Supplement Plans and When Is the Best Time?

Switching Medigap plans is possible but comes with caveats:

- Open Enrollment Period: Starts the month you turn 65 and enroll in Part B; during this 6-month period, insurers cannot deny coverage or charge more due to health.

- Guaranteed Issue Rights: You may have rights to switch without medical underwriting in certain situations, such as losing other coverage.

- After Open Enrollment: Switching typically requires passing medical underwriting, with possible premium increases or denial.

Planning your Medigap purchase carefully during your Open Enrollment helps avoid these hurdles.

Are you wondering which Medigap plan truly suits your health profile and budget? Our experts at Life Care Benefit Services are ready to help; exploring your options early can save money and stress.

Frequently Asked Questions About Choosing a Medicare Supplement Plan

What is the difference between Medicare Advantage and Medicare Supplement plans?

Medicare Advantage (Part C) is an alternative to Original Medicare that bundles coverage and may have network restrictions. Medicare Supplements (Medigap) work alongside Original Medicare to cover costs Medicare doesn’t.

Are prescription drugs covered by Medicare Supplement plans?

Standard Medigap plans do not cover prescription drugs. For coverage, Medicare Part D (prescription drug plan) is needed.

Can I have both a Medicare Supplement plan and Medicare Advantage plan?

No. Medicare requires you to have either Original Medicare with a Medigap plan or a Medicare Advantage plan, but not both simultaneously.

Does the Medicare Supplement plan cover foreign travel?

Some Medigap plans include foreign travel emergency coverage. Plans G, F, and N typically cover this. Verify details when choosing a plan.

How much does a Medicare Supplement plan typically cost?

Costs vary widely by plan type, carrier, and location. Premiums can range from under $100 to several hundred dollars monthly. Comparing quotes is important.

Is it possible to change my Medicare Supplement plan after enrollment?

Yes, but outside of the Open Enrollment Period, medical underwriting usually applies. Exceptions exist in specific situations like loss of other coverage.

Conclusion: Choosing the Best Medicare Supplement Plan for You

Knowing how to choose Medicare supplement plan puts you in control of your healthcare and finances as you age.

Understand your health needs, compare plan types, review premiums and benefits, and factor in tax implications.

Timing is critical—aim to enroll during your Open Enrollment to maximize choice and avoid medical underwriting challenges.

Partnering with an independent agency like Life Care Benefit Services can help you navigate offers from top insurers with trusted advice.

Table of Contents

- Why Do I Need a Medicare Supplement Plan?

- What Are the Types of Medicare Supplement Plans Available?

- Seven Crucial Factors to Consider When Choosing Your Medigap Plan

- How Do I Purchase and Switch Medigap Plans?

- What Common Mistakes Should I Avoid When Choosing a Medigap Plan?

- Can I Save Money on Medicare Supplement Premiums?

- How Do I Compare Medigap Plans Effectively?

- What Are the Tax Advantages and Deductions Related to Medicare Supplement Plans?

- Can I Switch Medicare Supplement Plans and When Is the Best Time?

- Frequently Asked Questions About Choosing a Medicare Supplement Plan

- Conclusion: Choosing the Best Medicare Supplement Plan for You

Q&A About Medicare Supplement Coverage

Q: How soon should I decide on a Medicare Supplement plan?

A: It’s best to make a decision during your Medigap Open Enrollment, the 6-month period starting when you enroll in Medicare Part B to avoid medical underwriting and secure lower premiums.

Q: Can I use Health Savings Account (HSA) funds to pay for Medicare Supplement premiums?

A: No, HSA funds can be used tax-free for Medicare Part A, B, C, and D premiums but not for Medigap premiums.

Q: Are all Medicare Supplement plans guaranteed renewable?

A: Yes, as long as premiums are paid, insurers must renew your Medigap plan regardless of health changes.

Q: What if I want to switch to a different Medigap plan later?

A: You can switch, but after the Open Enrollment Period, you may face medical underwriting, which can increase premiums or affect acceptance.

Q: Does Life Care Benefit Services provide personalized Medicare guidance?

A: Yes, we offer expert, unbiased advice to help find affordable, highly-rated Medicare supplement plans that fit your unique health and financial situation.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your Medicare supplement planning? For personalized advice tailored to your needs, explore essential life insurance strategies for small business owners and learn how comprehensive planning secures your future.