Planning for retirement is more than just saving money—it’s about securing a lifestyle you can enjoy without financial stress. Indexed Universal Life (IUL) policies have emerged as a powerful tool for many individuals seeking a flexible and tax-advantaged way to grow their retirement funds.

So, why choose IUL policies over traditional retirement accounts? The answer is simple: IULs offer the unique combination of life insurance protection and potential cash value growth tied to market indexes, but without the risk of losing principal from market downturns.

Imagine having a policy that not only safeguards your loved ones with a death benefit but also lets your cash value grow based on the upside performance of stock market indexes like the S&P 500. And if the market dips? Your cash value is protected by a guaranteed floor, so you don’t lose what you’ve already accumulated.

Does this sound too good to be true? Many people are discovering the strategic advantage of the best IUL policies for retirement planning—they provide living benefits, tax-deferred growth, and even the option to access funds through policy loans for emergencies or opportunities.

But not all IULs are created equal. Choosing the right policy tailored to your personal goals, risk tolerance, and budget is key. That’s where expert guidance comes into play. Life Care Benefit Services partners with over 50 top-rated carriers to help you navigate these options and find an IUL that perfectly fits your retirement strategy.

Are you curious about how an IUL can complement your existing retirement plan or replace less flexible options? There’s never been a better time to explore policies that offer both protection and growth potential.

Ready to see how indexed universal life insurance can work for you? Taking the first step is easier than you think—whether you’re new to retirement planning or looking to enhance your financial security. Check out our detailed guide on how to get an accurate indexed universal life insurance quote for your financial needs to start crafting your customized plan today.

Let’s dive in and uncover what makes the best IUL policies for retirement planning a smart choice for building wealth and protecting what matters most.

TL;DR

Looking for the best IUL policies for retirement planning? They offer tax-deferred growth, flexible living benefits, and access to funds when you need them most.

Choosing the right policy personalized to your goals can boost your retirement security. Ready to explore your options and build a smarter financial future?

1. Understanding Indexed Universal Life Insurance: Key Features and Benefits

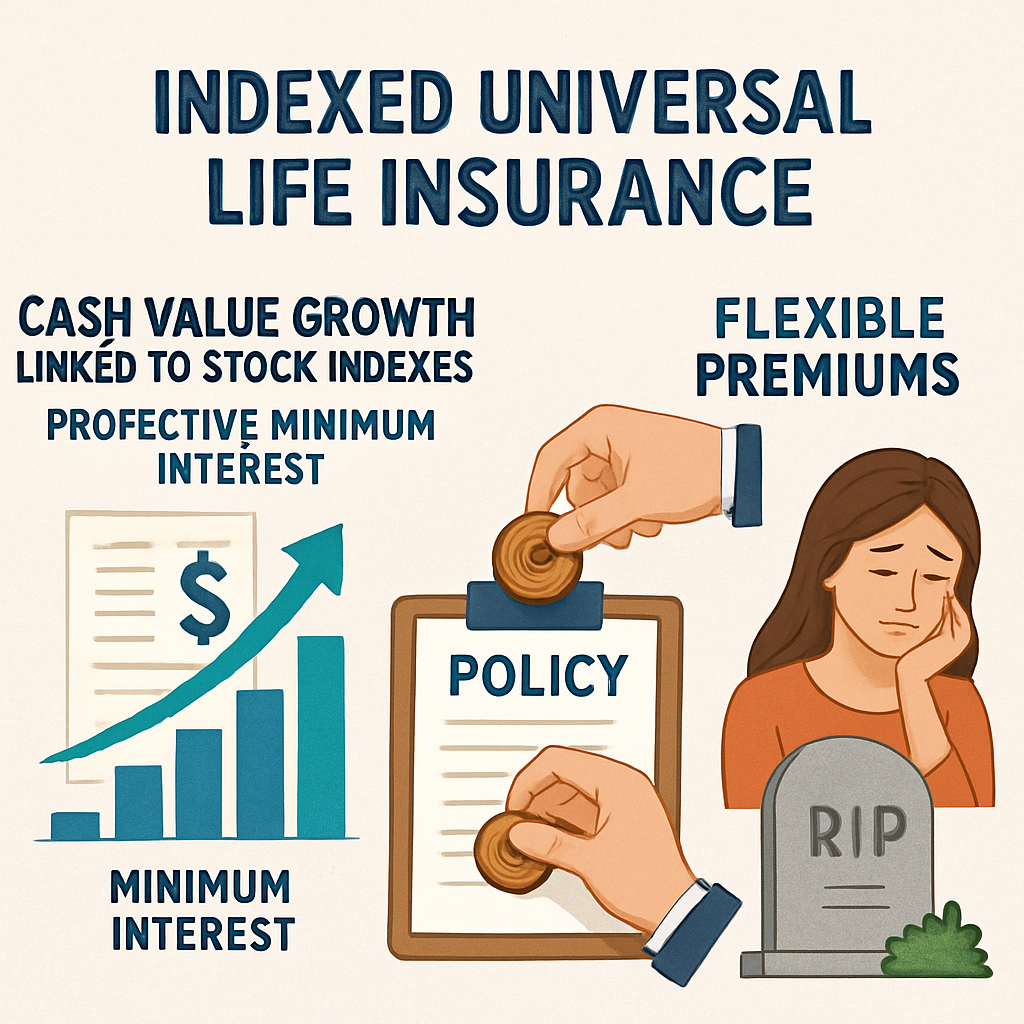

When exploring the best IUL policies for retirement planning, it’s essential to grasp what Indexed Universal Life (IUL) insurance really offers. Unlike traditional life insurance, an IUL policy blends permanent life coverage with a unique cash value growth component tied to stock market indexes. But what does that mean for you and your financial future?

What Sets IUL Apart?

Indexed Universal Life insurance is a type of permanent life insurance, so it stays in force for your entire life—as long as premiums are paid. But the real game-changer is how the cash value inside the policy grows.

With an IUL, your cash value is linked to an equity index, such as the S&P 500 or NASDAQ-100. So instead of earning a fixed interest rate like traditional universal life insurance, your cash grows based on the performance of these indexes. It’s important to note that your cash value won’t directly invest in stocks, which helps limit downside risk.

How does this shield you? Even if the market dips, your policy typically includes a guaranteed minimum interest rate, shielding your cash value from losses. At the same time, you still have the chance to benefit when the market performs well. Plus, many policies have an interest rate cap, so earnings grow up to a maximum amount. This balance between market exposure and downside protection is what makes IULs attractive to many individuals looking for growth without higher risks.

Flexible Premiums and Death Benefit

IUL policies offer a highly flexible premium structure. Unlike whole life insurance, you aren’t locked into a fixed premium schedule. As your cash value grows, you can use it to reduce or even fully cover premium payments, which can ease your financial burden during retirement or other times.

Your death benefit, which your beneficiaries receive upon your passing, is also adjustable in many cases. This flexibility means you can increase coverage or switch between level and increasing death benefits, adapting your insurance to your changing financial needs.

Living Benefits Beyond Death Coverage

What if you could access policy funds while you’re still alive? With IULs, once your cash value builds, you can take out loans or withdrawals, offering a source of supplemental income or emergency funds. Because the growth is tax-deferred, accessing the cash value in this way can be a smart strategy for retirement planning.

Additionally, some IUL policies offer riders that provide additional living benefits, like accelerated death benefits or even long-term care coverage options. These riders can add valuable protection for health-related expenses—something to seriously consider as part of your comprehensive financial plan.

Why Are Best IUL Policies for Retirement Planning So Popular?

Many families and individuals are turning toward indexed universal life insurance because it combines the security of permanent life insurance with growth potential and flexible payment options. It’s less complicated than variable universal life insurance—which requires picking individual stocks—and offers more growth opportunity than whole life insurance’s fixed returns. This sweet spot is ideal for those who want their hard-earned money to work smarter without excessive risk.

But remember: fees and caps can vary widely between policies and carriers, so understanding the fine print is crucial. Working with a knowledgeable insurance agent, like those at Life Care Benefit Services, can help you navigate these nuances and tailor a policy that aligns with your retirement goals.

Ready to take control of your retirement future? Explore detailed insights on Indexed Universal Life insurance from Progressive’s guide and fine-tune your approach with more info on Nationwide’s IUL products.

Does it sound like a promising fit for your financial planning? You’re not alone in considering this. Many experts believe IULs can be effective tools for long-term retirement security when chosen and managed carefully.

To sum up, Indexed Universal Life insurance offers:

- Permanent life coverage ensuring lifetime protection

- Cash value growth tied to market indexes, balancing growth with protection

- Guaranteed minimum interest rate securing your cash value from loss

- Flexible premium payments potentially funded by growing cash value

- Adjustable death benefits to fit evolving needs

- Living benefits like policy loans and riders for long-term care

Understanding all these elements gives you confidence to choose among the best IUL policies for retirement planning and make your money work for you.

2. Top Criteria to Evaluate When Choosing the Best IUL Policies for Retirement Planning

Choosing the best IUL policies for retirement planning isn’t as simple as picking the lowest premium or the highest death benefit. You need a keen eye on several critical factors that impact your policy’s growth, flexibility, and long-term sustainability.

Let’s break down the top criteria you should evaluate carefully—so you can maximize both protection and potential cash value growth.

1. Flexible Premiums and Payment Options

An IUL’s promise lies in its flexibility. You want a policy that lets you adjust premiums within certain limits. Why? Life circumstances change—maybe your income goes up or down, or you want to funnel more money during a prosperous year.

Be sure your policy allows you to:

- Increase or decrease premium payments depending on cash flow.

- Make lump-sum payments to boost your cash value.

- Avoid lapses by making minimum required payments.

Keep in mind, underpaying can stall cash value growth, while overpaying without guidance might trigger unwanted tax consequences like becoming a Modified Endowment Contract (MEC). Consulting with an expert can help you optimize premium funding in a tax-smart way.

2. Cash Value Growth Potential Tied to Index Performance

One of the biggest draws to IULs is your cash value can grow based on how well certain market indexes perform, like the S&P 500. But here’s where it gets tricky.

Policies have a participation rate, a cap, and a floor that govern your credited interest:

- Participation rate: The percentage of the index gain credited to your policy (e.g., 80% means you get 80% of the index’s gain).

- Cap rate: The maximum interest your policy can earn in a crediting period, often between 8% and 12%.

- Floor rate: The guaranteed minimum, usually 0%, ensuring you don’t lose cash value during negative index years.

For example, if the index returns 10%, but your cap is 8% and participation 100%, you earn 8%. Down years? Your floor protects you from loss. This balance limits downside risk while allowing upside growth. Look for policies offering competitive caps and participation rates that align with your goals.

3. Cost of Insurance (COI) Charges and Fees

Don’t overlook the impact of rising costs. COI charges increase as you age, eating into your cash value if premium contributions aren’t sufficient. Additionally, administrative fees can chip away at growth.

Ask for a detailed breakdown of:

- How COI is calculated over time.

- Policy fees and other expenses.

- What happens if cash values decline below certain thresholds.

Understanding these helps you avoid surprises later, like needing to pay higher premiums or experiencing unexpected decreases in death benefit.

4. Death Benefit Options and Flexibility

IUL policies typically offer adjustable death benefits. This means you can choose level or increasing benefits, and even lower your death benefit if needed to reduce premiums.

Why does this matter?

Because your priorities might shift—perhaps your kids are out of college, or you’ve paid off your mortgage—and adjusting your death benefit can optimize your insurance and cash value balance.

5. Riders and Living Benefits

Look for supplemental riders like accelerated death benefits or long-term care riders. These add living benefits, giving you access to funds during your lifetime for qualifying events. They enhance the value of your policy beyond just a death benefit.

Choosing policies with these options can offer additional security without needing separate insurance products.

6. Annual Policy Reviews and Strategic Monitoring

Have you ever thought about how your policy will hold up under different market conditions over time? It’s crucial to review your IUL policy at least annually. Regular monitoring helps you adjust premium payments, reallocate index segments, and anticipate rising costs.

Risk assessment tools like Monte Carlo simulations and stress testing can reveal how changing market returns or COI hikes affect your policy’s sustainability and cash value growth. Strategic management prevents unpleasant surprises and helps keep your retirement plan on track.

Don’t let your policy become a “set it and forget it” item. Active engagement is key.

7. The Reputation and Financial Strength of the Insurer

Last but not least, the carrier’s financial strength matters. You want reliable, top-rated insurers with solid track records of paying claims and crediting interest as promised.

Explore ratings from agencies like A.M. Best or Standard & Poor’s to confirm the insurer’s stability. Your peace of mind depends on choosing a company that’s in it for the long haul.

Considering these criteria thoughtfully can save you money and hassle while building a retirement asset that truly supports your goals.

Still wondering how to navigate these complexities? Our team at Life Care Benefit Services can help you compare multiple policies from over 50 top-rated carriers, tailoring solutions just right for your retirement planning needs. Don’t hesitate to schedule a consultation and get expert guidance today.

Choosing the best IUL policy means balancing growth potential with risk protection, cost management, and flexibility. When these pieces fall into place, you gain a powerful tool to fund your golden years with confidence.

Ready to explore your options in detail? Learn more about optimizing IUL policies through strategic reviews, the core features of indexed universal life insurance from a trusted insurer, and why monitoring costs and indexes matters on Investopedia’s indexed universal life insurance guide. Taking these steps will ensure you’re positioned to make informed decisions that protect your family and grow your retirement savings effectively.

3. Best IUL Policies for Retirement: Reviews and Highlights

Choosing the best IUL policies for retirement planning isn’t just about picking the highest cap rate or the flashiest promise. It’s about understanding how different carriers structure their policies—balancing growth potential, fees, flexibility, and financial strength.

So, which companies consistently stand out in this complex landscape? Based on expert reviews and market analysis, here are three top contenders you should know about.

1. Mutual of Omaha: Reliable Cash Value Growth with Low Fees

Mutual of Omaha has carved a niche for itself by focusing on minimizing costs during years when markets underperform, making its policies attractive for steady cash value accumulation. This approach is especially appealing if you’re looking to shelter your retirement savings from market downturns without sacrificing upside potential.

What sets their IUL apart is the transparency in their crediting strategies and their consistent effort to maintain competitive cap rates, even for existing policyholders. This means you’re less likely to face surprise reductions in your policy’s crediting metrics as market conditions fluctuate.

Curious about how exactly this impacts your retirement savings? Their emphasis on balancing cap rates with fee management aligns perfectly with long-term retirement goals. Learn more about Mutual of Omaha IUL features here.

2. Lincoln National: Diversified Index Options and Downside Protection

If variety and risk management are critical to your retirement planning, Lincoln National might grab your attention. Their flagship IUL products offer a broad selection of indexed strategies, not just limited to the standard S&P 500.

This diversity allows for more strategic allocations, helping to better position your policy in both bullish and bearish market cycles. Plus, Lincoln combines this with strong downside protection, ensuring your cash value doesn’t take a hit when markets stumble.

But how do you know if this policy really suits your financial style? It’s worth exploring their multiple index options to understand how your cash value could grow under different market scenarios. Their innovative design has led to steady growth potential in recent years. Check out Lincoln National’s IUL strategies in detail.

3. John Hancock: Estate Planning Excellence and Tax Efficiency

Looking to blend retirement planning with legacy goals? John Hancock’s Survivorship Universal Life offers an exceptional way to pass wealth efficiently to the next generation, making it not just an income vehicle but a strategic estate planning tool.

This policy’s design pays out the death benefit only after both insured individuals have passed, providing a powerful mechanism to manage estate taxes and protect assets for heirs. Along with tax-deferred cash value growth and tax-free policy loans, it’s a solid choice if comprehensive protection and wealth transfer are priorities.

Wondering if this is the right fit for your family’s future? Their reputation and product enhancements make this a leading choice in the premium IUL market. Discover how John Hancock’s Survivorship Universal Life can optimize your retirement and legacy.

Picking the best IUL policies for retirement planning isn’t one-size-fits-all — it depends on your cash flow, risk tolerance, and what you want your policy to achieve besides just a death benefit.

If you want to get the most bang for your buck, it pays to dig into details like loan interest rates, guarantees, and how companies treat their existing policyholders. For example, Penn Mutual is highly regarded for their solid guarantees and fair treatment of policyholders, avoiding complex volatility control indexes that can underperform during certain market conditions. See expert insights on Penn Mutual’s IUL policies.

Wondering if a higher cap always means a better IUL? Not necessarily. Policies that rely heavily on high cap rates but carry steep fees could leave you underwater if markets flatten or decline. That’s why stress-testing policies under less favorable market conditions with an independent broker is crucial.

To help you compare easily, here’s a snapshot of key features that can influence your choice among the top IUL policies:

| Feature | Mutual of Omaha | Lincoln National | John Hancock |

|---|---|---|---|

| Index Options | Standard S&P 500 strategies, focus on cost efficiency | Diverse indexed accounts including S&P 500 and more | Survivorship focused, with strong tax-planning benefits |

| Downside Protection | Floor guarantees with minimized fees | Strong downside protection with multiple index choices | Floor guarantees plus estate tax efficiency |

| Loan Features | Competitive loan rates, stable crediting during loans | Flexible loan options with varied exposure choices | Tax-free loans aligned with legacy planning |

| Policyholder Treatment | Consistent caps for existing policies | Focus on product innovation and flexibility | Strong focus on comprehensive protection and legacy |

Still feeling overwhelmed by the options? Don’t worry, this is exactly why working with an experienced IUL agent from Life Care Benefit Services is invaluable. They can help you assess which policy matches your personal retirement goals, run customized illustrations, and stress-test scenarios based on your exact needs.

After all, the best IUL policies for retirement planning are the ones tailored to you — giving you peace of mind with growth potential, tax advantages, and the protection your family deserves.

Ready for personalized advice? Schedule a consultation today to explore how these leading IUL policies can fit into your retirement plan.

4. Comparing IUL Policies with Other Retirement Planning Tools

When exploring the best IUL policies for retirement planning, one question keeps popping up: how do Indexed Universal Life (IUL) insurance policies stack up against other popular retirement savings options like 401(k)s and IRAs? It’s a hot topic because while all these tools aim to secure your financial future, they do it in very different ways.

Understanding the Fundamental Differences

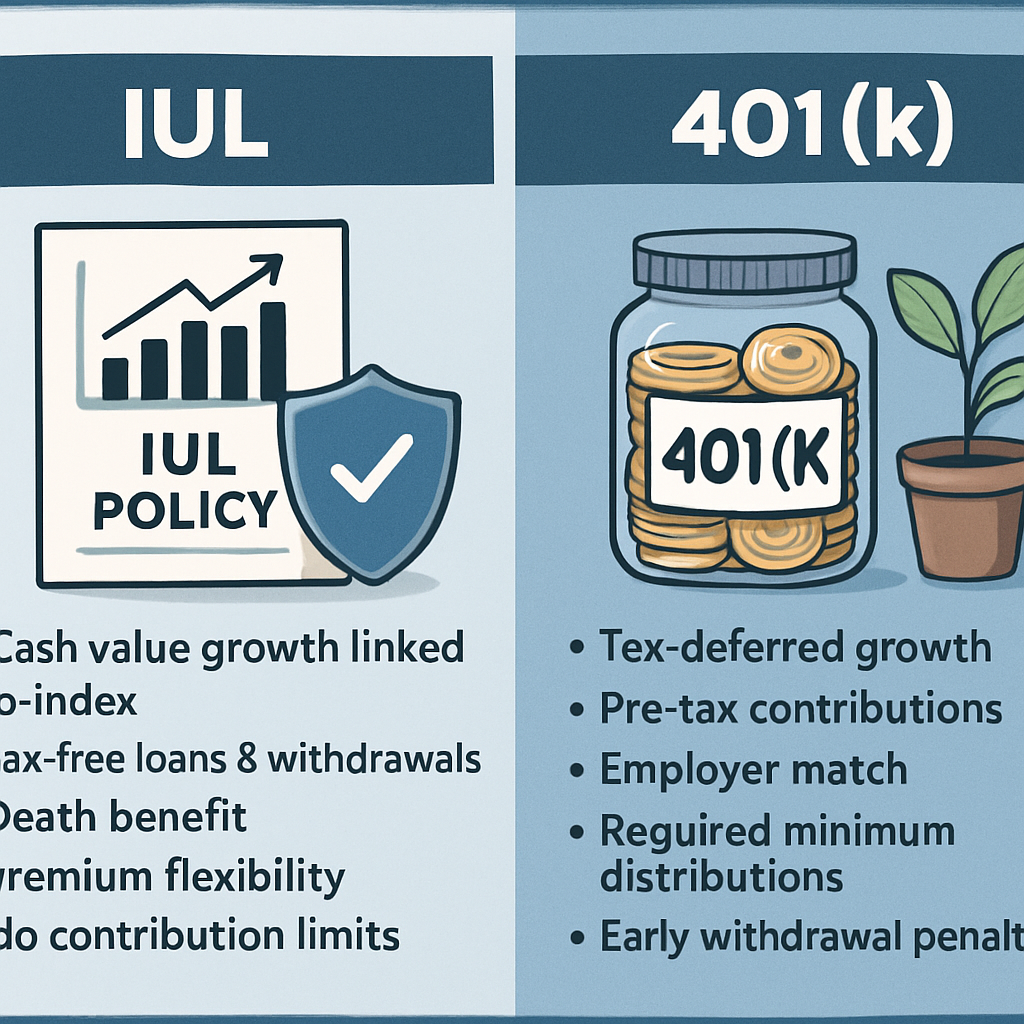

First off, let’s clarify that IUL policies are primarily life insurance products with a cash value component, whereas 401(k)s and IRAs are pure investment vehicles designed to grow your retirement nest egg.

Your IUL premiums are paid with after-tax dollars. The cash value inside grows tax-deferred and can be accessed through policy loans or withdrawals—often tax-free up to your cost basis. In contrast, 401(k) contributions generally use pre-tax dollars (except Roth 401(k)s), providing immediate tax relief. The funds grow tax-deferred, but you’ll pay income taxes upon withdrawal unless it’s a Roth account.

Key Comparison Factors

| Feature | Indexed Universal Life (IUL) Policies | 401(k) / IRA Plans |

|---|---|---|

| Primary Purpose | Death benefit protection plus cash value growth | Long-term retirement savings with tax advantages |

| Tax Treatment | After-tax premiums; tax-deferred growth; tax-free loans/withdrawals up to basis | Pre-tax contributions (traditional); tax-deferred growth; taxed at withdrawal; Roth option offers tax-free withdrawals |

| Access to Funds | Loans or withdrawals can be taken but may reduce death benefit; access timing and amounts may be limited by policy | Generally limited before age 59½ without penalties; loans and hardship withdrawals possible in specific cases |

| Market Exposure | Growth tied to a market index with a guaranteed floor to prevent losses but with capped upside | Direct investment in markets with full upside and downside exposure |

| Fees and Costs | Includes insurance costs, administration fees, and surrender charges | Typically lower fees, but investment expense ratios vary by fund choice |

See how they serve different objectives? An IUL offers a safety net with life insurance and a way to build cash value with downside protection. Meanwhile, 401(k)s are straightforward retirement savings plans with employer matching opportunities and generally easier access to funds, though early withdrawal penalties apply.

So, which one is right for you?

That depends on your financial goals. If your main concern is ensuring your loved ones receive a death benefit while also having a flexible savings component, an IUL policy could be the best IUL policies for retirement planning choice. Say you want protection along with supplemental income possibilities during retirement—that’s where IULs shine.

On the flip side, if maximizing retirement contributions, taking advantage of employer matching, and investing directly in the market are your priorities, then a 401(k) or IRA may better align with your needs. Also, 401(k)s tend to have higher contribution limits, making them powerful wealth-building vehicles, especially when you factor in potential employer contributions (according to ShareBuilder 401k insights).

What about fees and flexibility?

IUL policies can come with higher fees due to insurance costs, administration charges, and potential surrender fees if you end the policy early. That’s not to say they aren’t valuable—but you’ll want to review these costs carefully to avoid surprises.

401(k)s usually have lower administrative fees but you’re subject to market volatility with no guarantees. Plus, required minimum distributions (RMDs) start at age 73 for traditional 401(k)s and IRAs, while IUL policies don’t have RMDs, providing more control when to access funds.

Consider Combining Them for a Balanced Approach

Why choose one over the other when you can use both? Many savvy savers use 401(k) plans for steady, tax-advantaged retirement savings and pair them with IUL policies to add life insurance protection and flexible cash-value access.

This strategy helps you optimize tax benefits, protect your family, and diversify how you save for retirement and access funds.

Curious whether an IUL fits your personal situation? An experienced agent at Life Care Benefit Services can run personalized scenarios to find the best strategy tailored to your retirement goals.

Want to explore your options further? Reach out today to schedule a consultation—it could make the difference in mapping out your secure retirement path.

5. How to Maximize the Benefits of Your IUL Policy for a Comfortable Retirement

If you’re already considering the best IUL policies for retirement planning, you probably know the basics: life insurance combined with cash value growth tied to a market index. But how can you make sure your policy truly works hard for your future comfort? Let’s break down some practical strategies that can help you get the most from your Indexed Universal Life policy.

1. Start with the Right Premium Contribution

One of the biggest secrets to maximizing your IUL is paying more than the minimum premium. Why? Because the excess funds go toward your policy’s cash value, which grows tax-deferred and can compound over time. This compounding growth can significantly increase your financial cushion in retirement. It’s important, though, to maintain enough premium to cover the cost of insurance so your policy stays active and continues growing.

Think of your policy’s cash value like a personal nest egg that benefits from the potential market upside without risking your principal. But it’s your premium payments that fuel this growth. So, having a disciplined approach to contributing can make a world of difference.[source]

2. Use Flexible Withdrawals and Policy Loans Wisely

What if you need to access some cash before retirement? Unlike most retirement plans, many IUL policies allow tax-free withdrawals or loans against your cash value. This flexibility can serve as an emergency fund or even supplement income during retirement without triggering taxes, as long as the loan is repaid properly.

However, this is not a free pass—borrowed amounts reduce your death benefit and cash value until repaid. Strategically planning how and when to take loans can keep your policy on track and even enhance retirement income.[source] Have you ever considered how this flexibility can create a tax-efficient income stream alongside your 401(k) or IRA?

3. Monitor Your Policy Regularly

Many people don’t realize their IUL policies need regular reviews. Changing market conditions, interest rate environments, and insurance costs can affect your policy’s growth and premiums. Periodic check-ins with your insurance agent or financial advisor ensure your policy stays properly funded and aligned with your retirement goals.

If your policy is underfunded, it could drift into a danger zone where it might lapse or lose expected benefits. Keep an eye on the cash value performance and adjust premiums when necessary to avoid surprises.[source]

4. Understand Your Policy’s Features and Riders

The best IUL policies for retirement planning often include riders that enhance flexibility and benefits. For example, accelerated death benefits can provide funds if you face a chronic illness. Riders tailored to your unique situation can increase your policy’s value beyond just death benefit and savings.

Have you explored if your IUL policy offers living benefits or additional riders? These can be a game changer, especially if you want protection that does more than just a payout after you’re gone.

5. Work with Experts to Tailor Your Approach

Every family’s retirement goals and risk tolerance are different. Partnering with an independent agency like Life Care Benefit Services can help you compare policies from multiple carriers to find options that fit your financial picture.

Our experienced agents can run personalized scenarios that forecast how your premiums, market index crediting, and withdrawals might play out over time. This tailored insight allows you to optimize your IUL strategy with confidence.

Ready to unlock the full potential of your IUL policy? Request a quote or schedule a consultation today to explore how an Indexed Universal Life policy becomes a cornerstone of a flexible, comfortable retirement.

Conclusion: Taking the Next Step Towards Secure Retirement with the Best IUL Policies

Choosing the best IUL policies for retirement planning isn’t just about having insurance—it’s about building a flexible financial foundation that adapts to your life and goals.

Imagine a retirement where your policy not only provides a death benefit but also grows cash value tied to market indexes without the risk of market losses. That kind of security and growth potential is what makes Indexed Universal Life insurance stand out.

So, what should you do next? Start by assessing your own retirement needs and risk tolerance. Are you looking for growth potential with downside protection? Do you want living benefits that protect you if unexpected events arise?

Partnering with an independent agency like Life Care Benefit Services can simplify this process. Our experts work closely with you to compare the best IUL policies for retirement planning from over 50 top-rated carriers, tailoring solutions that fit your unique financial picture.

Don’t wait to take control of your retirement future. Request a personalized quote or schedule a consultation today, and discover how the right IUL policy can become your cornerstone for a comfortable, secure retirement.

Frequently Asked Questions About the Best IUL Policies for Retirement Planning

Thinking about the best IUL policies for retirement planning often leads to plenty of questions—and that’s perfectly normal. These policies have some unique benefits, and understanding them can put you ahead in building a secure retirement.

What exactly is an Indexed Universal Life (IUL) insurance policy?

Simply put, an IUL is a life insurance policy that also acts as a flexible retirement planning tool. It provides a death benefit, like traditional life insurance, but it also allows your cash value to grow based on the performance of stock market indexes—without the risk of losing money due to market downturns.

So, why should you care? Because with an IUL, your money has the potential to grow over time, offering both protection and a retirement income source.

How does the cash value in an IUL policy grow?

Good question! The cash value grows tied to an index, like the S&P 500, but there’s typically a cap on how much interest you can earn each year, and a guaranteed minimum so your cash value never decreases due to market drops.

This means your retirement savings enjoy upside potential, while downside risk is limited. It’s like having a safety net while still keeping some market growth.

Are the best IUL policies for retirement planning too expensive?

The cost varies depending on your age, health, and the policy features you choose. While IUL premiums can be higher than basic term life insurance, they give you living benefits and cash value growth, which many find worth the investment.

Plus, Life Care Benefit Services can help you compare options from over 50 carriers to find an affordable plan that fits your budget and goals.

Can I access my cash value during retirement?

Yes! One of the big perks of IUL policies is flexibility. You can usually access your cash value through tax-advantaged loans or withdrawals to supplement your retirement income.

This can provide a steady cash flow without having to liquidate other retirement assets, helping you manage taxes and investment risks better.

What happens if I face unexpected health issues?

Many top IUL policies include living benefits that allow you to use your death benefit early if you’re diagnosed with a chronic, critical, or terminal illness. That kind of financial relief during tough times is invaluable.

Wouldn’t it be comforting to know your policy supports you when life throws curveballs?

How do I choose the best IUL policy for my retirement planning needs?

Start by assessing your retirement goals, desired protection level, and risk tolerance. Then, work with an independent agency like Life Care Benefit Services that offers personalized guidance and access to a wide range of policies.

They’ll compare features like caps, participation rates, fees, and living benefits to find what fits your unique financial picture.

Is now a good time to get an IUL policy for retirement planning?

Absolutely! The earlier you start, the better your cash value can grow over time.

And because retirement planning takes a long-term view, locking in a policy now means more opportunity for growth and flexibility down the road.

Ready to explore the best IUL policies tailored to your retirement dreams? Contact Life Care Benefit Services today for a personalized consultation or a no-obligation quote. Your future self will thank you.