Choosing the right life insurance policy isn’t just about picking a plan—it’s about securing your family’s future and financial well-being. When it comes to permanent life insurance options, two popular choices often come up: Indexed Universal Life (IUL) and Variable Universal Life (VUL) insurance. But what exactly sets these apart, and which one might fit your unique situation best?

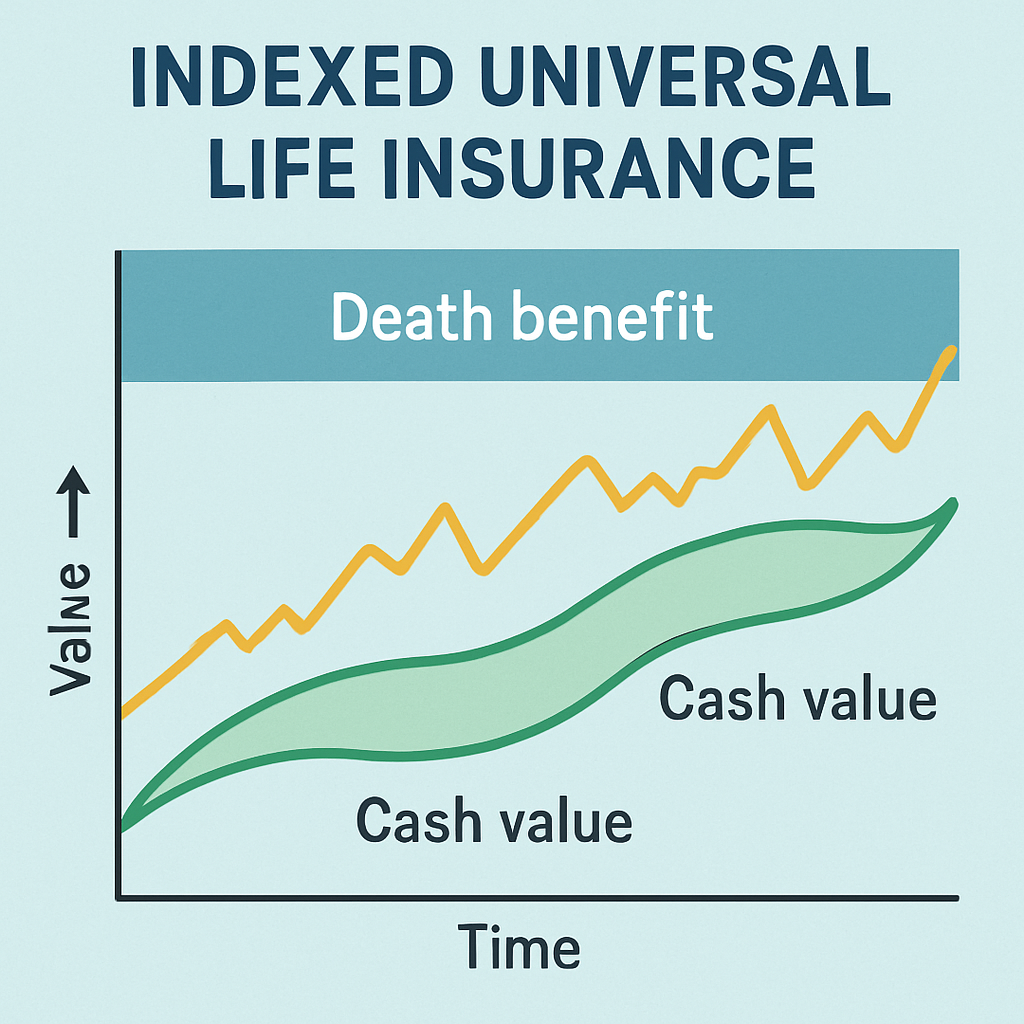

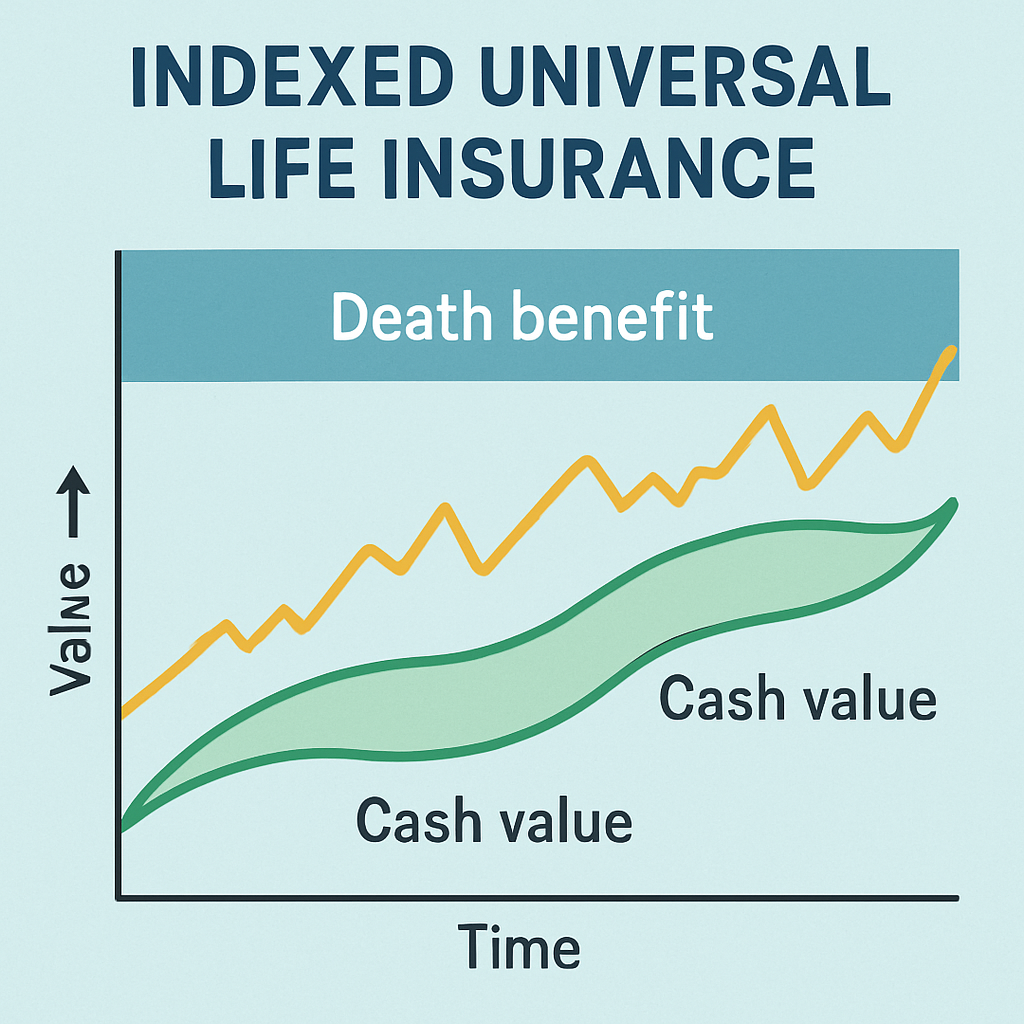

Have you ever wondered how life insurance can do more than just provide a death benefit? Both IUL and VUL policies offer the potential to build cash value over time, which can be a powerful tool for retirement planning, debt management, or unexpected expenses. But they accomplish this in very different ways, which affects risk, growth potential, and flexibility.

Understanding these differences can feel overwhelming—do you go with the market-linked growth of VUL or the more conservative, indexed approach of IUL? Each has its perks and considerations, so why not get clear on the essentials upfront?

For example, IUL policies tie your cash value growth to a stock market index—but without the risk of losing your principal to market downturns. On the other hand, VUL policies let you invest directly in mutual fund options, giving you more growth potential but also more risk. Which side of the risk-reward spectrum appeals more to you?

Getting clarity here isn’t just smart—it’s critical for making an informed choice that aligns with your financial goals and risk tolerance. By the end of this comparison, you’ll better understand how these options can grow your wealth while protecting your loved ones.

If you’re a family seeking affordable but comprehensive coverage or someone planning for retirement, knowing the ins and outs of IUL vs variable universal life insurance comparison helps you make confident decisions. For tailored advice on selecting the best policy to safeguard your future, don’t hesitate to explore our detailed guide on reviewing life insurance policies. Ready to dive into the specifics and find which policy fits your life? Let’s jump in.

TL;DR

Choosing between IUL and variable universal life insurance means balancing growth potential with risk tolerance. IUL offers steady indexed gains with downside protection, while VUL allows direct market exposure for higher reward but greater volatility.

Understanding these differences helps you align coverage with your financial goals and protect your family effectively.

1. Understanding Indexed Universal Life (IUL) Insurance

If you’ve been weighing your options in the IUL vs variable universal life insurance comparison, understanding what exactly an Indexed Universal Life (IUL) policy offers is a great place to start.

In simple terms, an IUL is a type of permanent life insurance that not only provides a death benefit to your loved ones but also a cash value component that has potential to grow over time. What makes it unique? The cash value earns interest based on the performance of a stock market index, like the S&P 500 or NASDAQ-100, without actually investing your money directly in the stock market.

Sounds interesting, right? Let’s break down the top reasons why an IUL might be a solution to consider for your long-term financial security.

1. Flexible Premiums and Death Benefits

Unlike term life insurance, IUL policies offer adjustable premiums, meaning you can customize how much you pay and when. You could skip or underpay premiums in certain years, then catch up later, as long as the policy stays in force. Similarly, the death benefit isn’t set in stone—you may have options to increase or decrease it to better match your changing needs.

This flexibility is ideal if your income fluctuates or if you want a life insurance policy that grows with your family’s needs.

2. Cash Value Growth Tied to Market Indexes

Here’s the magic: your cash value grows based on the change in a market index, but your money isn’t actually invested in stocks. This means your policy benefits from market upsides without risking losses when the market dips. Insurance companies set a guaranteed minimum interest rate to protect your principal, so you won’t lose cash value even if the index has a bad day.

However, your gains might be capped or limited by a participation rate set by the insurer, so you won’t get the full market return—but many appreciate the balance of growth with downside protection.

3. Ability to Borrow Against Your Cash Value

Need access to funds? Many IUL policies let you borrow against the cash value you’ve built up. This can be a smart way to tap into your policy’s value for emergencies, education expenses, or even supplementing retirement income. Just remember, outstanding loans and withdrawals will reduce the death benefit your beneficiaries receive.

This feature adds versatility but needs to be managed carefully to avoid unintended consequences.

4. Suitable for Long-Term Planning, Not Just Insurance

Since IUL policies have a cash accumulation element and flexible features, they’re often used beyond just life protection. Business owners might use them for key person insurance or estate planning, and individuals might see them as supplemental retirement tools, especially when other options have been maxed out.

That said, they’re generally not the best standalone retirement accounts compared to a 401(k) or IRA because of fees, caps on returns, and complexity. Still, they offer a unique blend of protection and growth that’s worth understanding as part of your broader financial plan.

Wondering if these benefits offset the costs involved? It’s true that IULs tend to have higher premiums than term policies due to their added features and living benefits. But for those looking for permanence and flexibility with some growth potential, they can be well worth exploring.

If you want to dive deeper into how the indexed interest is calculated or the specific features of policies from major providers, this in-depth explanation from Investopedia on Indexed Universal Life Insurance is a great resource.

For details on how policies track multiple indexes and manage loans or withdrawals, Nationwide’s Indexed Universal Life Insurance overview offers clear insights tailored for policyholders.

Ultimately, if permanence, potential cash growth, and flexibility sound like the right fit, an IUL policy could be a strong match — but it’s worth getting personalized advice to see if it aligns with your financial goals.

Ready to protect your family’s future with a policy that does more? Contact Life Care Benefit Services to schedule a consultation and explore your options today.

2. Exploring Variable Universal Life (VUL) Insurance

Variable Universal Life (VUL) insurance might sound complex, but it’s actually a powerful tool for those who want more than just a death benefit. It combines lifelong life insurance coverage with investment options that can grow your policy’s cash value based on market performance. Intrigued? Let’s break down why VUL stands out and what you should consider.

1. What Makes VUL Unique?

Unlike indexed universal life (IUL) insurance that ties cash value growth to a market index, VUL lets you direct your policy’s cash value into a variety of investment subaccounts like stocks, bonds, or mutual funds. This means your cash value can grow significantly if the market does well—but it can also decline if investments perform poorly. You’re essentially combining life insurance protection with an investment portfolio.

This feature is ideal if you’re comfortable with market risks and want your life policy to potentially build wealth over time.

2. Flexible Premiums and Death Benefits

One major advantage of VUL is the flexibility it offers. You can adjust your premium payments and sometimes even the death benefit amount to match your changing financial situation. Miss a payment or pay less one month? That might reduce your cash value growth or even decrease the death benefit, so be mindful of these adjustments.

This flexibility can be a big plus if your income fluctuates or if you want to tailor your plan gradually. But remember: managing these changes wisely requires regular policy reviews.

3. Investment Control — A Double-Edged Sword

With VUL, you get to choose how your cash value is invested, often from a menu of variable subaccounts with different risk levels. Want to play it safe or shoot for high returns? The choice is yours. But with control comes responsibility: your cash value will change daily with market ups and downs. It’s not unusual for your cash value and even your death benefit to fluctuate based on investment results.

Because of this, VUL insurance is best suited for those who either have experience with investments or are working closely with financial advisors. It’s also important to monitor your policy frequently to keep it funded enough so it doesn’t lapse unexpectedly.

4. Tax Advantages — Why They Matter

One big selling point for VUL is its tax-deferred growth. The cash value increases without being taxed each year, which can help you build wealth faster compared to taxable investments. Additionally, the death benefit is generally income tax-free for your beneficiaries, which can provide significant financial relief in difficult times.

But watch out—taking loans or withdrawals from your policy requires careful planning. Done right, they can be tax-free if your contract isn’t classified as a Modified Endowment Contract (MEC). That’s why consulting with a tax advisor before making changes is crucial.

5. The Risks You Shouldn’t Ignore

VUL insurance isn’t a set-it-and-forget-it product. The inherent market risks mean your policy’s cash value can drop. If it falls too low, you might have to pay extra premiums to keep the policy active. Unlike traditional whole life or IUL, there’s no guaranteed minimum return, so your policy could underperform.

This makes VUL more suitable for long-term investors who can handle market volatility. If you’re looking for simpler, more predictable growth, you might want to consider other options.

6. Who Benefits Most from VUL?

Are you a high-income earner or someone with a sophisticated financial plan? VUL can be an excellent fit if you want permanent life insurance paired with investment potential and flexible premiums. It’s also attractive if building cash value that you can access via loans or withdrawals is important to you.

If you’re unsure whether you have the appetite for market risk or the time to manage your policy, that’s perfectly okay. Sometimes, combining term insurance with separate investments or choosing an indexed universal life policy may be better aligned with your goals. Understanding the difference between IUL vs variable universal life insurance comparison can help you pin down what suits you best.

Curious to see if VUL could align with your financial future? Reach out to Life Care Benefit Services for personalized guidance. Their experts can help you navigate options and set up a strategy tailored just for you.

To dive deeper into the features and nuances of VUL insurance, check out the detailed insight on how Variable Universal Life insurance works at Thrivent and get an expert perspective on its pros and cons.

Looking for a clear visual comparison between VUL and other types of life insurance? The comprehensive overview at Abrams Insurance Services explains the differences with real-world examples that make your choices easier.

Tax considerations can be tricky with VUL, so consulting resources on tax strategies for life insurance like the IRS Publication 525 will help you avoid surprises down the road.

3. Key Differences Between IUL and VUL Insurance

When navigating the world of life insurance, especially in an IUL vs variable universal life insurance comparison, it’s important to grasp the core differences that set these two apart. Both offer flexibility beyond traditional term insurance, but their approach to growth, risk, and management varies significantly.

1. How Cash Value Growth Works

The first, and arguably most crucial, difference lies in how each policy’s cash value accumulates.

Indexed Universal Life (IUL) policies link cash value growth to a specific market index, like the S&P 500. However, your returns don’t mimic the exact market performance. Instead, they’re subject to caps (maximum growth limits) and floors (minimum guaranteed returns, often 0%). This means your cash value can grow steadily without ever dipping below zero—even during market downturns. It’s perfect if you want to benefit from market upswings but avoid losses.

In contrast, Variable Universal Life (VUL) policies invest your cash value directly into various securities such as stocks and bonds. This gives you potentially unlimited growth upside, as your cash value mirrors actual market returns without caps or floors. But here’s the kicker: you’re fully exposed to market risks. If investments drop, so does your cash value—and that can affect your ability to keep premiums current.

For a detailed breakdown, Insurance and Estates provides an in-depth look at how indexed and variable accounts operate, which is helpful in understanding these contrasting growth mechanics.

2. Risk and Volatility

Let’s be honest—how much market risk you’re comfortable with can make or break your experience with these policies.

IUL is designed for the cautious investor. Thanks to its guaranteed 0% floor, your cash value won’t lose ground during market dips. It’s like having a safety net protecting your principal while still participating in gains. This makes IUL a favored choice for individuals who want some exposure to market growth but can’t afford big surprises.

On the flip side, VUL attracts those who prioritize high growth and are comfortable with ups and downs. The absence of floors means your cash value can decline when markets fall, which could jeopardize your premium payments and even the policy itself if losses are severe. If you’ve got the financial cushion and stomach for market volatility, VUL’s investment flexibility might be rewarding.

Thinking about risk tolerance is key. Ask yourself: Would you be prepared to cover premiums out-of-pocket if your cash value took a significant hit? That’s a reality many VUL policyholders face during tough markets.

3. Management and Fees

Managing your policy is another major difference in the IUL vs variable universal life insurance comparison.

IUL policies are mostly hands-off. Because they track an index rather than invest directly, the insurer handles the complex moving parts, and you don’t need to constantly monitor fund choices. This convenience usually comes with lower fees and fewer management tasks, ideal if you want simplicity paired with steady growth.

Meanwhile, VUL demands a more active approach. You select from various investment subaccounts and are responsible for rebalancing according to your goals and risk appetite. These investments incur higher fees — sometimes 1%–3% annually — for active management and fund expenses. This means VUL entails not just market risk but also operational costs that add up with time.

If you’re someone who enjoys hands-on portfolio management and is equipped with investment know-how, VUL rewards you with control. Otherwise, IUL’s straightforward design aligns better with those looking for protection without the complexity.

Summary Table: Key Differences Between IUL and VUL Insurance

| Feature | Indexed Universal Life (IUL) | Variable Universal Life (VUL) |

|---|---|---|

| Cash Value Growth | Linked to market index with caps & floors (typically 0%) | Invested directly into securities; no caps or floors |

| Risk Exposure | Downside protected; cash value won’t lose in downturns | Full market risk; cash value can decline |

| Policy Management | Passive; insurer manages index tracking; lower fees | Active; you manage investments; higher fees |

| Suitability | Risk-averse, conservative growth seekers | Aggressive investors comfortable with volatility |

Still wondering which fits your plan? Conservative financial planners appreciate IUL’s blend of growth and protection while aggressive investors chase VUL’s strong upside potential. A personalized consultation with experts—like those at Life Care Benefit Services—can help clarify your unique fit.

Both policies come with flexible premiums and tax advantages, making them powerful tools for long-term wealth building according to SmartAsset’s detailed comparison on IUL vs VUL.

If you want to dig even deeper into these differences, Insurance and Estates’ expert insights provide extensive analysis perfect for tailoring this choice to your financial goals.

So, what’s your risk comfort level? Do you value stability with steady growth or are you ready to embrace market fluctuations for the possibility of bigger rewards? The right choice between IUL and VUL insurance could play a pivotal role in your family’s financial security and retirement planning.

Ready to explore tailored life insurance options? Reach out to the team at Life Care Benefit Services for expert advice designed to fit your goals, lifestyle, and risk tolerance. A no-obligation consultation can unveil which policy makes the most sense for your future.

4. Which Policy Is Best for Mortgage Protection and Small Business Owners?

Deciding between IUL and variable universal life insurance can feel overwhelming, especially when your priorities include mortgage protection and safeguarding a small business. Which policy truly fits these needs? Let’s break down key considerations to help you make a confident choice.

1. Flexibility to Cover Mortgage Payments

Mortgage protection isn’t just about having life insurance; it’s about ensuring your family can keep their home without financial stress if something happens to you. Both IUL and VUL policies provide a death benefit that beneficiaries can use to pay off the mortgage.

But here’s the catch: IUL policies offer more predictability by crediting interest linked to market indexes with a floor, meaning your policy’s cash value and death benefit are less likely to suffer due to market downturns. This stability can be crucial when you want mortgage protection that won’t fluctuate wildly.

For small business owners juggling business and personal finances, an IUL’s steady growth with downside protection can offer peace of mind that funds will be there when needed. Meanwhile, VUL may appeal if you’re comfortable with market risk and want potentially higher cash accumulation, but the uncertainty might not be ideal if you need guaranteed mortgage coverage.

2. Cash Value Growth Potential for Business Needs

Small business owners often look beyond basic protection—cash value growth in a life insurance policy can act as a valuable asset. VUL’s direct market exposure creates an opportunity for greater cash value accumulation, which you might use for business loans or emergency funds.

IUL policies also grow cash value, but typically with less volatility due to their index-crediting strategies. This means your money can grow steadily, adding another layer of financial security without the rollercoaster effect.

3. Budget-Friendly Premiums That Adapt

Affordability matters. IUL policies tend to have moderate premiums, and their flexible structure allows you to adjust payments within limits if your priorities shift. This is helpful for small businesses facing cash flow changes.

VUL premiums can fluctuate if you increase your investments, and market losses could mean you need to contribute more to keep coverage from lapsing.

4. Living Benefits for Business Owners and Families

Have you considered the value of living benefits like accelerated death benefits or chronic illness riders? Both policy types often include these, but IUL policies usually emphasize predictable, long-term protection plus options for accessing cash value during your lifetime—which can be a lifeline for mortgage payments or business continuity in tough times.

Does this really work for you? If eliminating the risk of losing your home or business is a priority, an IUL policy’s balance of growth and stability often fits best.

5. Expert Guidance Can Make All the Difference

The “IUL vs variable universal life insurance comparison” ultimately hinges on your tolerance for risk and your financial goals for mortgage protection and your business. Do you need steady, dependable coverage, or are you ready to leverage market gains for more aggressive asset growth?

Our team at Life Care Benefit Services specializes in helping families and small business owners like you find exactly the right match. From mortgage protection insights to personalized financial planning, we take the complexity out of your insurance choices.

Take the next step toward peace of mind—schedule a consultation to explore tailored solutions for your mortgage and business protection needs.

Ready to dive deeper? Learn more about essential life insurance strategies for small business owners to safeguard your family and enterprise effectively.

Want to understand how to tailor mortgage protection coverage that fits your budget and goals? Our guide on getting a mortgage protection insurance quote online walks you through every crucial step.

5. How Each Policy Supports Retirement Planning

When comparing IUL vs variable universal life insurance, understanding how each supports your retirement goals is crucial. Both policies offer life insurance protection paired with a cash value component, but they grow and pay out differently — and that impacts your retirement strategy.

1. Indexed Universal Life (IUL): Market-Linked Growth with Downside Protection

An IUL policy links the cash value growth to a stock market index, like the S&P 500, but with a safety net — your cash value won’t drop below zero even if the market tanks. This means you can potentially earn higher interest than traditional whole life policies without risking loss of principal in the cash value portion.

What’s even better? The cash value grows tax-deferred. During retirement, you can access this money through tax-free loans and withdrawals, providing a flexible income source. And because the policy’s premiums and death benefit options can adjust, you get flexibility to fit changing retirement needs.

However, be mindful that IUL policies often come with higher fees and premiums that may increase with age. Navigating these nuances with expert guidance ensures you leverage the policy effectively for retirement according to recent analysis.

2. Variable Universal Life (VUL): Investment Choice with Growth Potential—and Risks

VUL policies invest your cash value in sub-accounts, similar to mutual funds, offering potentially higher long-term returns depending on market performance. This approach can supercharge your retirement savings if you’re comfortable with market risk and committed to a long-term strategy.

Keep in mind, the cash value fluctuates with the market, so losses are possible. On the upside, these policies provide a tax-advantaged way to grow money and offer a death benefit that supports your loved ones.

VULs are complex and require commitment, often needing substantial premiums over many years. Advisors emphasize that VULs suit those with high incomes and maxed-out traditional retirement accounts, as explained by financial experts.

3. Which One Aligns Better with Your Retirement Vision?

Are you looking for more conservative growth with built-in market protection? IUL’s floor on returns might provide peace of mind while still building cash value for retirement income.

Or do you prefer investing actively with the potential for higher rewards, accepting the risks that come with market fluctuations? A VUL could suit your goals, especially if you have other retirement funding avenues covered.

Both policies enable tax-advantaged growth and death benefits, but they do not replace traditional retirement accounts like 401(k)s or IRAs. Instead, they can complement these by adding life insurance security and alternative savings growth.

Have you considered how flexible your retirement income needs are? IUL’s adjustable premiums and death benefits might help if your circumstances change, while VUL requires steady investment contributions for best performance.

Ultimately, your choice will depend on your risk tolerance, retirement goals, and whether you want insurance combined with investment potential. Working closely with a knowledgeable advisor can clarify which path fits your financial future.

Ready to explore how an IUL or VUL policy can enhance your retirement plan? Schedule a consultation with Life Care Benefit Services. Our experts will help you weigh these options against your unique needs, guiding you toward a solution that balances protection and growth.

6. Common Misconceptions and Risks to Consider

When diving into the world of life insurance, especially when comparing IUL vs variable universal life insurance, it’s easy to get tangled in some common misconceptions. Let’s clear those up so you can make a confident decision.

1. “IUL and VUL Are Just Like Investing in the Stock Market”

Many people think that indexed universal life (IUL) and variable universal life (VUL) insurance policies behave just like stock market investments. Not quite. While both policies allow for cash value growth linked to market performance, IULs feature downside protection with a guaranteed floor, shielding you from market losses, unlike direct market investments. On the other hand, VUL investments are at full market risk, meaning your cash value can go up or down based on actual investment returns. Investopedia highlights how IUL’s floor limits losses but also caps upside potential.

2. “These Policies Have Low Fees”

Let’s be honest: life insurance with an investment component isn’t cheap. IUL and VUL policies often carry multiple layers of fees—everything from administrative costs, insurance charges, to fund management fees. These fees can eat into your cash value growth far more than you might expect. For IULs, the complexity of fees and caps can limit returns, while VUL policies carry market risk plus fees on investment options. Always ask your agent for a clear fee breakdown before committing. For more on VUL fees and risks, check out Protective’s overview of variable universal life.

3. “I Can Use My Policy’s Cash Value Anytime Without Penalty”

Accessing cash value is a big selling point, but beware of surrender charges and tax implications, especially in the early years. With both IUL and VUL, withdrawing or borrowing too soon can trigger steep fees or even cause your policy to lapse. That means loss of coverage and potential tax bills. It’s not a savings account you dip into whenever you want—it requires strategic planning and long-term commitment.

4. “Both Policies Fit Everyone’s Needs”

Choosing between IUL and VUL depends heavily on your risk tolerance and financial goals. If you’re more conservative and want protection against market downturns, IUL might be better. But if you’re comfortable with investment swings and aiming for higher growth, VUL could fit. Remember, these aren’t replacements for traditional retirement accounts but complement them with life insurance protection.

Are You Equipped to Navigate the Complexities?

Figuring out which type of policy aligns with your unique situation isn’t easy. These products have many moving parts and potential pitfalls. Remember to ask detailed questions about how the cash value grows, fees involved, and what flexibility you have over time.

Don’t let misconceptions lead to costly decisions. Working with experienced advisors — like those at Life Care Benefit Services — empowers you with personalized options designed for your family’s future.

Ready to cut through the confusion? Schedule your consultation today and get clear insights tailored to your financial goals.

Conclusion

Deciding between indexed universal life (IUL) and variable universal life (VUL) insurance ultimately comes down to your comfort with risk, growth expectations, and financial goals. Both have distinct advantages, but neither is a one-size-fits-all solution.

IUL offers a balance, with growth tied to an index and downside protection, making it appealing if you want conservative growth with cash value potential. VUL, on the other hand, places your cash value in investment options, offering higher growth potential but with more volatility and complexity.

Have you thought about how these policies fit within your overall financial strategy? They are not just insurance—they’re long-term financial tools that can complement retirement planning, mortgage protection, and legacy goals.

Choosing the right policy is about understanding these nuances and working with an experienced advisor who can personalize recommendations. At Life Care Benefit Services, we emphasize transparent, tailored solutions designed to protect your family’s future without surprises.

Ready to take the next step? Explore how you can benefit from life insurance strategies that fit your unique needs by checking out our step-by-step guide to reviewing life insurance policies. Schedule a consultation today to cut through the jargon and get clear guidance that empowers your decisions.

Frequently Asked Questions (FAQ)

What is the main difference between IUL and variable universal life insurance?

The core difference lies in how your cash value grows. With Indexed Universal Life (IUL), your cash value is linked to a stock market index like the S&P 500 but with a floor to protect against losses. Variable Universal Life (VUL), however, invests directly in separate sub-accounts containing stocks, bonds, or mutual funds, giving you more upside but also more risk.

Is IUL safer than variable universal life insurance?

Generally, yes. IUL offers downside protection through its floor, so you won’t lose money due to market downturns. VUL policies don’t have that cushion, meaning your cash value can fluctuate drastically—and you could even lose money if investments perform poorly.

Which type is better for long-term growth?

Variable universal life insurance often has higher growth potential because you control investments directly and can tap into riskier assets. But those rewards come with higher volatility. IUL provides more stable growth tied to indexes but capped returns. Your choice depends on your risk tolerance and investment knowledge.

Can I adjust my investment choices within these policies?

With VUL, you usually have a broad menu of investments to choose from, giving you flexibility to manage your portfolio. IUL doesn’t offer direct control over investments—it’s more about selecting participation rates tied to the index. If you like hands-on investing, VUL is usually a better fit.

How do costs compare between IUL and variable universal life insurance?

Variable universal life insurance tends to have higher fees due to investment management costs and increased policy complexity. IUL policies usually carry lower fees but may have caps or participation limits affecting your returns. Always review the policy illustrations carefully and ask your advisor about all associated costs.

Are there tax benefits to either policy?

Both IUL and VUL offer similar tax advantages: the cash value grows tax-deferred, and death benefits are typically income tax-free to beneficiaries. However, withdrawals and loans may have different tax implications, so it’s important to structure distributions carefully to avoid unintended taxes.

Who should consider IUL versus variable universal life insurance?

If you want moderate growth with some downside protection and less investment hassle, IUL often fits well. But if you’re comfortable with market risk, want to actively manage your investments, and seek higher growth potential, VUL can be a powerful tool. Always align your choice with your financial goals and risk comfort.

Still feeling overwhelmed by these options? You’re not alone. That’s why working with an experienced advisor at Life Care Benefit Services can make a huge difference. Schedule a consultation today and get personalized advice that breaks down the jargon and fits your unique situation.