Group health insurance is a vital benefit for many small businesses.

But what exactly does it entail for small business owners?

Here’s a complete cheatsheet on group health insurance for small business owners.

Some are unaware of the variety of plan types available.

Some are uncertain how to manage costs effectively.

Some wonder how to stay compliant while offering insurance.

Some seek ways to maximize employee satisfaction with benefits.

Some want to know the enrollment process, step-by-step.

Let’s dive right in.

What Is Group Health Insurance for Small Business Owners?

Group health insurance is a single insurance plan that covers all eligible employees of a small business under one policy. Small businesses typically range from 1 to 50 employees for these plans. Unlike individual plans, group health insurance pools risk among employees, often resulting in better coverage options and potentially lower premiums.

For small business owners, providing group health insurance is not always mandatory—businesses with fewer than 50 full-time employees are generally exempt from the federal mandate. However, many choose to offer group health coverage as a competitive advantage when attracting and retaining talented employees.

Offering quality group health insurance benefits directly impacts your company’s culture, employee loyalty, and productivity. According to recent surveys, 88% of employers say health care benefits are very or extremely important to their workforce. Furthermore, 56% of employees say health coverage influences their decision to stay at a job.

Understanding the full scope of group health insurance options and how to set them up can empower you to decide what works best for your business and your team.

Why Should Small Businesses Offer Group Health Insurance?

Offering group health insurance has clear benefits that go beyond just compliance and coverage. Here’s why small business owners invest in group plans:

- Attract and Retain Talent: Competitive health benefits help you recruit skilled employees who value insurance coverage as a key part of their compensation package.

- Tax Advantages: Small businesses can typically deduct health insurance premiums as a business expense. Qualifying businesses may also be eligible for tax credits of up to 50% of premiums through the Small Business Health Options Program (SHOP).

- Promotes Employee Wellness: Group plans often include wellness programs, mental health support, and care management that keep your workforce healthier and reduce absenteeism.

- Financial Predictability: Fixed monthly premiums in fully insured plans help with financial planning, avoiding unexpected costs related to employee healthcare claims.

- Boosts Employee Satisfaction: Enhanced benefits packages contribute to employee morale and job satisfaction, which translates to better retention rates.

In summary, group health insurance for small business owners is an investment in both your employees’ futures and your company’s stability.

What Types of Group Health Insurance Plans Are Available?

Choosing the right plan depends on your company’s size, employee demographics, and budget flexibility. Common group health plans include:

- Traditional Group Health Insurance: Covers a group under one policy. Offers comprehensive benefits with typically lower deductibles, but premiums tend to be higher.

- High Deductible Health Plans (HDHPs): Feature higher deductibles but lower monthly premiums. Often paired with Health Savings Accounts (HSAs), giving employees tax-free ways to save for medical expenses.

- Health Reimbursement Arrangements (HRAs): Employer-funded accounts to reimburse employees for individual health plan premiums or out-of-pocket medical costs. Options include Individual Coverage HRA (ICHRA) and Qualified Small Employer HRA (QSEHRA), providing flexibility and cost control.

- Small Business Health Options Program (SHOP): Specialized marketplace for small employers (1-50 employees) under the Affordable Care Act. Employers can select plans that qualify for tax credits.

- Professional Employer Organizations (PEOs): Firms that manage HR functions including benefits, helping small businesses access larger group rates by pooling employees across companies.

Each of these options has pros and cons. For example, HDHPs may suit younger, healthier employees, while traditional plans are better for those needing extensive coverage. HRAs offer employers budget control while empowering employees to select plans suited to their needs.

Exploring these choices with a licensed insurance broker or consultant can clarify which plan aligns best with your company’s goals.

How Do Health Reimbursement Arrangements Help Small Business Owners?

Health Reimbursement Arrangements (HRAs) have surged in popularity among small businesses due to their flexibility and cost-efficiency. Let’s break down the two main types:

- Individual Coverage HRA (ICHRA): Employers reimburse employees tax-free for individual health insurance premiums. Provides flexible contributions without caps and allows for varying reimbursement levels for different employee classes (e.g., full-time, part-time).

- Qualified Small Employer HRA (QSEHRA): Designed for employers with fewer than 50 full-time employees who don’t offer group coverage. Allows tax-free reimbursement up to set limits ($6,350 for self-only and $12,800 for family coverage in 2025).

HRAs decouple insurance benefits from a specific group policy. Employees gain control over their own health plan choices, while employers cap expenses and reduce administrative burdens.

This flexibility is crucial for small business owners managing fluctuating budgets or diverse employee needs. Plus, HRA contributions are tax-deductible for the business and tax-free for employees, amplifying financial advantages.

Incorporating an HRA can also complement traditional group plans or HDHPs, providing a balanced approach to benefits and cost management.

How Much Does Group Health Insurance Cost Small Business Owners?

Costs vary widely based on plan type, coverage level, number of employees, location, and employee demographics. Key contributors to costs include:

- Plan Design: Plans with richer benefits and lower deductibles cost more.

- Employee Age and Health: Older or higher-risk employees usually raise premium costs.

- Employer Contribution Level: Employers generally pay 50% to 100% of premiums, influencing total expenses.

- Additional Coverages: Adding dental, vision, or life insurance increases premiums but enhances benefit appeal.

Many small businesses share premiums with employees, often paying 50% or more, which both parties must consider in budget planning.

There is good news. Small business owners may qualify for tax credits of up to 50% of their premiums if they meet criteria such as having fewer than 25 full-time employees, average wages under $56,000 per year, and paying at least 50% of employee premiums through SHOP Marketplace plans.

This significantly lightens the financial load while providing robust benefits to your team.

Careful plan selection, exploring HRAs, and integrating wellness initiatives can further reduce expenses without sacrificing coverage quality.

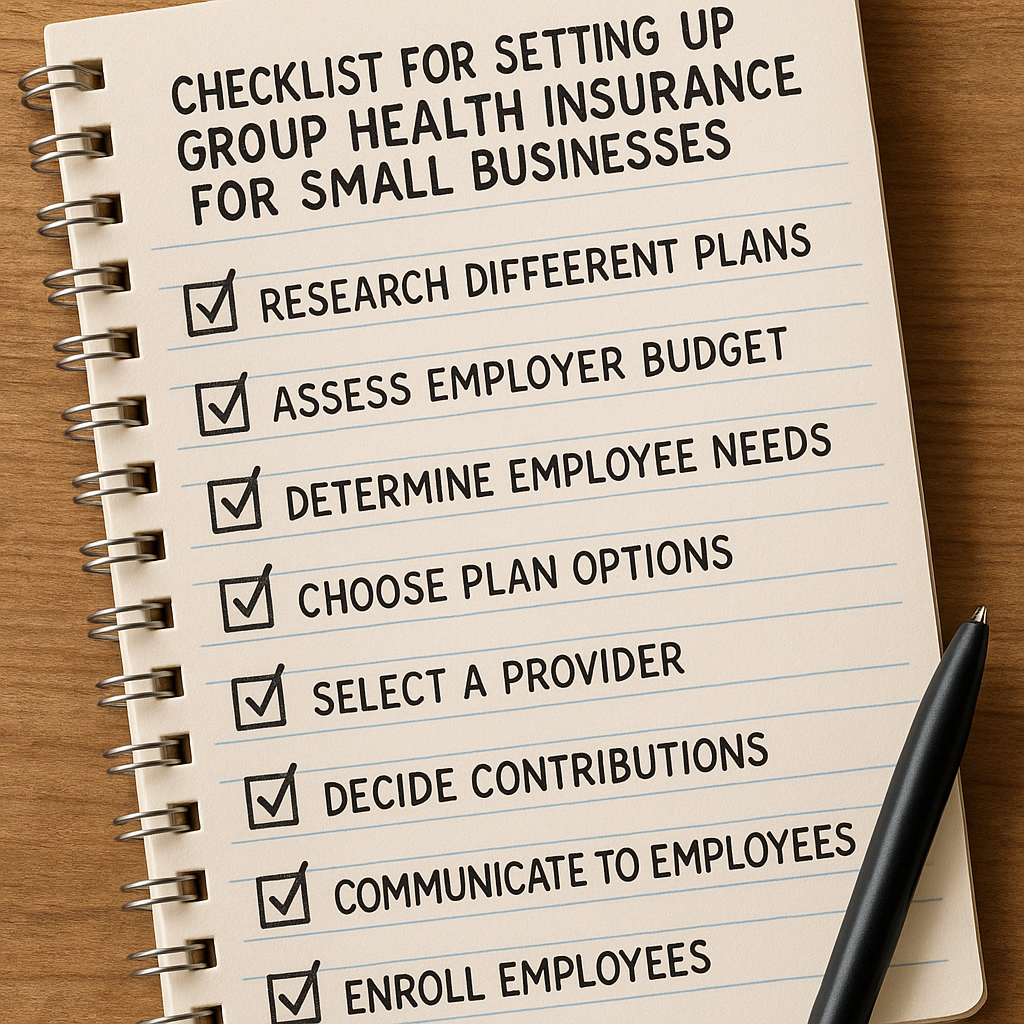

What Are the Steps to Set Up Group Health Insurance for Small Businesses?

Setting up a group health insurance plan can seem overwhelming, but following a structured approach simplifies the process:

- Assess Your Company’s Needs: Evaluate your workforce size, demographics, and budget. Gather employee input through surveys or meetings to understand their priorities.

- Research Plan Types and Providers: Explore various group plans, HRAs, HDHPs, and SHOP options. Consult licensed brokers who can provide personalized recommendations.

- Define Your Budget and Contribution Strategy: Determine how much your business can afford monthly or annually, and decide the employer vs. employee cost split.

- Choose a Provider and Plan Options: Compare network size, benefits, premiums, and customer service quality to select the best fit.

- Prepare Documentation for Enrollment: Gather necessary business documents such as tax IDs, wage reports, and employee information.

- Communicate Clearly with Employees: Educate your team on plan options, enrollment deadlines, and benefits through meetings, written materials, and one-on-one sessions.

- Complete Enrollment and Set Up Administrative Processes: Submit paperwork and premiums with your insurer. Set up systems for managing claims, HRAs, or reimbursements.

- Ensure Compliance: Stay up-to-date with federal, state, and local regulations, including ACA requirements and nondiscrimination rules.

- Review and Adjust Annually: Monitor utilization, costs, and employee feedback to optimize your benefits going forward.

Following these steps creates a smooth, transparent process that benefits both your business and employees.

How Can Small Business Owners Manage and Reduce Health Insurance Costs?

Small businesses face rising premiums, but strategic approaches can reduce expenses without sacrificing benefits.

Consider options like:

- Offering High-Deductible Health Plans: Lower monthly premiums combined with Health Savings Accounts help control costs.

- Implementing HRAs: Reimbursing individual coverage premiums gives flexibility and employer control over contributions.

- Joining Associations or PEOs: Pooling employees into larger groups can leverage better rates.

- Reviewing and Adjusting Benefits Annually: Identify and remove underutilized benefits or renegotiate plan terms.

- Encouraging Wellness Programs: Healthier employees lower claims, reducing premiums over time.

- Taking Advantage of Tax Credits: Many small businesses qualify for significant savings via the SHOP program or other federal incentives.

For example, some employers combine traditional group plans with ICHRA reimbursements to optimize flexibility and costs for diverse workforces.

Keep exploring emerging solutions like innovative HRA administration platforms that simplify plan management while delivering employee-friendly insurance experiences.

What Should Small Business Owners Know About Enrolling Employees in Group Health Insurance?

The enrollment phase is critical for a successful benefits program.

Key tips include:

- Provide Clear, Simple Communications: Use plain language explaining benefits, costs, enrollment deadlines, and procedures.

- Gather Complete and Accurate Employee Data: Social Security numbers, dependent info, and eligibility status to avoid delays.

- Offer Multiple Enrollment Channels: Online portals, paper forms, or in-person assistance help increase participation.

- Clarify Enrollment Periods: Initial enrollment, annual open enrollment, and special enrollment triggered by qualifying events ensure employees understand when they can make changes.

- Protect Employee Privacy: Handle all health data confidentially per legal requirements.

- Support Employees with Questions: Designate contacts such as HR representatives or insurance brokers to assist.

Well-managed enrollment improves employee satisfaction and reduces administrative headaches.

How Do I Choose the Best Health Insurance Provider for My Small Business?

Choosing a provider is more than just price comparison. Consider these essential factors:

- Plan Variety: Does the provider offer diverse plans to meet your employees’ different needs?

- Provider Network Size: Ensure access to preferred doctors and hospitals.

- Customer Service Quality: Look for responsive support for both employers and employees.

- Cost Transparency and Predictability: Clear premium and out-of-pocket costs help with budgeting.

- Additional Benefits: Options for dental, vision, mental health, and wellness programs enhance your offering.

- Local Market Presence: Providers with regional strength may offer tailored solutions better suited to your area.

Leading providers in the small business space include UnitedHealthcare, Blue Cross Blue Shield, Humana, Highmark, and Kaiser Permanente. Each has unique strengths and availability that vary by state.

Evaluate your workforce’s health profiles and preferences while working with licensed brokers to pinpoint the plan and insurer best aligned with your business goals.

Can Small Businesses Offer Dental, Vision, and Other Benefits Alongside Health Insurance?

Yes! Supplementing health insurance with dental, vision, life insurance, disability, and wellness programs creates a comprehensive benefits package. These add-ons usually come with separate policies but coordinate well with group health plans. Employees appreciate the broader coverage, especially dental and vision, which often have lower costs and help ensure total health care needs are met.

Offering these options also improves employee retention and satisfaction. Many insurers and brokers package these benefits together for simplified management.

How Do Health Insurance Tax Credits Work for Small Businesses?

The Small Business Health Care Tax Credit is a valuable financial relief available through the SHOP Marketplace program. To qualify:

- Your business must have fewer than 25 full-time equivalent employees.

- The average employee wage should be $56,000 or less annually.

- You must provide health insurance coverage through SHOP and pay at least 50% of employee premiums.

Businesses meeting these conditions can receive tax credits up to 50% of premiums paid, drastically lowering the net cost of providing group coverage.

It’s important to consult with a tax advisor or benefits consultant to maximize your credit benefits correctly.

Common Questions About Group Health Insurance for Small Business Owners

- Am I required to provide health insurance if I have fewer than 50 employees?

- No, small businesses with fewer than 50 full-time employees are generally not required to offer health insurance under the Affordable Care Act. However, offering benefits can be a strong competitive advantage.

- What is the Small Business Health Options Program (SHOP)?

- SHOP is a marketplace designed for small employers to purchase qualified health insurance plans for their employees, often with eligibility for tax credits.

- Can I include part-time employees in my group health insurance plan?

- Eligibility for group health insurance depends on your plan and provider. Generally, full-time employees (working 30+ hours/week) qualify. Part-time employees can sometimes be included depending on the policy.

- What are the main differences between ICHRA and QSEHRA?

- ICHRA offers unlimited, flexible reimbursements and can be offered to any sized business or employee class. QSEHRA has annual contribution limits and is exclusive to businesses with fewer than 50 full-time employees not offering group health insurance.

Small Business Health Insurance Explained

Want a clear, easy-to-understand overview from industry experts? Check out this video that breaks down key options, enrollment tips, and cost considerations for small business health insurance:

How Do I Find More Insurance Resources and Guides?

Understanding group health insurance options is just one facet of managing your business’s benefits strategy. Life Care Benefit Services offers personalized assistance tailored to small business owners—with access to over 50 top-rated insurance carriers.

Explore our expert insights on related insurance solutions to help you navigate life insurance, mortgage protection, retirement planning, and more.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your group health insurance decisions? For further personalized guidance, explore the expert resources linked throughout this article.

Summary

Group health insurance for small business owners is a powerful tool to attract talent, reduce financial risk, and provide essential benefits. From traditional policies to innovative HRAs, understanding the options helps you make informed choices that align with your business’s size, budget, and employee needs.

By carefully planning your benefits package, leveraging tax credits, and communicating clearly during enrollment, you create a healthier, more committed workforce. Stay proactive with annual reviews and adjust plans as your business evolves.

Take advantage of local brokers and experts to simplify this process, ensuring that your small business benefits deliver maximum value—for you and your employees alike.

Frequently Asked Questions (FAQs)

- What is the minimum number of employees needed to qualify for group health insurance?

- Typically, it starts with two or more employees to qualify, but requirements vary by state and insurer.

- Are small business owners covered under their own group health plans?

- Often, owners are not counted as employees for group plan eligibility, but they can sometimes be covered depending on the plan design and state regulations.

- Can I change my group health plan mid-year?

- Mid-year changes are allowed only for qualifying life events like marriage, birth, or job loss. Otherwise, changes occur during annual open enrollment.

- How do Health Savings Accounts (HSAs) work with group health plans?

- HSAs pair with High Deductible Health Plans, letting employees save pre-tax dollars for medical expenses. Employers may contribute to HSAs as part of their benefits package.