You’ve probably heard of indexed universal life insurance but wondered what an indexed universal life insurance quote really means for you and your family. At its core, this type of policy combines the protection of life insurance with the opportunity to build cash value linked to a stock market index — but without the risk of losing money when markets go down.

So why should you care about getting an indexed universal life insurance quote? Because understanding your personalized quote is the first step to unlocking affordable financial protection tailored to your future needs. It’s not just about coverage; it’s about how your policy can grow over time and help with retirement planning or unexpected expenses.

Many people overlook the benefits of indexed universal life insurance because it sounds complex. But it doesn’t have to be. Think of the quote as your roadmap—it helps you see potential premiums, cash value growth, and death benefits, adjusted to your goals and budget. This clarity empowers you to make informed decisions that fit your family’s financial security.

Wondering if this type of life insurance is right for you? Consider this: unlike term life insurance, which only provides coverage for a limited time, an indexed universal life policy offers lifelong protection with living benefits, meaning you can tap into your policy’s cash value if life throws unexpected challenges your way.

Getting a personalized quote might seem overwhelming, but it’s simpler than you think, especially with expert guidance. At Life Care Benefit Services, we specialize in helping families and individuals navigate these options with ease. We work with over 50 top-rated carriers to find policies that match your unique situation.

Ready to see how an indexed universal life insurance quote fits into your overall financial plan? Exploring your options could be the smartest step you take today. Don’t miss out on valuable insights tailored just for you—check out how to review your life insurance policy step-by-step, so you know exactly what to ask and expect when requesting a quote.

Let’s dive in and demystify the process, so you feel confident protecting what matters most.

TL;DR

Thinking about an indexed universal life insurance quote? It offers lifelong protection with flexible premiums, cash value growth tied to market indexes, and living benefits you can access when needed.

Getting a personalized quote from Life Care Benefit Services helps you understand costs and benefits tailored to your goals—making financial security simpler and clearer.

Step 1: Understand Indexed Universal Life Insurance Basics

Before diving into your indexed universal life insurance quote, it’s essential to grasp the basics of what an Indexed Universal Life (IUL) insurance policy really is. At its core, IUL is a form of permanent life insurance—which means coverage that lasts your entire lifetime, as long as premiums are paid.

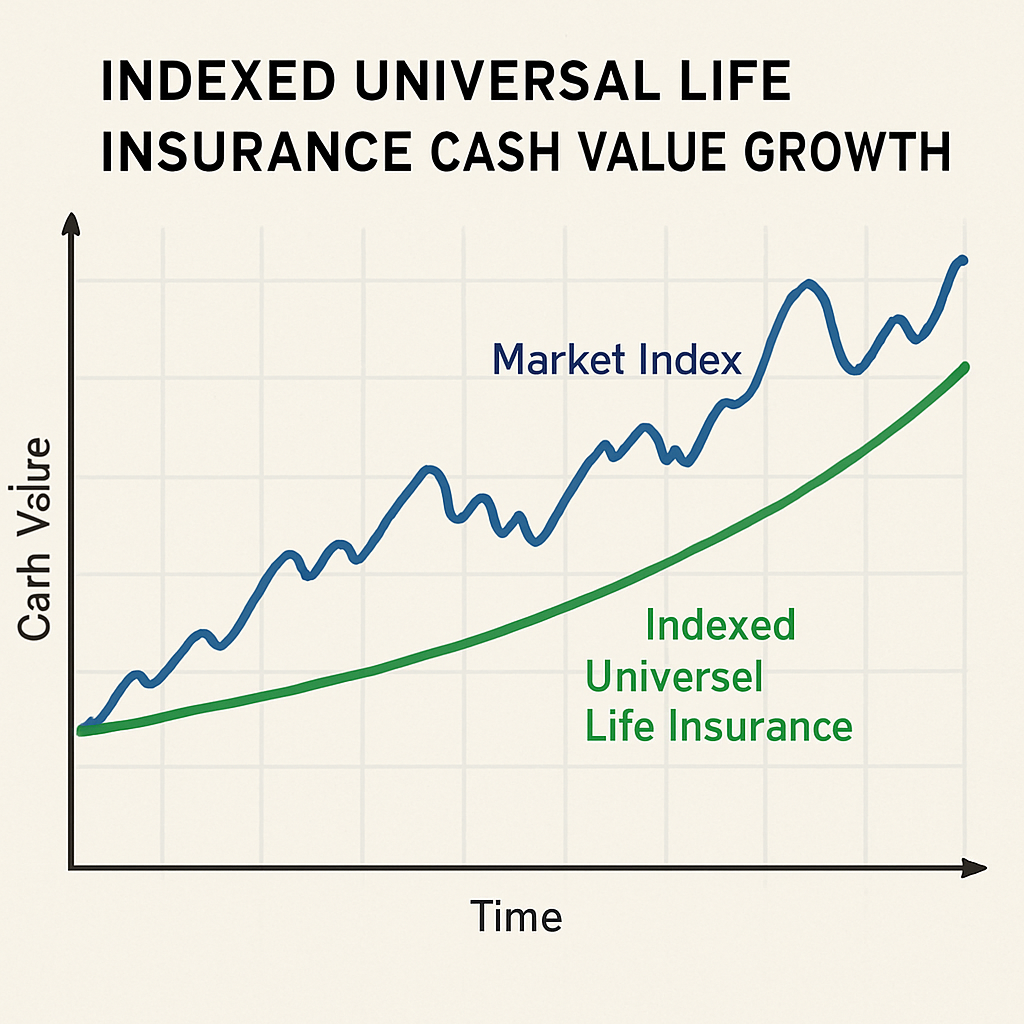

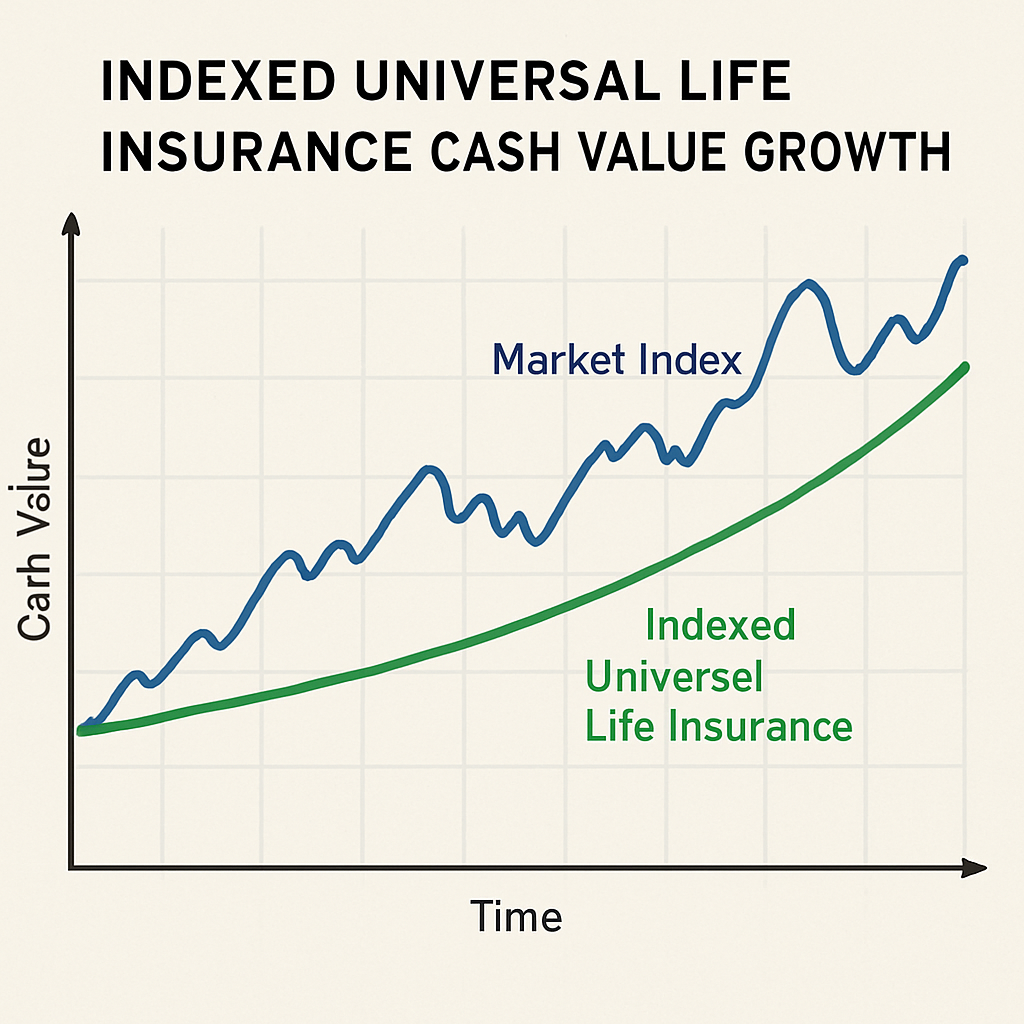

Unlike traditional whole life insurance where the cash value grows at a fixed interest rate, IUL policies tie the cash value growth to the performance of a market index, such as the S&P 500 or Nasdaq-100. This means your policy’s cash value has the potential to earn interest credited based on how these indexes perform—without actually investing your money directly in the stock market.

Sounds intriguing, right? But don’t worry, there are safeguards. Even if the market index dips or performs poorly, your policy offers a guaranteed minimum interest rate, ensuring you won’t lose the cash value you’ve accumulated. This key feature provides a cushion against market volatility while still allowing the potential for higher returns during favorable market conditions (Investopedia explains this feature well).

How Does the Cash Value Work?

When you pay your premium, a part of it covers the insurance costs and fees. The remainder goes into your policy’s cash value account. This amount then earns interest based on the performance of your selected index or a fixed account option you choose. You can usually allocate a percentage of your cash value to be tracked against these indexes or a fixed rate, depending on your risk preference.

Here’s a quick example: Let’s say your policy’s selected index gained 6% over a month, and your participation rate—the percentage of that gain your account will receive—is 50%. If your cash value is $10,000, an additional $300 (that’s 6% × 50% × $10,000) would be credited to your cash value for that month. However, remember that participation rates, caps, and spreads may apply to limit the gains you receive. Caps set maximum returns, and spreads deduct a percentage before your credited interest.

Curious about the flexible premium element? One of the benefits of IUL policies is the ability to adjust your premium payments within limits. If your cash value grows sufficiently, it might even cover future premiums, allowing you to skip payments without losing coverage. It’s flexibility that regular term life insurance policies simply can’t offer.

What About the Death Benefit?

Your IUL also provides a death benefit, which is the amount paid to your beneficiaries when you pass away. This benefit usually includes the face amount plus any accumulated cash value, depending on the options you select. Some policies allow you to increase the death benefit if your cash value rises, offering potential for a higher payout.

Still wondering if it’s worth it? Since IUL insurance blends life coverage with cash value growth indexed to the markets, it often appeals to people looking for permanent protection plus a way to build wealth with downside protection—versus the fixed growth of whole life or the higher risks of variable life insurance (Progressive Insurance breaks down this comparison clearly).

Key Takeaways

- IUL is permanent life insurance with a cash value component that grows tied to a stock market index.

- The cash value is protected from negative returns by a guaranteed minimum interest rate but may be subject to caps and participation rates on gains.

- Premiums are flexible, and cash value can sometimes cover future premiums, giving you payment options.

- The death benefit can increase if the cash value grows, potentially offering more for your beneficiaries.

Understanding these basics will help you better evaluate your indexed universal life insurance quote and decide if it fits your long-term financial goals. Remember, an IUL is a mix of protection and potential growth—not just a savings or investment vehicle.

Ready for the next step? Let’s explore how to assess your personal needs and match them with the right IUL policy features.

Step 2: Identify Your Life Insurance and Financial Goals

Now that you understand the basics of indexed universal life insurance, it’s time to pause and reflect on what you’re aiming to achieve. Knowing your life insurance and financial goals is the foundation for getting the right indexed universal life insurance quote and eventually choosing the best policy for your needs.

Why Clarifying Your Goals Matters

Think of your insurance policy as a tool—not just a safety net. Are you looking primarily for protection, wealth accumulation, or a bit of both? Your answer shapes everything from the policy structure to premium payments and death benefit amount.

For example, some families want to ensure mortgage protection so their home is secure if something happens to the breadwinner. Others focus on building cash value that can supplement retirement income or fund a child’s college education.

What about you? Is your priority protection, investment growth, or flexibility that adapts to changing circumstances?

Common Life Insurance Goals to Consider

- Income Replacement: Protect your family from losing essential income if you pass away unexpectedly.

- Debt and Expense Coverage: Ensure outstanding debts, funeral costs, and ongoing expenses are covered.

- Wealth Accumulation: Build cash value within the policy that grows tax-deferred, which you can later access through policy loans or withdrawals.

- Legacy Planning: Leave money to heirs, favorite charities, or fund trusts.

- Retirement Supplement: Use the cash value growth to supplement your retirement savings, offering more flexibility and tax advantages than traditional accounts.

Your goals can be a combination of these, and that’s perfectly normal. Indexed universal life (IUL) insurance is designed for this type of flexibility, making it a versatile option.

Questions to Ask Yourself Before Requesting an Indexed Universal Life Insurance Quote

Before you get that quote, spend some time with these questions:

- How much financial protection does your family currently have? Is it adequate?

- Are you comfortable with a policy that involves some market-indexed growth potential but with a safety floor?

- Do you want the ability to adjust premiums and death benefits over time?

- Is growing cash value for retirement or other future needs important to you?

- Are you planning for any specific expenses, like your children’s education or paying off a mortgage?

Being honest with yourself here will make your insurance journey smoother and more personalized.

Don’t Forget to Consider Your Financial Situation

Goals should align with what you can realistically afford. Indexed universal life insurance offers flexible premiums, but it’s crucial to maintain enough cash value to cover insurance costs and fees to keep the policy in force.

Evaluate your current budget and expected future financial changes. A well-thought-out plan can help avoid surprises down the line.

Interested in breaking down your financial goals and how they match IUL features? Western & Southern explains the important interplay between policy features and your personal goals.

Bring Your Goals to Life With a Professional Agent

It’s one thing to sketch out your goals on paper, but a seasoned insurance agent at Life Care Benefit Services can help translate those goals into a tailored indexed universal life insurance quote specific to your situation.

They’ll work with you to balance protection and potential growth, explain riders that enhance your policy, and forecast how your cash value might build over time.

Remember, the right policy today can give you peace of mind and financial flexibility tomorrow.

Still wondering how to align your financial goals with an indexed universal life insurance quote? Resources like the FINRA Investor Education Foundation’s guide can help you understand life insurance as part of your broader financial planning.

Identifying your goals might seem overwhelming at first, but taking this step seriously now will help you secure a policy that truly fits your needs and gives your loved ones the protection they deserve.

So, what’s your top financial priority? Reach out to Life Care Benefit Services to start crafting an indexed universal life insurance quote built around your unique goals.

Step 3: Gather Necessary Personal and Financial Information

Now that you’ve started shaping your goals with the help of a professional agent, it’s time to roll up your sleeves and gather the personal and financial info you’ll need to get an accurate indexed universal life insurance quote.

This step isn’t just form-filling — it’s about painting a clear picture of your health and financial situation so insurers can offer you the best possible terms.

Personal Information: The Foundation of Your Quote

First off, you’ll need some basic details like your age, height, weight, and contact info.

But it goes deeper than that. Insurance companies typically ask about your medical history—including any past illnesses, surgeries, or chronic conditions—to assess your overall health risk.

Have you ever considered how lifestyle habits can influence your premiums? If you smoke or use tobacco products, expect higher rates. Quitting tobacco—even smokeless tobacco—can often lead to significant savings after a smoke-free period, so it’s worth factoring into your timeline.

Also, be ready to share info on your family’s health history. Certain hereditary conditions can affect your premium, so having details on your parents’ and siblings’ health can speed up the process.

Financial Details: More Than Just Numbers

Your financial info plays a crucial role too. Insurance companies look at your income and employment status to verify that the coverage amount you’re applying for makes sense.

Speaking of employment, your job matters. Some occupations carry higher risks (like construction or commercial diving) and can impact your quote significantly.

Driving records also come under the microscope. A history of accidents or DUIs can flag you as higher risk, increasing premiums.

High-Risk Activities Matter

Do you have a hobby that gets your adrenaline pumping? Activities like skydiving, mountain climbing, or even motorcycle riding can bump up your rates. It’s important to disclose these honestly, as omitted info can cause claim issues down the line.

Could adjusting your hobbies improve your quote? Sometimes, cutting back on high-risk activities or taking safety courses can help lower premiums.

Medical Exams and Documentation

Many indexed universal life insurance quotes require a medical exam. This usually involves a physical checkup, blood work, and urine tests to verify your health data.

Your agent at Life Care Benefit Services can guide you through scheduling these exams where needed and explain all steps clearly.

Don’t have recent medical records handy? Contact your doctor early to gather reports; this can expedite underwriting.

Keep Everything Organized

Having a checklist helps. Include items like past medical records, medication lists, family health history, employment info, and any documentation about your lifestyle habits.

If you’re feeling overwhelmed, remember: gathering this info upfront is critical. It prevents delays and helps secure a more precise indexed universal life insurance quote tailored to you.

Wondering where to start?

The Massachusetts Division of Insurance provides insights into how lifestyle choices affect your premiums, helping you understand what insurers look for beyond just numbers.

For financial details, FINRA’s Investor Education Foundation breaks down why accurate financial info is essential for life insurance underwriting and how it protects your interests in the long run.

Don’t wait until the last minute to collect your info—start now to make the quoting process smooth, transparent, and tailored perfectly to your unique needs.

Ready to get that personalized indexed universal life insurance quote? Reach out to Life Care Benefit Services today, and we’ll help you through every step!

Step 4: Compare Indexed Universal Life Insurance Quotes Effectively

Now that you’ve gathered the necessary details for your indexed universal life insurance quote, it’s time to compare what different providers are offering. But hold on—don’t just look at the bottom-line premium. There’s a lot more to consider.

Comparing indexed universal life insurance quotes effectively means understanding how each quote reflects the nuances of the policy’s design. What exactly should you focus on?

Understand The Key Policy Features Behind The Numbers

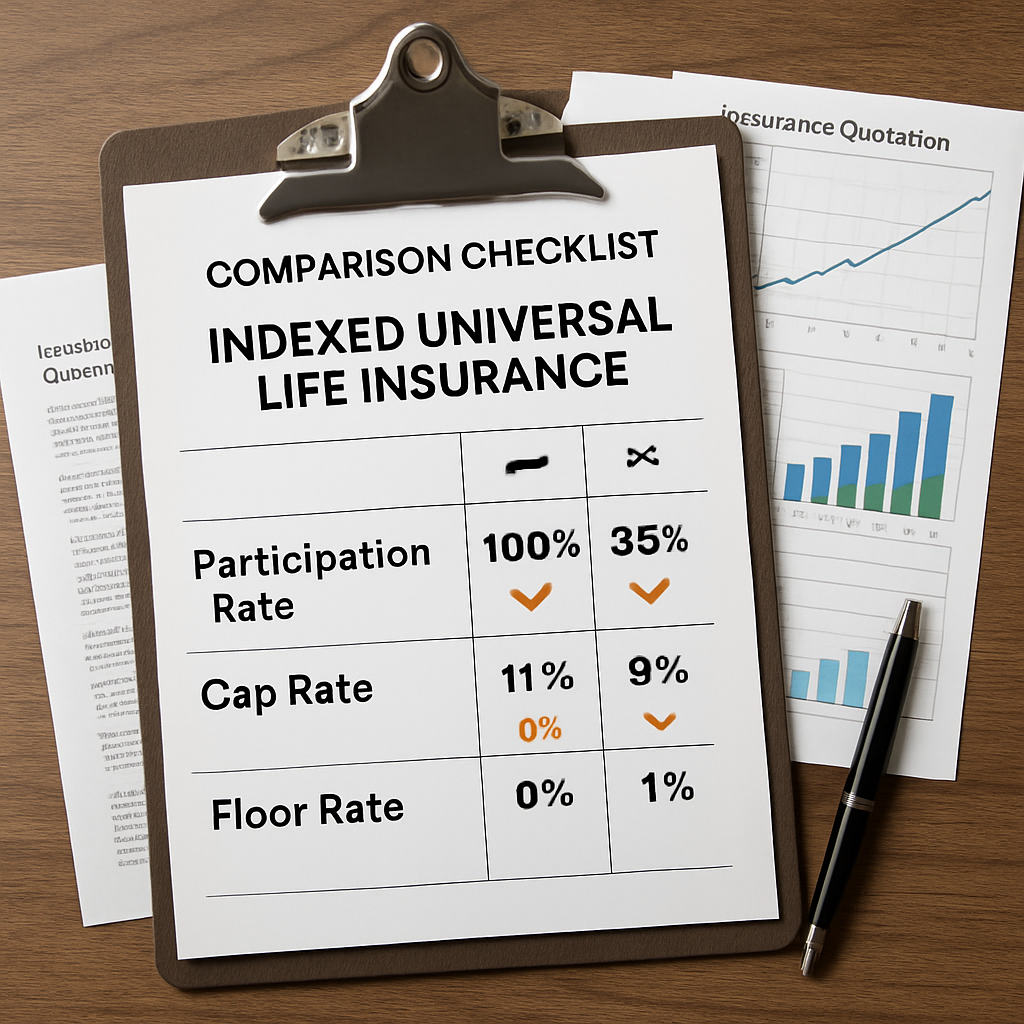

Indexed universal life, or IUL, isn’t a one-size-fits-all policy. Premiums might look similar across quotes, but factors like participation rate, cap rate, and floor rate can dramatically impact your policy’s cash value growth and protection.

For example, a policy with a higher participation rate gives you a bigger slice of the index gains, while a higher cap rate sets a more generous maximum on those gains. The floor rate, on the other hand, acts as a safety net—guaranteeing a minimum interest rate even during market downturns.

Ask your insurance advisor for these specific rates. Once you have them, compare them side by side rather than just focusing on premiums.

Beware Of Differences In Fee Structures And Flexibility

Not all IUL policies have the same fees. Look carefully for costs like administrative fees, cost of insurance charges, and surrender charges that can eat into your cash value over time.

Also, check how flexible each policy is. Can you adjust your premiums or death benefit as your financial needs evolve? Since life circumstances change, you want a policy that accommodates that, not one that locks you in rigidly.

Shop Beyond The Sticker Price: Consider The Death Benefit Options

The death benefit can be level or increasing. An increasing death benefit includes your policy’s cash value alongside the initial coverage, which might cost more but offers more financial flexibility for your beneficiaries.

Think about your long-term goals. If your priority is leaving a larger legacy or covering ongoing expenses like a mortgage, an increasing death benefit might be worth the extra premium.

Are you wondering how different insurers treat policy loans against cash value or what riders they offer? These extras can influence your overall policy value.

Use Trusted Tools And Experts To Guide Your Comparison

Online quoting tools can be a great start, but don’t underestimate the value of personalized advice. Insurers calculate quotes based on your age, health, lifestyle, and underwriting class, so a quote from one company might not match another’s even with the same inputs.

For accurate comparisons, work with an independent agency like Life Care Benefit Services. We partner with multiple top-rated insurers, letting you see a spectrum of options rather than a single carrier’s view.

We also recommend you review SmartAsset’s guide on indexed universal life insurance quotes for insights on how market factors and policy design affect your quote.

Remember: it’s about more than just the cost. It’s about which policy fits your goals and offers the flexibility and financial protection you need.

Compare At A Glance: Key Factors To Evaluate

| Feature | What To Look For | Why It Matters |

|---|---|---|

| Participation Rate | Higher percentage means more index gains credited | Maximizes cash value growth potential |

| Cap Rate | Maximum interest credited from the index | Limits upside but protects from extreme volatility |

| Floor Rate | The guaranteed minimum interest | Protects your cash value from losses due to market decline |

| Premium Flexibility | Ability to increase or decrease payments | Adapts to your changing financial situation |

| Death Benefit Type | Level vs increasing | Affects payout size and premium cost |

| Fees & Charges | All costs including admin and surrender fees | Impacts long-term policy performance |

Feeling a bit overwhelmed? That’s normal. Indexed universal life insurance is complex, but taking the time to compare these details carefully will pay off.

Want a no-pressure review of your best options? Reach out to Life Care Benefit Services to get expert assistance comparing policies tailored just for you.

You don’t have to navigate indexed universal life insurance quotes alone—let us help you secure the policy that provides both protection and financial growth.

Step 5: Work With a Trusted Insurance Advisor to Customize Your Quote

So, you’ve gathered your indexed universal life insurance quotes, compared participation rates, cap rates, floor guarantees, and other important features—now what? This is the moment where partnering with a trusted insurance advisor truly makes all the difference.

Why is an expert advisor crucial when customizing your indexed universal life insurance quote? Because these policies aren’t one-size-fits-all. Every detail, from premium flexibility to death benefit type, can—and should—be tailored to your unique financial circumstances and goals.

Why You Need Personalized Guidance

Indexed universal life insurance blends investment-linked growth with lifelong protection, making it complex. It’s easy to get lost in the jargon or overlook hidden fees that could impact your cash value growth or benefits down the road.

An experienced insurance advisor brings clarity to these complexities. They’ll assess your current financial health, future goals, risk tolerance, and family needs to help you build a policy that aligns with both protection and growth. Think of them as your financial detective and strategist rolled into one.

Plus, advisors have access to multiple insurers and policy options you might not find on your own. This broader view ensures you’re not accidentally settling for a higher premium or fewer benefits.

How Advisors Customize Your Indexed Universal Life Insurance Quote

When you work with an advisor, expect a detailed conversation about your life and financial goals. They’ll analyze key factors like:

- Premium Flexibility: Advisors can help you decide if you want a policy that allows varying premium payments depending on your cash flow.

- Death Benefit Options: Whether you want level or increasing death benefits, they’ll tailor it based on your family’s future financial needs.

- Index Choices: Some IUL policies let you choose which stock market index to tie your cash value growth. Experts weigh which is suitable given market trends and personal risk tolerance.

- Loans and Withdrawals: Understanding how to strategically use your policy’s cash value through loans or partial withdrawals is essential. Advisors make sure you know the impact this can have on cash value and death benefits.

Good advisors will also run detailed policy illustrations showing best- and worst-case scenarios. This way, you know what kind of growth and costs to expect in different market conditions.

Don’t Skip On Asking The Right Questions

When you meet with an advisor, arm yourself with questions that get to the heart of your indexed universal life insurance quote:

- How do the fees in this policy compare to others?

- What happens if I want to reduce or skip premiums down the line?

- Are there any surrender charges if I cancel the policy early?

- How is the guaranteed minimum interest rate applied?

- What are the tax implications on cash value growth and loans?

- How flexible is the death benefit if my needs change?

Having a checklist like this ensures you don’t miss important details during your discussion.

How to Choose The Right Advisor

Trust is key because an indexed universal life insurance quote is just the starting point—your advisor shapes how that policy performs over time. Look for professionals who are:

- Independent: Advisors unaffiliated with a single carrier provide unbiased options across the market.

- Experienced: Those specialized in life insurance and retirement planning understand the nuances of IUL policies.

- Transparent: They clearly explain fees, risks, and benefits without sales pressure.

At Life Care Benefit Services, our advisors partner with you to explore dozens of top-rated carriers, find competitive rates, and build an indexed universal life insurance policy customized to your goals and budget.

Ready to take your next step? Reach out today for a no-obligation conversation and get an indexed universal life insurance quote designed specifically for your future.

Want to understand why working with an expert really pays off? According to industry specialists, personalized advice can safeguard you from costly mistakes and help maximize the powerful features that indexed universal life insurance offers.

Similarly, leading insurance providers emphasize that customizing your policy through professional guidance not only ensures proper coverage but also optimizes cash value growth and flexibility.

Don’t let a generic indexed universal life insurance quote limit your protection or financial potential. Explore your tailored options with a trusted advisor who understands your world—and your wallet.

Step 6: Finalize Your Indexed Universal Life Insurance Policy and Begin Coverage

So, you’ve navigated the complexities of your indexed universal life insurance quote, weighed your options, and consulted professionals. Now it’s time to take that critical final step: finalizing your policy and officially starting your coverage.

Review, Review, Review

This might sound obvious, but don’t rush through the final paperwork. IUL policies are intricate, with adjustable premiums, varied caps, participation rates, and fees that can evolve over time. Before signing, carefully review the policy illustration with your advisor. This document projects how your cash value and death benefit may grow, but remember, these are estimates—not guarantees.

Ask yourself: do you understand how all the pieces fit together? Are you clear on how premium payments work, especially if your financial situation changes? Knowing this upfront will save headaches later.

Complete Medical Exams and Underwriting

Finalizing your policy usually means completing a medical exam and providing other underwriting information. This step confirms your health status and risk level, which affects your final premiums. Some insurers allow a hassle-free process if you qualify for simplified issue policies, but often the full underwriting process is necessary for the best rates and full coverage.

Don’t sweat it—this is standard. Your Life Care Benefit Services advisor will guide you through scheduling and preparing for your exam, explaining what to expect so you feel at ease throughout.

Choosing Payment Options and Setting Up Premiums

Once underwriting is done, you’ll select how you want to pay your premiums. IUL policies offer flexibility here, letting you adjust payments based on your budget and goals.

Some prefer monthly payments for easier budgeting, while others pay annually to maximize cash value growth efficiency. You can even increase or decrease premiums later. Your advisor will help you decide what fits your unique situation and ensure automatic payments or reminders are in place to avoid missed payments.

Understand Your Policy’s Features and How to Monitor It

Starting coverage isn’t just turning on a switch. Indexed universal life insurance policies require ongoing attention. Since your cash value ties to market indexes, monitoring performance and policy fees regularly is vital to prevent lapses.

Ask your advisor for tips on tracking your policy’s health, how to handle periods of low market returns, and what actions to take if potential shortfalls arise. Being proactive here ensures your coverage and financial goals stay on track.

Ready to Begin?

Finalizing your policy is a huge milestone toward protecting your family’s future and growing your cash value.

If you haven’t yet secured a tailored indexed universal life insurance quote customized to your needs, now’s the perfect time to reach out. Expert guidance makes all the difference in building the right policy for you.

Remember: financial experts at NerdWallet highlight that personalized advice and careful policy management are the keys to maximizing indexed universal life insurance benefits while minimizing risks. Don’t stop here—partner with a trusted advisor for ongoing support.

So, what should you do next? Schedule a consultation with Life Care Benefit Services to finalize your coverage and start your journey toward financial security with confidence.

Conclusion

Choosing the right indexed universal life insurance policy isn’t just about getting coverage—it’s about securing your family’s future and building financial flexibility. An indexed universal life insurance quote is the first crucial step in understanding how this unique policy can fit your goals. Remember, IUL policies blend life insurance protection with cash value growth tied to market indexes, so they offer both security and potential for accumulation.

But don’t let the complexity intimidate you. Staying proactive by regularly reviewing your policy and working with a trusted advisor means you’ll avoid unexpected gaps and make the most of your plan. At Life Care Benefit Services, we specialize in finding personalized solutions that fit your budget and aspirations, helping you protect what matters most.

Wondering how to get started? Requesting an indexed universal life insurance quote tailored to your needs is easier than you think—and it opens doors to customized coverage with living benefits that grow with you. This isn’t just insurance; it’s a strategy for long-term financial security and peace of mind.

So, what’s next? Don’t wait. Reach out today for a consultation and take control of your financial future with confidence. Life Care Benefit Services is here to guide you every step of the way.

FAQs About Indexed Universal Life Insurance Quotes

When exploring indexed universal life insurance, you probably have some important questions swirling around. Let’s clear things up by diving into some of the most frequently asked questions about indexed universal life insurance quotes.

What exactly is an indexed universal life insurance quote?

Essentially, it’s an estimate from an insurer outlining the cost and coverage options for an indexed universal life (IUL) policy tailored to your needs. This quote reflects your chosen death benefit amount, premium flexibility, and how your cash value growth might tie to market indexes like the S&P 500. Getting a personalized quote helps you understand the premiums you’ll pay and what benefits you can expect.

How do insurers calculate these quotes?

Many factors influence your quote including your age, health, lifestyle, and the coverage amount you want. Insurance companies also weigh how premiums might fluctuate because IUL policies offer flexibility. The potential cash value growth based on index performance and policy-specific caps or floors also play a role. Since every policy has unique features, quotes will differ between providers.

Can I adjust my premium after I get the quote?

Yes! One of the biggest advantages of indexed universal life insurance is premium flexibility. While the initial quote gives you a baseline estimate, you can often increase or decrease your premium payments within policy limits later on. This flexibility can help you adapt your coverage and costs as your financial situation changes.

Why should I request an indexed universal life insurance quote from Life Care Benefit Services?

Getting a quote through Life Care Benefit Services means you benefit from our experience with over 50 top-rated carriers. We tailor your quote to your goals and budget—not just offer you a one-size-fits-all price. Our team guides you through the details like caps, floors, participation rates, and how these influence your cash value growth, so you know what to expect before buying.

How soon can I get a quote and what information will I need?

You can request a quote quickly—sometimes within minutes online or with a call to an expert. Be ready to share basic info like your age, health status, lifestyle habits, and how much coverage you’re looking for. This info helps us provide the most accurate and competitive quote possible.

Do I pay for an indexed universal life insurance quote?

Absolutely not. Quotes are free and come with no obligation. Think of it as your first step to exploring whether an IUL policy could fit your financial security plan.

What happens after I receive my quote?

This is where the power of choice kicks in. You can compare options, ask questions, and review policy details with Life Care Benefit Services. If an IUL policy sounds like the right fit, our advisors help you complete the application and set you on the path to stronger financial protection with flexibility to grow your cash value.

Still wondering if an indexed universal life insurance quote is worth your time?

Getting clear, personalized information upfront means no surprises down the road.

Reach out today to get your tailored indexed universal life insurance quote from Life Care Benefit Services and discover how this unique protection can work for you and your family.