You ever find yourself staring at life insurance paperwork and get totally lost in all the fine print? It’s like, you know you need coverage, but then throw in something like an accelerated death benefit rider and suddenly you’re scratching your head wondering, “How much is this going to cost me?”

Here’s the thing: this rider isn’t just another fee to worry about. It’s a powerful feature that lets you access a portion of your life insurance benefit early—typically if you’re seriously ill. That sense of relief, knowing you could tap into funds when you really need them, can be priceless.

So, how do you figure out if adding one fits your budget or if it inflates your premium more than you can handle? Enter the accelerated death benefit rider cost calculator—kind of like your financial GPS for understanding what this rider will mean for your payments.

Imagine trying to guess your car’s fuel efficiency without a gauge. That’s what trying to pick an insurance rider without a cost calculator feels like—unedited guesswork! This tool breaks down your costs clearly, so you won’t get blindsided by surprise expenses.

And don’t worry—it’s not some complicated maze of numbers or insurance jargon. Good calculators help you plug in a few details and get instant, straightforward results tailored to your policy and situation. That means you can plan smarter and protect your family without second-guessing.

Wondering if this calculator is worth your time? Think about the piece of mind it offers. When you know exactly what you’d pay, you can make confident choices about your coverage.

If you’re curious to see how this works in real life, or want to get a better look at how such riders affect overall insurance costs, our detailed guide on how to add accelerated death benefit rider to life insurance might be just what you need.

Let’s dive in and demystify this—because knowing is better than guessing when it comes to protecting your family’s future.

TL;DR

Wondering how much an accelerated death benefit rider will cost you? The accelerated death benefit rider cost calculator takes the guesswork out, showing you clear, personalized estimates based on your policy details.

It’s quick, simple, and gives you the confidence to make smarter insurance choices without surprises.

Step 1: Understand What an Accelerated Death Benefit Rider Is and Why It Matters

Have you ever wondered what would happen if life threw a serious curveball your way? Like a sudden diagnosis that turns your whole world upside down? That’s exactly the kind of moment where an accelerated death benefit rider can make a huge difference.

So, what is this rider anyway? Simply put, it’s an add-on to your life insurance policy that lets you tap into some of your death benefit while you’re still alive—if you’re diagnosed with a qualifying serious illness, often terminal. Instead of waiting for your beneficiaries to receive the full payout after you pass, you can access a portion upfront to help with immediate expenses.

Imagine needing funds for specialized medical care, home modifications, or even just to cover day-to-day bills when your income suddenly drops. That’s where this rider comes in handy. It’s not just about money—it’s about peace of mind, knowing you have some financial breathing room when things get tough.

How Does the Accelerated Death Benefit Rider Work?

Here’s the deal: if your insurer accepts your diagnosis of a terminal illness or other qualifying condition, the rider allows you to receive part of the death benefit early. Typically, you might get anywhere from 25% to 100%, depending on your policy. But remember, any amount you take out now gets subtracted from the payout your loved ones will receive later.

That might sound like a bummer, but think about it this way—using some of those funds now can help you focus on your health or family, rather than stressing about finances. Plus, you can usually use the money however you want. Whether that’s paying for an in-home nurse, covering travel expenses to see family, or simply keeping the lights on, it’s flexible support when you need it most.

It’s important to know that each insurance company has its own set of rules about which illnesses qualify and the paperwork you’ll need to provide. So, it pays to ask your carrier for specifics before buying or adding this rider. Some policies even cover situations like admission to a nursing home or critical illnesses, making the benefit broader than just terminal conditions.

Why Should You Care About This Rider?

Honestly, this rider is one of those silent lifesavers. The last thing you want when facing a serious health crisis is extra financial strain that distracts from healing or spending quality time with your family.

Now, you might be thinking, “Can’t I just wait and deal with things later?” But here’s the thing: medical bills and related costs pile up fast, often before the policy’s death benefit would normally pay out. Having the option to access funds early can prevent dipping into savings, delaying needed care, or even going into debt.

Also, good news: many insurance policies include the accelerated death benefit rider by default at no extra cost. That said, if yours doesn’t, you can often add it for a bit more on your premium. Calling it a peace-of-mind investment isn’t far off.

Progressive explains that this rider helps ease unexpected financial burdens, which can be the difference between focusing on health or stressing over payments.

So, what’s the catch? Well, using the benefit means your loved ones will get less after you pass. Plus, depending on your situation, accelerated payments might impact Medicaid eligibility or have tax implications. It’s a smart move to discuss this with a tax advisor or insurance pro to understand exactly how it fits your unique story.

How to Decide If You Need This Rider

Start by asking yourself: Could my family handle financial pressure if I faced a serious illness tomorrow? If the answer isn’t a confident yes, this rider might be worth serious consideration.

Also, take some time to compare policies using an accelerated death benefit rider cost calculator. It helps you see personalized estimates of what adding this rider might do to your premiums, so you’re not guessing. Knowing the cost upfront lets you weigh it against the potential benefits without surprises.

Remember, not all policies or insurers are the same. Some might bundle this rider for free, others charge, and the qualifying conditions can vary. So, do your homework, ask your agent, or even get a second opinion to find the right fit.

Ultimately, this rider isn’t about betting on the worst—it’s about preparing for the unexpected so you and your family can focus on what really matters when life gets messy.

If you want to dig deeper, here’s a comprehensive breakdown of life insurance riders that lays out different options and when they might make sense.

Now that you’re clear on what an accelerated death benefit rider is and why it matters, you’re ready for the next step—figuring out costs and whether it fits your budget. And hey, it’s easier with tools like the accelerated death benefit rider cost calculator, which we’ll cover soon.

Step 2: Learn How the Cost of an Accelerated Death Benefit Rider Is Calculated

Ever wondered how adding an accelerated death benefit (ADB) rider actually affects what you pay for your life insurance? It’s a fair question, especially because the way insurers figure out the cost can feel pretty confusing. But let’s unpack it together — no jargon, just straight talk.

The first thing to know is: this rider isn’t about adding a flat fee. Instead, the cost depends on a few key factors tied to your policy and your personal profile. Think of it like tuning a radio, where the signal varies based on where you live, your health, and the policy’s face value.

1. Base Premium and Death Benefit Size

Your accelerated death benefit rider cost is linked closely to your policy’s overall death benefit — that’s the amount your beneficiaries would receive. The bigger the benefit, the higher the potential payout if you activate the rider, so insurers factor that into your premium calculation.

For example, if your life insurance has a $500,000 death benefit and the ADB rider allows access to up to 50% of it, the insurer’s risk exposure changes. They’ll price the rider accordingly, often increasing your premium by a small percentage of your base cost.

2. Your Age and Health Status

Age and health can’t be ignored here. Older policyholders or those with certain health conditions may face slightly higher costs because the chances of using the rider increase. It’s like underwriting the risk — the insurer calculates the likelihood you might need to tap into those living benefits sooner.

This makes sense if you think about it. If someone’s younger and healthier, they’re less likely to need this benefit early on, so the additional cost stays lower. Your age and medical history matter a lot in premium pricing.

3. Qualifying Conditions and Restrictions

The kind of illnesses or qualifying events covered by the rider can also influence the cost. Some policies only cover terminal illnesses, while others include chronic or critical conditions. The broader the coverage, the higher the cost tends to be.

That’s because insurers take on more risk if you can trigger the benefit for several health issues. So, if you want comprehensive coverage with fewer restrictions, expect the premium to take a little jump.

4. How Much Coverage You Access Early

This is where things get interesting. You don’t have to activate the full rider at once. Many policies let you access just a portion of the death benefit. And the more you take early, the more the cost can increase.

But here’s a trade-off: tapping the rider reduces the remaining death benefit for your beneficiaries. It’s like borrowing money against a future paycheck — you get help now, but what’s left later shrinks.

Understanding this balance helps in deciding how much coverage is worth the cost. If you’d like to see how different scenarios affect your premium, an accelerated death benefit rider cost calculator is a handy tool. It lets you input your policy details to get a personalized estimate without the headache.

5. How Premiums Are Billed

In most cases, the cost for the accelerated death benefit rider is added to your existing premiums as a monthly or annual charge. Sometimes it’s a fixed amount, and other times it’s a percentage based on your policy’s face value or your age bracket.

One quick tip: ask your Life Care Benefit Services agent to break down the math for you in plain English. They can show you exactly what you’re paying for and why.

So, what should you do next? Couple things. First, get comfortable with the variables that impact cost — from your age to the payout amount. Second, use an accelerated death benefit rider cost calculator to run your own numbers based on your policy.

That way, you won’t be caught off guard when premiums arrive, and you’ll see if this rider fits your budget while giving you peace of mind.

And if you’re curious about how it stacks up against other riders or want a more tailored view, Life Care Benefit Services has experts ready to help you navigate the fine print and find what really makes sense.

Remember, knowledge isn’t just power here; it’s peace when you need it most.

Step 3: How to Use an Accelerated Death Benefit Rider Cost Calculator Effectively

Ever had that feeling where insurance math just seems like another language? You’re not alone. It’s tough, right? But here’s the good news: an accelerated death benefit rider cost calculator takes the guesswork out.

Think about it this way — you’re not just punching numbers. You’re figuring out if this rider fits your life, your budget, and your peace of mind. So let’s break it down, step-by-step, on how to get the most out of this tool.

Gather Your Financial Details First

It’s kind of like cooking — you need all your ingredients before you start. Grab your policy info, especially the face value of your life insurance and the current premium. You’ll also want to know your age and any ongoing loans against your policy. These factors matter because they can influence the rider’s cost and the amount you can actually access if you need to use it.

Don’t forget to consider your health status too, since terminal illness qualifications directly impact your eligibility to tap into the accelerated death benefit. It’s a good idea to jot this all down so you’re ready.

Find a Reliable Calculator and Input Your Numbers

There are plenty of calculators out there, but not all are created equal. Look for tools that are specifically designed for accelerated death benefit riders — not just generic life insurance calculators. These will ask targeted questions about your policy and health to give you a tailored cost estimate.

When entering your details, be as precise as you can. Guessing could lead to misleading results that either scare you with overestimated costs or lull you into thinking it’s cheaper than it really is.

Play Around with Different Scenarios

Here’s where it gets interesting. Try tweaking the payout amount you want to accelerate. What happens if you ask for 20%, or 50%, or the maximum allowed by your insurer? Watching how costs shift can be eye-opening. It shows you the real trade-off between the money you get early and what’s left for your beneficiaries later.

And since some companies charge a one-time activation fee or factor in interest on advanced funds, factor those into your scenarios to get a clear picture of the full cost.

Ask Yourself: Does This Work for Me?

Just because the calculator spits out numbers doesn’t mean you’re locked into anything. It’s about understanding if paying a bit more in premiums for this rider makes sense for your unique situation. Will having quick access to funds in a tough time bring you peace? Or will it strain your budget unnecessarily?

If you’re scratching your head at this point, that’s okay. It’s normal. That’s why teaming up with an expert, like a Life Care Benefit Services agent, can make a world of difference. They can explain the numbers, help you compare riders, and tailor solutions that feel right for you. After all, these calculators are tools, but your agent brings context.

Double-Check Policy Fine Print and State Rules

Quick heads up: availability and specifics of accelerated death benefit riders can vary by state and insurer. Some states have restrictions on the amounts or conditions under which you can activate the rider. So while the calculator gives a solid estimate, double-check with your insurance provider or agent to confirm what applies to your policy.

This little step avoids surprises down the road.

Keep Records and Revisit Annually

Life changes, and so do policies. Using your calculator once a year — or whenever you have a major life event — can keep your coverage working for you without breaking the bank. Maybe your health improves, or your financial needs shift. Either way, doing this regularly keeps you proactive instead of reactive.

For a deeper dive into how cost calculators can guide your choices, check out this handy explanation of accelerated death benefits and how they work in practice. You can also explore general life insurance calculator tips and tricks that make choosing coverage less stressful.

Ready to go beyond the numbers? Try pairing your online calculations with personalized advice from a Life Care Benefit Services agent who can help you weigh every option.

It’s not just about what you pay today, but what you and your loved ones get tomorrow. And that’s what this calculator helps you see — clearly and confidently.

Step 4: Compare Accelerated Death Benefit Riders Across Different Life Insurance Products

Choosing life insurance is already a bit like navigating a maze blindfolded, right? And then you toss in accelerated death benefit (ADB) riders and suddenly you’re juggling terms you might barely understand. But hang in there, because this comparison is where things start to clear up.

Accelerated death benefit riders, in simple terms, let you tap into your death benefit early if you’re diagnosed with a serious illness. Sounds like a no-brainer, but not all riders, and not all life insurance products, offer the same features, costs, or conditions. So, what’s the real difference when you compare them side by side? Let’s break it down.

Whole Life Insurance + Accelerated Death Benefit Riders

Whole life policies are the classic choice. You pay fixed premiums, and your coverage lasts your entire life. With an ADB rider added, you can usually access a portion of your death benefit if you get a qualifying terminal or chronic illness diagnosis.

The big win here is predictability. Premiums don’t change, and the ADB rider cost is generally built into your overall rate or added as a small premium charge. But keep in mind, your death benefit will be reduced by whatever you take out early. And sometimes, fees or interest might apply depending on the policy’s fine print.

Indexed Universal Life (IUL) Insurance and ADB Riders

Now, IULs are a little more complex — they mix a death benefit with a cash value that can grow linked to a stock market index like the S&P 500. The ADB rider here often offers more flexibility but can cost more because you’re not just paying for insurance — you’re also investing.

One cool thing is the potential for cash value growth might offset some costs long term, but, here’s the catch: activating the rider usually means you’ll reduce both your death benefit and sometimes your cash value. Plus, costs can vary more widely depending on the insurer.

Honestly, if you’re considering an IUL with an accelerated death benefit rider, you’ll want to run those numbers using an accelerated death benefit rider cost calculator or talk to an expert who can pinpoint what works for your situation.

Term Life Insurance + ADB Riders

Term life insurance, the straight shooter — covers you for a set period, like 10, 20, or 30 years. It’s usually the most affordable, and you can add an accelerated death benefit rider too.

The plus? Adding an ADB rider can be relatively inexpensive here, and you get solid protection during the term. But remember, unlike whole or universal life, there’s no cash value component. So, no savings or investment side to soften the blow of costs or premiums increasing with age.

Also, some term policies have restrictions on when and how you can use ADB riders, like specific illness criteria or waiting periods. It’s worth checking those details closely.

Group Life Insurance and Accelerated Death Benefit Options

If you’re covered through your employer, group life insurance sometimes comes with accelerated death benefits, but the features are usually more limited.

The downside? Less flexibility, and you typically can’t customize riders as you would with individual policies. Plus, group policies often end when you leave the job, so you might lose that accelerated benefit option exactly when you might still need it.

That’s why many folks consider supplemental individual policies for added peace of mind.

How to Use an Accelerated Death Benefit Rider Cost Calculator Wisely

Here’s where an accelerated death benefit rider cost calculator becomes a handy tool. Comparing riders across different products means juggling multiple variables — rider fees, impact on death benefits, medical eligibility, and more.

By inputting your personal info and policy details, a cost calculator can provide realistic estimates, helping you spot which policies pack the best bang for your buck. Just remember, calculators are estimates — real quotes from Life Care Benefit Services can give you the precise cost and policy perks based on your unique needs.

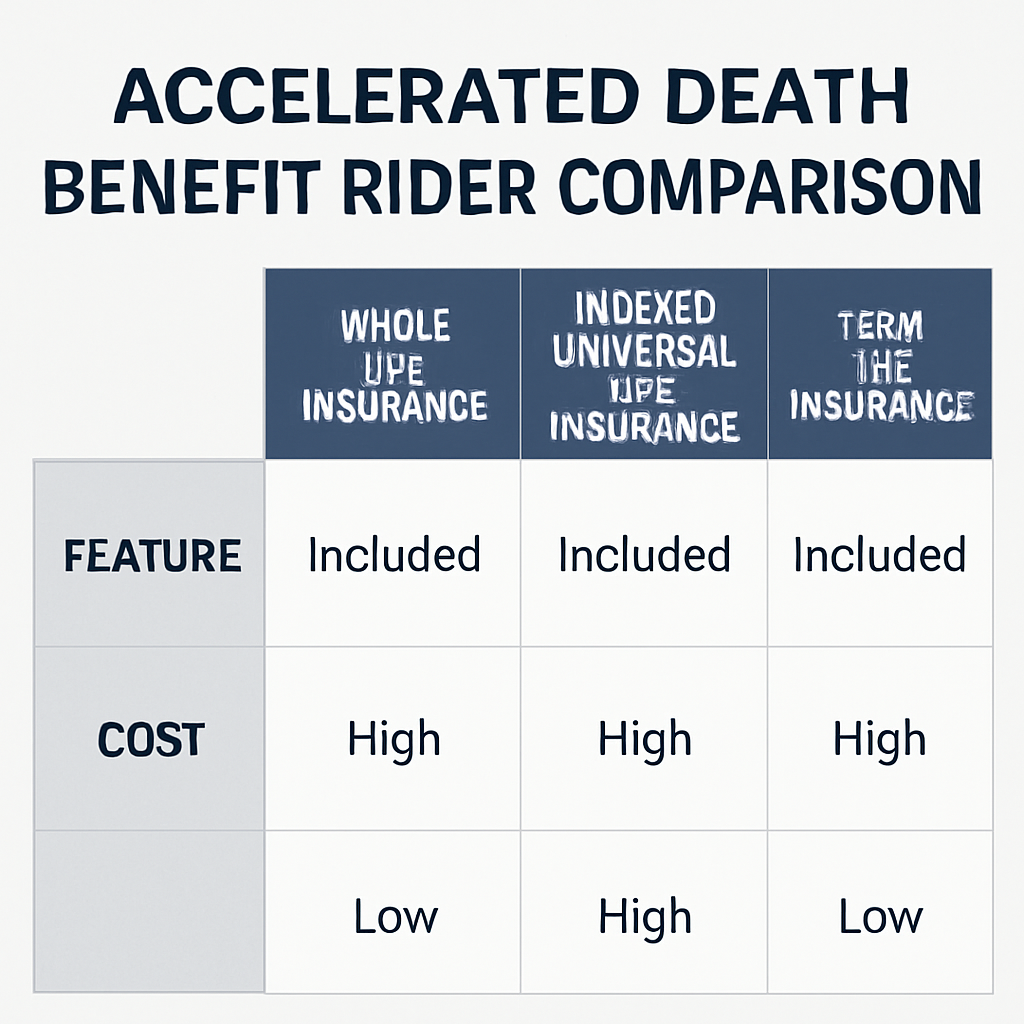

Comparison Table: ADB Riders Across Life Insurance Products

| Life Insurance Type | ADB Rider Features | Cost Impact | Effect on Death Benefit | Policy Flexibility |

|---|---|---|---|---|

| Whole Life Insurance | Early benefit for terminal/chronic illness; built-in or small added cost | Moderate; stable premiums | Death benefit reduced by amount taken early | High; premiums fixed, policy permanent |

| Indexed Universal Life (IUL) | Early benefit; flexible but complex conditions | Variable; can be higher due to investment component | Reduces death benefit and possibly cash value | High; includes cash value growth and flexible premiums |

| Term Life Insurance | Cost-effective rider for set term duration | Low to moderate; affordable premiums | Death benefit reduced by accelerated payout | Low; no cash value, limited customization |

| Group Life Insurance | Limited ADB options; less customization | Usually included or low additional cost | Death benefit reduced by amount paid out | Low; tied to employment |

At the end of the day, it’s about matching your comfort with risk, how much you want to invest in premiums, and what flexibility you might need if life throws a curveball. If you’re wondering how all these options stack up for your personal story, it’s smart to chat with Life Care Benefit Services. We’re all about finding affordable, tailored protection that fits your life, not the other way around.

And hey, don’t let the math freak you out. Using an accelerated death benefit rider cost calculator alongside expert advice turns confusion into clarity. Because knowing exactly what your options cost, and what you actually get, is the peace of mind you deserve.

Ready to see how this all shakes out for you? Reach out to schedule a personalized consultation — it’s the step that makes all the difference.

Step 5: Understand How the Rider Affects Your Overall Life Insurance and Retirement Planning

Ever feel like your life insurance and retirement planning are puzzle pieces that don’t quite fit? Adding an accelerated death benefit rider can shift that picture in ways you might not expect. It’s kind of like finding a secret compartment in your old desk—it changes what you thought was fixed.

Here’s the thing: an accelerated death benefit rider (ADBR) isn’t just a backup plan for your beneficiaries. It’s a living benefit that lets you tap into part of your life insurance payout early if you face a qualifying serious illness or disability. This can be a game changer for handling unexpected healthcare costs or making meaningful improvements to your quality of life.

But how does this rider really fit into the bigger picture of your financial goals? Let’s break it down.

Impact on Your Life Insurance Policy

First, the obvious: when you take an early payout through your accelerated death benefit rider, the total death benefit reduces by that amount. That means your loved ones receive less later on. But remember, that early access could help you avoid dipping into savings or going into debt during a tough health episode.

Think about it this way: that money is still yours—just a little more flexible. And since many policies offer this rider at little or no added premium, it can be a low-cost form of financial protection that works for both now and later.

How It Plays Into Retirement Planning

Now, here’s where it gets interesting for retirement. Serious illnesses can derail your retirement savings fast. The ADBR gives you an option to fund medical bills or care without touching retirement accounts that might have tax penalties or disrupt your long-term growth.

Plus, using an accelerated benefit might mean you can maintain your lifestyle and independence longer, which is a huge factor in how you enjoy retirement. It’s not just about the numbers—it’s about what your money allows you to do.

Using the Accelerated Death Benefit Rider Cost Calculator Wisely

Okay, so you might wonder: how much will this actually cost me? An accelerated death benefit rider cost calculator can help make sense of potential premiums based on your age, health, and coverage amount. It’s one of those tools that turns confusion into clarity, helping you see if this rider fits comfortably within your budget and plan.

And remember, different insurers handle this rider differently—some bake it in at no extra cost, while others charge a small premium. That’s why personalized advice is key.

Should You Add the Rider?

So, what should you do next? Chat with a pro who can look at your whole financial picture—the kind that combines life insurance benefits with retirement planning goals. At Life Care Benefit Services, we’re all about helping you find that sweet spot where coverage makes sense, premiums stay affordable, and your future feels secure.

Don’t just guess. Use tools like the accelerated death benefit rider cost calculator and expert consultations to map out your options. It’s about having choices when life throws the unexpected at you, without blowing up your long-term plans.

Want to see how this rider shapes your life insurance and retirement game plan? Schedule a consultation and get tailored guidance that clicks with your unique story.

Conclusion

Choosing whether to add an accelerated death benefit rider can feel like a big, tangled decision. You want to protect your family and prepare for the surprises life might throw, but the costs can make your head spin. That’s where the accelerated death benefit rider cost calculator really shines—it takes this overwhelming puzzle and breaks it down into numbers you can actually understand.

Think about it this way: rather than guessing, you get a clear picture of how much extra you might pay, based on your unique situation. It’s like having a flashlight in the dark—it shows you what’s ahead without leaving you stumbling.

And here’s the thing—just because it sounds smart doesn’t mean it fits for everyone. You owe it to yourself to see how it plays with your budget and your bigger financial goals. That’s why chatting with a trusted advisor, someone who gets your story, is the next smartest move.

So, don’t leave it to chance. Use tools like the accelerated death benefit rider cost calculator and lean on expert guidance to make choices that feel right for you. Because at the end of the day, it’s about peace of mind and knowing you’ve got a plan that won’t leave you scrambling.

Ready to cut through the noise? Schedule a consultation at Life Care Benefit Services and get the kind of personalized help that changes everything.

Frequently Asked Questions about Accelerated Death Benefit Rider Cost Calculator

So, you’re probably wondering — how exactly does this accelerated death benefit rider cost calculator work? Well, it’s simpler than it sounds. The calculator takes key details like your age, health, policy type, and coverage amount to estimate how much extra you’d pay for this specific rider. It’s kind of like getting a personalized snapshot of what this add-on would cost, instead of blind guessing.

Maybe you’re asking: “Does it really give me an exact number?” Not quite. The calculator provides an estimate—think of it as your financial GPS that points you in the right direction but might adjust the route based on real-time conditions. It’s a tool to narrow down your options and prepare you, but final pricing always needs a human touch.

What factors influence the cost?

Great question. The cost depends on several things you might not even think about. For example, your current age isn’t just a number here. Older applicants often pay more because the risk to the insurer’s higher. Then there’s your health status and if you’ve got any medical conditions. The type of life insurance policy you have—whether it’s term, whole, or indexed universal life (IUL)—also changes the equation. And of course, the size of your basic coverage and the amount of acceleration you want will move the needle.

It can feel like a lot, but the calculator crunches these pieces for you, so you’re not stuck piecing it all together alone.

Is this rider worth the extra cost?

Look, I get it — adding on riders feels like piling on expenses. But think about it this way: If you ever face a serious illness or medical emergency, this rider can give you access to part of your death benefit early, easing the financial pressure when things get tough. It’s like having a financial backup plan within your policy. The key is knowing what it costs upfront and seeing if that lines up with how comfortable you feel financially.

And that’s exactly where the accelerated death benefit rider cost calculator steps in. It helps you weigh potential benefits against real costs, so you make a choice that actually feels right.

How often should I use the calculator?

Whenever life shifts. Got a new health diagnosis? Planning to increase coverage? Or just want peace of mind around your financial planning? Run the numbers again. Prices and options can change, so keeping fresh info helps you stay on top of your policy.

Can I trust the calculator to replace talking with an advisor?

Short answer: no. Think of the calculator as your prep tool, not the whole playbook. It gives you a starting point, but insurance nuances, policy details, or your personal situation often need a real person’s insight. At Life Care Benefit Services, we’re here to make those conversations easy and tailored to you. So, use the calculator to come with questions — then schedule a chat to get clarity and confidence.

Where can I find a reliable accelerated death benefit rider cost calculator?

There are plenty of calculators floating around, but not all are built the same. You want one that’s backed by trusted carriers and personalized for your situation. That’s why connecting with Life Care Benefit Services can make all the difference. We help you find tools that match your needs and give you straight answers without the confusing jargon.

So, curious to see what your actual costs might be? Don’t wait. Try out an accelerated death benefit rider cost calculator today and then reach out to get a consultation that dives deeper into what all this means—for your peace of mind and financial future.