How much does indexed universal life insurance cost? It’s a question that naturally comes up when you’re thinking about securing your family’s future while also growing your savings. Indexed Universal Life (IUL) insurance isn’t just another life insurance policy; it offers a unique blend of protection and potential cash value growth linked to market indexes—giving you flexibility with your premiums and benefits. But exactly what impacts the cost, and how can you get the best value?

Many people assume life insurance costs are fixed, but with IUL, the price varies based on several personal factors like your age, health, lifestyle, and the death benefit amount you choose. Plus, your premium payments aren’t static—they can adjust within certain limits to fit your financial goals over time. This flexibility can seem confusing at first, but it’s actually what makes IUL insurance a powerful tool for long-term financial planning.

Imagine you’re buying a policy that not only protects your loved ones if something happens to you, but also helps you build a growing cash value that you can access later for things like retirement income or emergencies. That combination can come at a higher initial premium compared to term life insurance. However, the living benefits and tax advantages often make it well worth the cost.

So, what should you do next? Understanding all the components that play into your insurance premium and seeing real-life examples of how costs can vary will help you make an informed decision. That’s exactly what we’ll guide you through in this article.

We’ll break down the key factors that determine the cost of an indexed universal life insurance policy, explore what makes IUL different from other life insurance options, and provide tips on how to get an accurate quote tailored to your needs. Plus, if you want personalized advice tailored to your situation, scheduling a consultation with a trusted agency like Life Care Benefit Services could be your first step toward peace of mind and financial security.

Ready to dive deeper into what makes IUL both a smart protection choice and a savvy financial strategy? Let’s get started and unlock the answers to how much indexed universal life insurance really costs.

TL;DR

Wondering how much does indexed universal life insurance cost? It varies based on factors like age, health, coverage amount, and policy features.

While premiums may be higher initially than term life, the cash value growth and living benefits provide valuable long-term financial security for your family’s future.

Understanding Indexed Universal Life Insurance and Its Cost Components

If you’re diving into indexed universal life insurance (IUL), it’s important to get a solid grasp on what exactly you’re getting—and how much it might cost you. After all, knowing the ins and outs of IUL’s cost components will help you make an informed decision on whether it’s right for your financial future.

What Exactly Is Indexed Universal Life Insurance?

Indexed universal life insurance is a permanent life insurance policy that combines a death benefit with a cash value component that can grow based on a stock market index, like the S&P 500. But here’s the catch: your money isn’t directly invested in the market. Instead, the insurance company credits interest based on the performance of the chosen index.

So, if the index goes up, your cash value grows according to the “participation rate” and “cap rate” set by the insurer. And if the index goes down? You won’t lose money because of a guaranteed minimum interest rate—but you also won’t earn interest that period. This blend offers growth potential with a risk buffer, unlike variable universal life insurance.

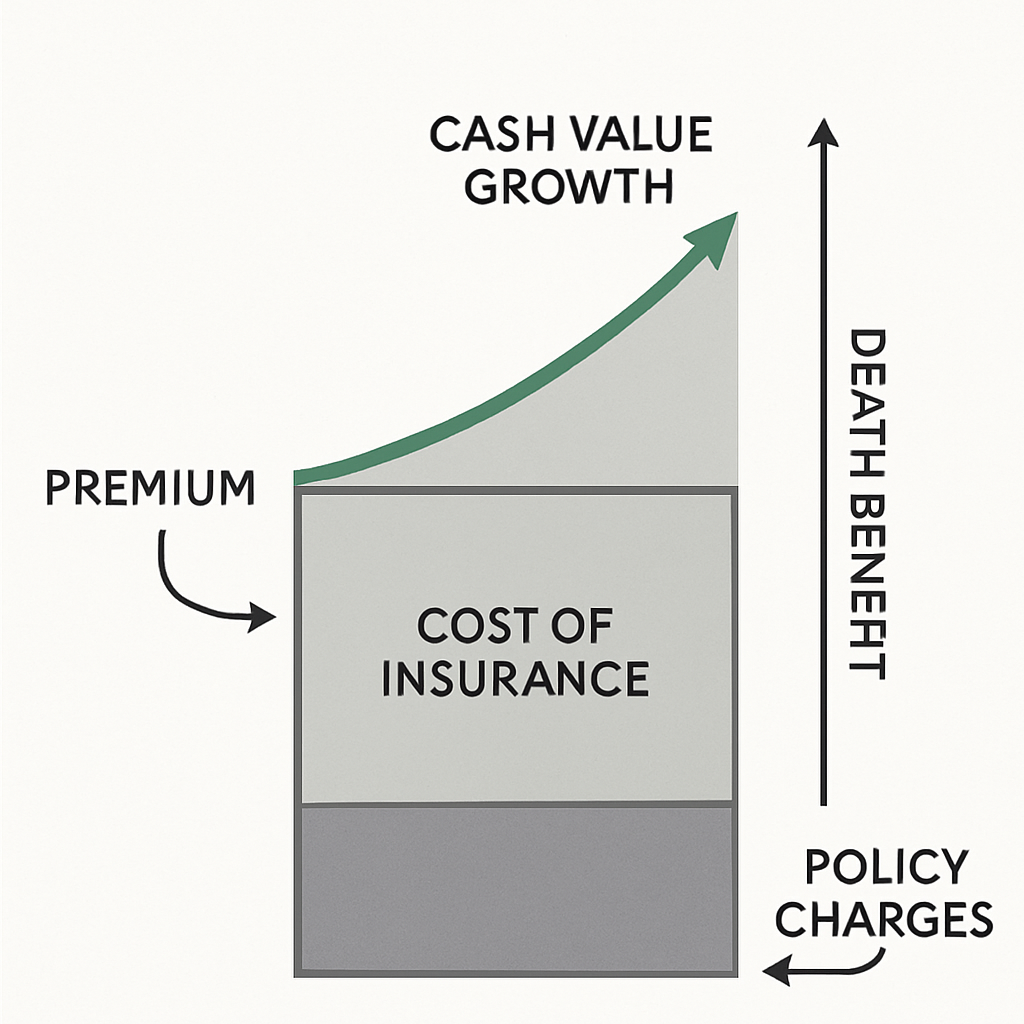

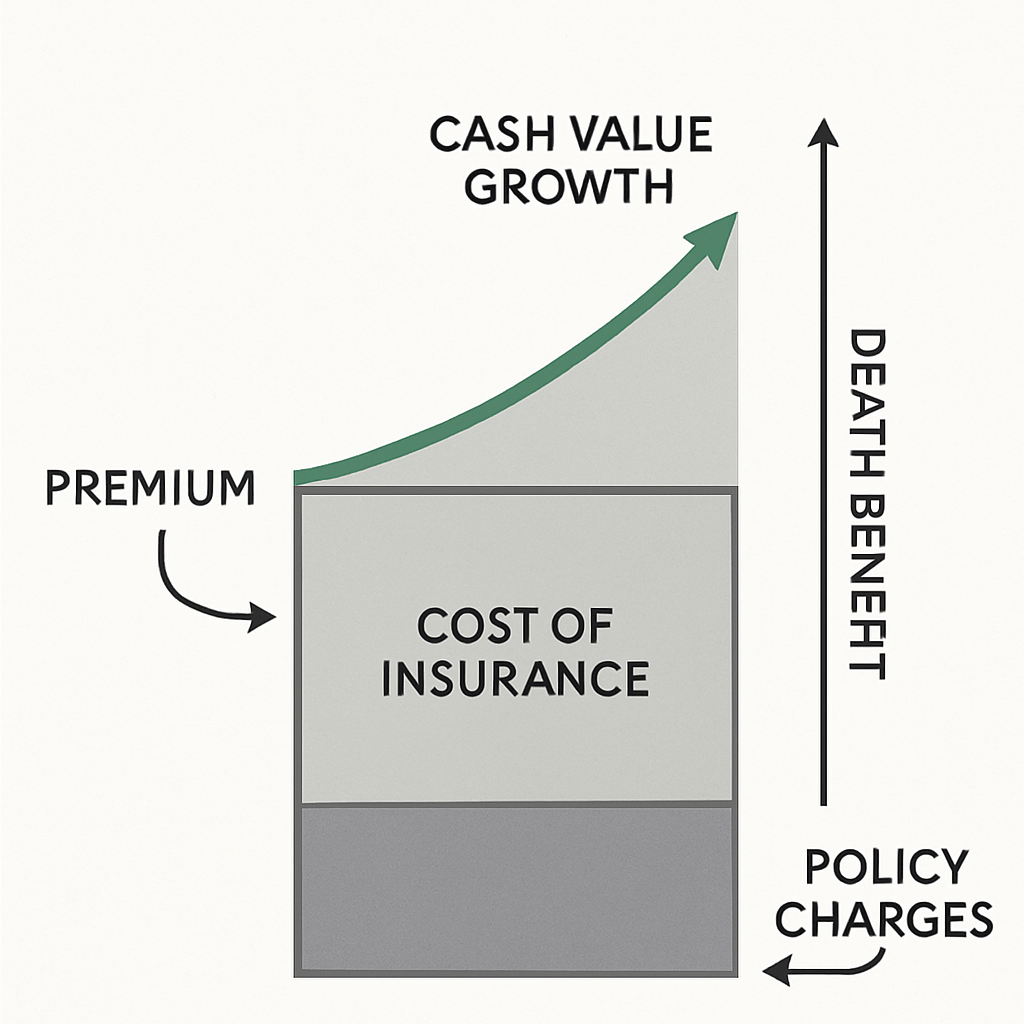

Breaking Down the Cost Components of IUL

When it comes to how much does indexed universal life insurance cost, it boils down to several key elements that interact within your premium payment:

- Base Premium: This is the amount you pay regularly to keep your policy active. IUL premiums are flexible, meaning you can adjust them within limits. But keep in mind, paying less might affect the growth of your cash value and the death benefit.

- Cost of Insurance (COI): This is a premium portion that covers the risk the insurer assumes by providing your death benefit. It’s influenced by your age, health, and coverage amount. As you get older, COI typically increases, impacting your overall premiums.

- Policy Fees and Charges: These include administrative fees and charges for riders or additional features. Unlike term life insurance, IUL often has higher fees due to its investment and cash value components.

- Cash Value Allocation: After covering COI and fees, the remainder of your premium funds the cash value account. This portion might be credited interest based on your selected index’s performance, plus any fixed-rate account allocations.

How These Costs Play Out Over Time

IUL’s adjustable premiums present a flexible edge—but that flexibility comes at a cost. Your premiums may start higher than term life insurance, but they cover permanent protection and opportunity for cash value growth.

Think of it this way: early on, interest credited to your cash value might feel modest, especially if the market isn’t booming. Additionally, insurers often cap earnings on indexed gains and set participation rates (sometimes between 25% to 100%) that determine how much of the index’s gain you actually receive.

Is this a good deal? That depends on your goals. If you’re looking for permanent life coverage with a chance to accumulate cash value that you can borrow against, and you want downside protection, IUL’s cost structure can be a fit. But if your main concern is the initial premium, there may be more affordable life insurance options like term insurance or whole life plans.

Worried about rising costs as you age? That’s a common concern. Because the COI rises with age, many policyholders increase their premium payments or adjust their death benefit over time to keep the policy in force and maintain cash value growth. Without these adjustments, the policy could lapse.

Key Factors Affecting Your Premiums and Policy Value

Beyond your age and health, a few other things influence how much does indexed universal life insurance cost for you:

- Your chosen index: Different insurers offer options like the S&P 500 or Nasdaq 100. Each index has a distinct performance history and volatility.

- Participation rate: Determines how much of the index’s gain the policy credits to your cash value.

- Gain Cap: A ceiling on the maximum interest you can earn from index performance in a period.

- How much premium you pay above the minimum: More premium means more cash value growth potential.

Knowing this, you can customize an IUL to fit your budget and financial plan. But don’t forget: fees and insurance costs will always eat away a chunk of your premium, so make sure you understand the full illustration from your insurer.

Planning Ahead and Getting the Best Value

So, how do you get a clear picture of what you’ll pay? Working with a knowledgeable independent agency like Life Care Benefit Services can make all the difference. We help you access multiple top-rated carriers, so you can compare costs, benefits, and policy features tailored for your needs.

Getting an accurate quote lets you balance premium affordability with the cash value growth and death benefit you need. If you want to learn about how to get a tailored IUL insurance quote, check out our detailed guidance on how to obtain a personalized indexed universal life insurance quote.

Remember, indexed universal life insurance is part protection and part financial strategy—it’s not a get-rich-quick scheme but a thoughtful tool to build lasting security for you and your loved ones. If you want permanent coverage with growth potential while limiting downside market risk, then it’s worth understanding all these cost components deeply.

For broader financial security solutions, including health insurance or retirement planning, Life Care Benefit Services is ready to help you navigate the options that best fit your lifestyle and goals. Don’t hesitate to schedule a consultation to explore your personalized plan today.

For further insights on the basics and nuances of indexed universal life insurance, consider the expert explanations available via Investopedia’s detailed Life Insurance Guide as well as comprehensive regulatory perspectives from the National Association of Insurance Commissioners.

By understanding what drives indexed universal life insurance costs—from base premiums to participation rates and policy fees—you position yourself smartly to secure dependable coverage with lasting value.

Factors Influencing the Cost of Indexed Universal Life Insurance

When you’re asking how much does indexed universal life insurance cost, you’re really opening a door to a complex world of variables. Understanding these factors can help you grasp why premiums vary so much and what you’re actually paying for.

Cost of Insurance (COI): The Heart of Your Premium

Cost of Insurance is the primary driver behind what you’ll pay each month or year. It covers the death benefit protection your policy provides and varies based on your age, gender, health status, and the actual policy face amount—aka the death benefit. Naturally, younger and healthier individuals pay less for COI, making early planning a smart financial move.

The amount that the insurance company risks (the death benefit minus your policy’s cash value) directly impacts your COI. This means as your cash value builds, the net amount at risk decreases, potentially lowering your monthly charge.

Premium Load Charges: What’s Taken Out Upfront

Before your premium fuels your cash value or covers insurance costs, insurers deduct a premium load—essentially a processing and administrative cost. This fee typically ranges between 5% to 10% of each premium payment and covers underwriting, agent commissions, and state taxes.

For example, if you pay $10,000 in premiums annually, roughly up to $1,000 might be deducted before your cash value is funded. This can significantly impact how quickly your policy grows, especially in the early years. Knowing this upfront helps set realistic expectations about your policy’s cash accumulation.

Administrative and Policy Fees: Keeping Your Policy Active

Beyond COI and premium loads, you’ll notice monthly or annual administrative fees. These fees cover maintenance expenses like customer service, paperwork, and technology platforms for managing your policy. Usually, these run between $5 and $15 per month but sometimes start higher in early years before tapering off.

While they might seem small, over many years, administration fees add up and impact your policy’s overall cost efficiency. So, it’s worth asking your agent for a clear fee schedule.

Indexing Costs: Participation Rates, Caps, and Spreads

A unique element of Indexed Universal Life Insurance is that your cash value growth ties to a market index like the S&P 500, but it’s not a direct stock market investment. The insurer applies financial mechanisms to credit interest based on participation rates, cap rates, and spread fees.

- Participation Rate: This limits how much of the index’s gain your policy credits. If the index gains 10% and you have an 80% participation rate, your credited growth is 8%.

- Cap Rate: Sets the maximum interest credited regardless of how well the index performs—so if the cap is 12% and the index earns 15%, you still get only 12%.

- Spread Fees: These are deductions from your gains. For instance, a 3% spread reduces a 10% index return to 7% credited growth.

These factors directly affect your policy’s growth potential and, consequently, the long-term value of your cash accumulation and death benefit.

Surrender Charges and Policy Loans: The Cost of Flexibility

Many IUL policies impose surrender charges if you cancel or withdraw early—usually lasting between 10 to 15 years. These fees start higher, sometimes up to 8-12% of the cash value, and gradually decrease to zero. This is important to understand if you’re not planning on holding your policy long term.

Additionally, if you take out a loan against the policy’s cash value, you’ll incur interest charges, which can eat into your policy’s net worth and reduce your death benefit if unpaid. Loan interest rates might vary from around 5% to 8%, depending on your insurer and loan terms.

Optional Riders: Tailor-Made Costs for Extra Benefits

Would you like accelerated death benefits, long-term care coverage, or a waiver of premium rider? Each adds to your protection but also adds to the cost. For instance, a long-term care rider might increase your premiums by several hundred dollars a year, yet it could be invaluable if you need it down the line.

Choosing riders is a balancing act: you want the coverage you need without paying for unnecessary add-ons.

So, how do all these factors add up? The key is that indexed universal life insurance is a customized product. Your age, health, coverage amount, chosen riders, and investment feature configurations all blend to shape your premium.

That’s why there’s no one-size-fits-all answer to how much does indexed universal life insurance cost. A personalized illustration from a trusted agent can reveal how these moving parts fit together for your financial plan.

Want to make sure you’re not overpaying or missing critical coverage? Working with a dedicated advisor from Life Care Benefit Services can help. They’re experienced in breaking down these factors and tailoring solutions to your unique needs.

Learn more about the detailed cost components of indexed universal life insurance, like the premium load and COI charges, through Financial Independence Group’s expert breakdown on common IUL fees and charges. To dive into policy mechanics and cash value intricacies, Western & Southern’s comprehensive guide on Indexed Universal Life Insurance is an excellent resource.

Ready to get a clear picture of your costs?

Request a personalized quote or schedule a consultation with Life Care Benefit Services today to navigate the numbers confidently and protect your family’s future with tailored indexed universal life insurance solutions.

Comparing Indexed Universal Life Insurance Cost With Other Permanent Life Insurance Options

When asking yourself how much does indexed universal life insurance cost, it’s essential to put that question side-by-side with other permanent life insurance types. This comparison helps you see where IUL stands—not just in price but in value and flexibility.

Permanent life insurance options typically include Indexed Universal Life (IUL), Whole Life insurance, and Variable Universal Life (VUL) insurance. Each has unique characteristics that shape their premiums and overall costs.

Indexed Universal Life vs. Whole Life Insurance: Premiums and Growth

Whole Life insurance is known for its fixed premiums and guaranteed cash value growth. Your payments stay consistent, making budgeting straightforward. But that stability can come at a higher upfront premium compared to IUL.

Indexed Universal Life, on the other hand, offers flexible premiums. You can adjust payments within certain limits, which can be valuable during tighter cash flow periods. The cash value growth ties to a market index—with caps and floors in place—which often means the growth potential is higher than Whole Life but with some protection against losses.

But how does that affect cost? Typically, IUL policies can start with lower premiums compared to Whole Life because the cash value growth isn’t guaranteed—it’s tied to market performance. That said, fees like premium loads, cost of insurance (COI), and administrative charges in IULs can be more complex, influencing your out-of-pocket expenses.

In contrast, Whole Life premiums factor in guarantees and stable growth, so while you pay more upfront, there can be fewer surprises in fees or performance.

Wondering if the premium flexibility of IUL is worth the trade-offs in guaranteed growth? It depends on your financial goals and risk comfort.

Indexed Universal Life vs. Variable Universal Life: Risk and Fees

Variable Universal Life insurance lets you invest your cash value directly in securities like stocks and bonds, unlike IUL’s market index tracking with participation rates and caps.

This means VUL cash value growth could potentially be greater than IUL but carries higher risks—including possible losses when markets underperform. Naturally, VUL premiums tend to be higher to cover more complex management and investment administration fees.

Indexed Universal Life offers a middle ground that appeals to those wanting some upside potential without full exposure to market swings.

Still, the higher fees and investment risks in VUL mean your premiums might be unpredictable and often costlier long-term.

How Does This Impact Your Wallet?

Here’s a quick reality check: while Indexed Universal Life insurance can sometimes appear cheaper initially due to its flexible premiums, the combination of participation rates, caps, and various fees might equalize or, in some cases, surpass the cost of Whole or Variable Universal Life over time.

That’s why personalized illustrations are crucial—they allow a view into your policy’s future costs based on your unique situation.

At Life Care Benefit Services, we tailor these insights to your financial goals, so you’re not stuck paying premiums that don’t fit your budget or coverage needs.

Summary Table: Comparing IUL, Whole Life, and VUL Insurance Costs

| Feature | Indexed Universal Life (IUL) | Whole Life | Variable Universal Life (VUL) |

|---|---|---|---|

| Premium Type | Flexible within limits | Fixed and level | Flexible but often higher |

| Cash Value Growth | Linked to stock market index; has caps & floors | Guaranteed fixed growth | Direct investment in securities; no guarantees |

| Fees and Charges | Moderate to high (loads, COI, admin fees) | Generally lower, stable fees | Highest (investment management plus admin fees) |

| Risk Exposure | Minimal downside risk; limited upside | Low risk; very stable | High risk; potential for loss or gain |

| Death Benefit | Flexible, adjustable | Fixed, guaranteed | Flexible, adjustable |

Choosing the right policy comes down to your appetite for risk, need for flexibility, and how you balance premium costs against potential cash value growth and death benefit security.

Still puzzled about how much does indexed universal life insurance cost compared to these other options? Get personalized advice from our experts at Life Care Benefit Services. We dive into your unique circumstances and help you select a policy that aligns perfectly with your budget and long-term plans.

Ready to compare tailored quotes side-by-side? Financial Independence Group’s detailed fee breakdown is a great resource for digging deeper into IUL costs, while Western & Southern’s comparison of IUL vs. Whole Life sheds light on cost and coverage differences.

For a closer look at how investment strategies affect both Indexed and Variable Universal Life insurance, take a peek at SmartAsset’s overview on IUL vs. VUL insurance costs and benefits. Understanding these nuances helps you make confident decisions.

Don’t wait to secure your family’s future with a policy that fits your financial story. Contact Life Care Benefit Services to schedule a free consultation or request a customized quote today.

How to Estimate Your Indexed Universal Life Insurance Premium

Figuring out how much does indexed universal life insurance cost can feel overwhelming. Don’t worry—it’s not about guessing numbers blindly. With a clear process, you can estimate your premium and understand what factors will influence it. This empowers you to make informed choices aligned with your budget and goals.

Step 1: Assess Your Coverage Needs

First things first—determine the death benefit amount you want. This is the face value your policy will pay out to beneficiaries. Think about your family’s financial obligations, future expenses, and any debts you want covered. For example, a small business owner might want a higher death benefit to ensure business continuity or pay off loans, while a parent might focus on future education costs for children.

Choosing an appropriate death benefit is crucial because it directly affects your premium. A higher death benefit generally means a higher premium. Narrowing down this number helps your insurance agent provide accurate premium estimates.

Step 2: Consider Your Age and Health Status

Your age and health play a big role in insurance pricing. Younger, healthier individuals typically enjoy lower premiums due to lower risk. Your insurance provider will look at your medical history, lifestyle, and possibly require a physical exam to assess risk during underwriting.

If you have existing medical conditions, don’t be discouraged. You might still qualify for indexed universal life insurance, but premiums could be higher. That’s why working with an experienced agent—like those from Life Care Benefit Services—is key. They can help navigate underwriting nuances to get the best rate possible.

Step 3: Decide on Premium Payment Flexibility

One of the advantages of indexed universal life insurance is flexible premiums. You can adjust how much and how often you pay (within policy limits), which impacts your cash value growth and overall coverage.

Will you make regular monthly payments or lump-sum contributions? A steady premium stream often simplifies budgeting, while higher initial payments can build cash value faster—possibly lowering required future premiums.

Step 4: Understand the Impact of Index Investment Options

Your policy’s cash value grows based on performance tied to one or more market indexes, like the S&P 500. The premiums you pay not only cover insurance costs but also fund this investment portion.

Estimating premiums means factoring in how aggressive or conservative your investment choices are. Higher potential returns might mean your cash value can offset insurance costs, influencing your premium amounts. However, remember these returns are subject to caps, participation rates, and floors set by insurers to manage risk.

Step 5: Request A Personalized IUL Illustration

Now that you have your basic inputs ready—death benefit, age, health, premium preferences, and investment stance—it’s time to get specific. Reach out to a licensed life insurance agent who specializes in indexed universal life insurance to request a personalized illustration.

These illustrations provide a scenario-based projection of premiums, cash value accumulation, fees, and potential death benefits over time. It’s important to remember these are estimates, not guarantees, but they give a real-world picture of what to expect.

According to experts at Capital for Life, reviewing multiple illustrations helps you compare costs and benefits across different insurers and product features. It’s all about finding the right balance for your financial plan.

Step 6: Factor in Possible Additional Costs

Beyond base premiums, be mindful of other charges that affect the total cost. These include policy fees, cost of insurance (which increases with age), and administrative costs. Some insurers may also have surrender charges if you cancel early.

Ask your agent to break down these fees clearly. Transparency here prevents surprises and ensures your premium estimate reflects the actual investment.

Quick Tips for Estimating Your IUL Premium

- Start with a clear picture of your financial goals and coverage needs.

- Be honest and thorough during the health questionnaire to avoid underwriting delays.

- Understand how your premium payments support both insurance coverage and cash value growth.

- Revisit your plan annually with your agent to adjust premiums or death benefits as your needs change.

Wondering what an average premium looks like? For example, a $500,000 IUL policy for a healthy 30-year-old non-smoker could range around a few thousand dollars annually, but exact figures vary widely by insurer and individual factors. For more detailed personalized rates, a consultation with an expert is essential.

Remember, estimating how much does indexed universal life insurance cost is not a one-size-fits-all exercise. Your unique situation demands a tailored approach with professional guidance.

Ready to find out what your premium might be? Contact Life Care Benefit Services today to schedule a free consultation. Our dedicated agents work with over 50 top-rated insurers to deliver quotes and policy options that fit you—and your family’s future.

Maximizing Value: Living Benefits, Mortgage Protection, and Retirement Planning With IUL

When you ask, how much does indexed universal life insurance cost?, it’s easy to get caught up in premiums without realizing the broader value this policy can offer. Let’s dive into how an IUL goes beyond just death benefits, providing living benefits, mortgage protection, and even bolstering your retirement planning.

Unlocking Living Benefits: A Safety Net While You’re Still Living

Have you wondered if your life insurance could help you while you’re still alive? That’s exactly what living benefits, or accelerated benefits, bring to the table.

With living benefits, you can access a portion of your policy’s death benefit early if you face qualifying events, like a terminal illness diagnosis or the need for long-term care. This feature can ease financial strain during tough times—covering medical bills or daily expenses—without having to tap into savings or retirement funds.

Often added through riders, some insurers offer living benefits with no additional premium unless you use them. It’s a smart way to build financial flexibility into your protection plan. Plus, these options are widely regulated to protect consumers and come from reputable carriers, giving you peace of mind according to the Alabama Department of Insurance.

Mortgage Protection: Safeguard Your Home and Your Family

One of the biggest worries for homeowners is ensuring their mortgage can be covered if something happens to the primary earner. Indexed universal life insurance can be structured to provide this essential safety net.

If you pass away prematurely, the death benefit can be used to pay off or significantly reduce your mortgage debt, relieving your family from financial burden and securing their home. This dual role means your premiums fund both your life insurance coverage and the potential growth in cash value that fuels retirement savings.

Think of it as killing two birds with one stone—protecting your loved ones immediately and building long-term financial assets.

Retirement Planning With IUL: Tax-Advantaged Growth and Flexibility

Can retirement income really spring from your life insurance? The answer is yes, with the right IUL design.

Indexed universal life insurance has a cash value component that grows tax-deferred, tracking a market index without directly investing in volatile stocks. This means you could see accumulation when the market is up, but your cash value won’t decrease when indexes drop—a unique blend of growth potential and downside protection.

Many people use this cash value as supplemental retirement income by accessing policy loans or withdrawals, often tax-free if structured correctly. This can smooth out unexpected expenses or lifestyle upgrades during retirement without tapping traditional retirement accounts. Keep in mind, improper withdrawals can affect your death benefit or cause tax implications, so regular reviews with your insurance professional are key according to Allianz Life.

But How Much Does All This Cost?

The truth is, your policy’s cost depends on your age, health, coverage amount, and chosen riders. Adding living benefits or mortgage protection riders may increase premiums slightly, but their value often outweighs the incremental cost.

Think of it as an investment toward comprehensive financial security—not just a line item on your budget.

At Life Care Benefit Services, we help you tailor your IUL to align with your unique financial goals. Want to make sure your policy supports your mortgage and retirement while keeping premiums affordable? Let’s build a plan that works for you.

Ready to explore how much does indexed universal life insurance cost in your personal situation? Contact Life Care Benefit Services today for a free consultation and get personalized quotes from over 50 trusted carriers.

Common Misconceptions About Indexed Universal Life Insurance Costs

When it comes to figuring out how much does indexed universal life insurance cost, there are several misconceptions that can really cloud your judgment—sometimes leading to sticker shock or even missed opportunities. Let’s clear up some of the most common myths to help you make smarter decisions.

Myth #1: IUL Premiums Are Fixed and Predictable Forever

Many people assume that once you set your premium, you’re locked in for life with a steady payment. That’s not how indexed universal life insurance works. Because of its flexible premium feature, you can adjust your contributions over time. But that also means your costs can change based on policy performance, fees, and coverage needs.

For example, if market returns on the chosen index don’t perform as expected, you might need to increase premiums to keep the policy in force. Conversely, during strong years, less out-of-pocket premium may be required.

Understanding this flexibility is key, but it does require regular review—don’t just set it and forget it. Insurance professionals recommend annual check-ins to make sure your premiums and coverage still match your financial goals, which also helps avoid unexpected costs down the road according to Insurance News Net.

Myth #2: IUL Cost Is Just About the Premium

Thinking the only cost is the monthly or annual premium misses the bigger picture. IUL policies come with embedded costs like the cost of insurance (COI), administrative fees, and sometimes charges for added riders. These can eat into the cash value growth and increase what you’ll need to pay over time.

And there’s more—policy loans or withdrawals, although they can provide tax-advantaged access to cash, might generate additional costs if not managed properly. Misusing these options can cause your policy to lapse or reduce your death benefit, potentially leaving your family at risk.

So, when asking how much does indexed universal life insurance cost, it’s important to factor in all these moving parts, not just the premium number on paper.

Myth #3: IUL Costs Are Too High for Average Families

You might hear that indexed universal life insurance is only for the wealthy. That’s simply not true. IULs offer flexible premium options, so you can tailor the cost to fit your budget and financial goals.

Whether your priority is mortgage protection, supplemental retirement income, or college funding, an IUL can be structured to suit middle-income families. The key is working with an experienced agent who understands how to balance coverage and cost effectively. Life Care Benefit Services specializes in helping families find affordable options by comparing offerings from over 50 carriers to get personalized quotes that make sense for your situation.

Myth #4: Market Upside Means You’ll Never Pay More Because Your Cash Value Grows

It’s tempting to believe that market gains linked to your policy index will cover all costs—but that’s a risky assumption. IULs have caps on returns and floors to protect against losses, but this means cash value growth isn’t guaranteed to outpace your policy charges.

Since some expenses are fixed, poor index performance might mean you need to pay higher premiums or risk policy lapse. Your cost can also increase if you rely heavily on policy loans or if cap rates are lowered by the insurer.

Be wary if anyone suggests an IUL is a hands-off, no-cost product. It requires active management and clear expectations.

What Should You Keep in Mind?

To truly understand how much does indexed universal life insurance cost, look beyond initial premiums. Consider ongoing policy fees, potential rate adjustments, and how your chosen index may impact cash value growth and costs. Always request a detailed illustration and review it with a knowledgeable agent.

Need help sorting through these complexities? Insurance News Net’s insights and expert reviews from providers like Witt Actuarial Services shed light on how IUL illustrations can sometimes oversimplify or overstate performance expectations. They also stress the importance of transparency and conservative assumptions when evaluating costs.

At Life Care Benefit Services, we’re here to help you decode IUL costs and find a customized policy that stands the test of time and market ups and downs. Don’t hesitate to request a quote or schedule a consultation—let’s make those misconceptions a thing of the past and secure your financial future on your terms.

Conclusion

Understanding how much does indexed universal life insurance cost is essential before committing to any policy. It’s more than just the initial premium—it’s about the ongoing fees, cash value growth potential, and how actively you manage the policy over time. Remember, indexed universal life insurance isn’t a set-it-and-forget-it product; it requires periodic reviews and adjustments to align with your financial goals and market shifts.

So, what should you do next? Start by requesting detailed illustrations that clearly outline your expected costs and potential returns. Compare these with your budget and personal financial plans. If you’re unsure, consult with a trusted independent agency—like Life Care Benefit Services—that can break down complex terms into plain English and customize solutions just for you.

Think of IUL as a dynamic tool in your financial toolkit. When managed properly, it can provide not only life insurance protection but also an opportunity to build cash value with living benefits. But it’s crucial to keep realistic expectations and avoid promises of no-cost or guaranteed returns that sound too good to be true.

Ready to secure your family’s future while optimizing your insurance costs? Don’t hesitate to request a quote or schedule a consultation with Life Care Benefit Services today. It’s your move to clarity and confidence in your insurance choices.

Frequently Asked Questions About How Much Does Indexed Universal Life Insurance Cost

Curious about how much does indexed universal life insurance cost? You’re not alone. Many people ask the same questions when exploring their options. Below, we break down some of the most common questions to help you get a clearer picture.

What factors influence the cost of an indexed universal life (IUL) insurance policy?

The cost of an IUL policy varies based on several key factors. Your age, health status, the amount of coverage you want, and how much you plan to contribute toward the policy’s cash value all play roles. Additionally, fees and ongoing premiums can differ by insurer, so your personal profile and the policy’s design will impact the final cost.

For example, younger and healthier individuals typically pay lower premiums since their risk is reduced. On the other hand, adding riders like accelerated death benefits or long-term care coverage can increase your premiums but provide valuable living benefits.

Are premiums fixed or can they change over time?

One of the benefits of indexed universal life insurance is flexibility. Premiums are generally flexible, meaning you can adjust how much you pay within certain limits to help your policy grow or keep costs manageable. Unlike term life insurance with fixed premiums, IUL lets you scale payments up or down depending on your financial situation and goals.

However, keep in mind that while premiums can be flexible, the cost of the insurance component itself may rise as you age. Active management and periodic policy reviews are crucial to ensure affordability and that your policy fits your evolving needs.

What are the common fees associated with an IUL policy?

Many people underestimate the impact of fees on the overall cost. Typical fees include the cost of insurance, administrative fees, premium loads, and surrender charges if you decide to cancel early. Each insurer structures these differently.

Be sure to get detailed illustrations from your prospective insurer. These should clearly show both the fees and how they affect your cash value growth over time. This transparency is essential for making an informed decision.

How does the cash value component affect the overall cost?

The cash value in an IUL policy grows based on a credited interest linked to a market index, like the S&P 500, but you’re protected from negative market returns. This living benefit means your policy can build cash savings, which may help offset some costs as it grows.

However, remember that your contributions toward cash value impact how much you pay. The more you allocate there, the higher your premiums, but the greater your potential financial flexibility down the road.

Can I get a clear estimate of costs before buying?

Absolutely, and this is something we strongly recommend. Request personalized illustrations that show projected premiums, fees, and potential cash value growth based on your specific goals and profile. This step helps avoid surprises and ensures you find a policy within your budget.

At Life Care Benefit Services, we specialize in breaking down these complex numbers into easy-to-understand insights so you can feel confident in your decisions. Curious to find out what an IUL policy would cost you? Don’t hesitate to request a quote or schedule a consultation with our expert advisors today.

Is indexed universal life insurance costlier than other types of life insurance?

Generally, IUL policies tend to have higher premiums than term life insurance because they combine a death benefit with a cash value component and living benefits. Compared to whole life insurance, IUL may sometimes offer more flexibility and potentially cost savings, but this depends on your personal strategy and how actively you manage the policy.

The key is to weigh the cost against the value you receive. If you want coverage that adapts to your financial life and builds cash value with market-linked upside, IUL can be a smart investment.

Still feeling overwhelmed? Let’s simplify it together — connect with Life Care Benefit Services and explore tailored insurance plans that fit your budget and goals.