Thinking about retirement can be a bit overwhelming, right? You want to make sure you’ve got enough saved up, but there are so many choices—and let’s be honest, some of them come with confusing names like IRA and Roth IRA.

Ever found yourself wondering, “What’s the real difference between these two accounts?” You’re not alone. Lots of folks get stuck trying to figure out which one actually works better for their future. Spoiler alert: there’s no one-size-fits-all answer, and that’s exactly why a solid IRA vs Roth IRA retirement planning guide matters.

Here’s what I’ve noticed: people don’t just want to understand the nitty-gritty rules—they want to feel confident that their money is growing in the smartest way possible. They want to know if they’ll owe taxes now or later, whether they’ll have easy access to their cash if life throws a curveball, and how their choices today affect the family they care about tomorrow.

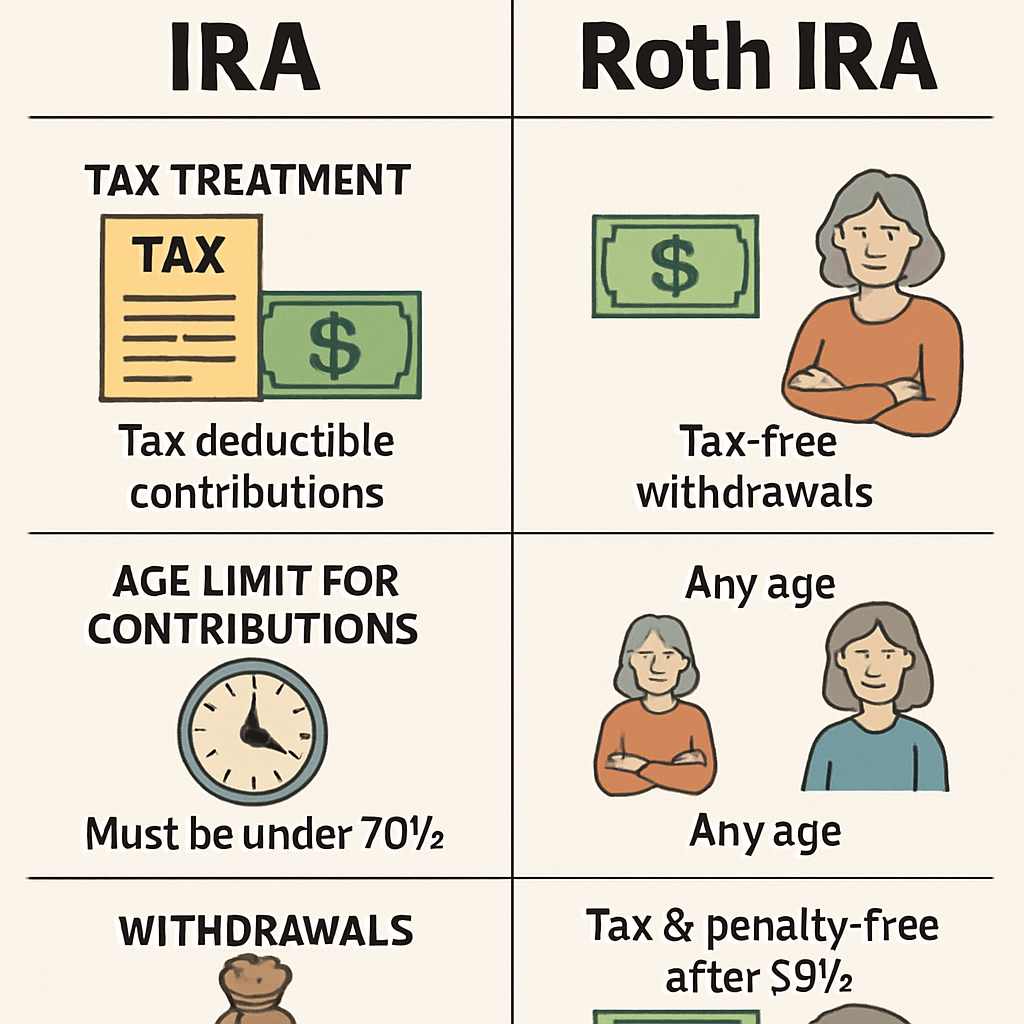

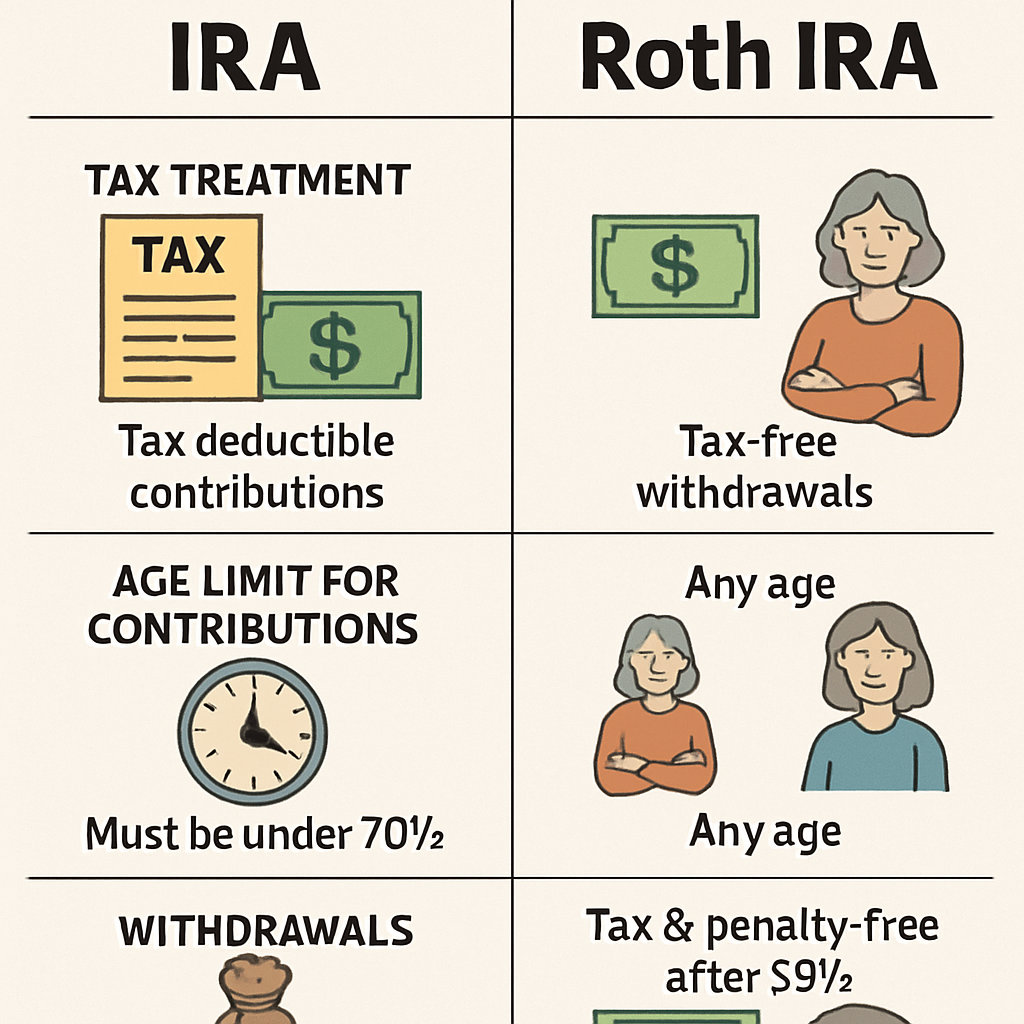

So, what’s the deal with these IRAs? In a nutshell, traditional IRAs offer you tax breaks upfront but tack on taxes when you withdraw later. Roth IRAs, on the other hand, make you pay taxes now but let you pull out your money without a tax bill during retirement. It sounds straightforward—but wait till you dig into income limits, contribution rules, and withdrawal options.

If you’re nodding along, thinking this sounds familiar, that’s good. Understanding the emotional weight behind these choices—the “what-ifs” about your family’s future and security—is the first step to making sense of it all.

Let’s explore this together in a way that feels doable, not daunting. Because mastering your retirement options is less about memorizing rules and more about finding what fits your life right now.

By the way, if you’re curious about how retirement planning ties in with protecting your family’s financial future, our step-by-step guide on reviewing life insurance policies might give you some helpful perspective.

Ready to cut through the noise and get clear? Let’s dive in.

TL;DR

Trying to pick between a traditional IRA and a Roth IRA? It boils down to when you want to pay taxes and how you want access to your money.

Traditional IRAs give you tax breaks now but tax you later, while Roth IRAs tax you upfront and offer tax-free withdrawals in retirement. Knowing this can help you plan your family’s secure future without surprises.

Understanding IRA and Roth IRA: Key Features and Benefits

Picking between an IRA and a Roth IRA isn’t just a financial decision; it’s about figuring out how you want your money to work for you—now and later. Maybe you’ve heard the basics before, but let’s get into what really sets these two apart, so you can make sure your retirement plan fits your life, not the other way around.

Who Can Contribute?

To start, both IRAs require you (or your spouse if you file jointly) to have earned income. That’s just fancy talk for wages, salaries, or self-employment earnings. Good news: since the SECURE Act changes in 2020, there’s no age limit to contribute to a traditional IRA anymore. So whether you’re 25 or 75, as long as you have earned income, you’re in the game.

With Roth IRAs, there’s no age restriction either, but there’s a catch with income. For 2025, if you’re a single filer making over $150,000, or married filing jointly over $236,000, your ability to contribute to a Roth IRA phases out or disappears entirely. This makes Roth IRAs great for younger folks or those expecting to climb the income ladder in the future (source).

Tax Treatment: Paying Now or Paying Later?

Here’s the crux that trips up a lot of people. With traditional IRAs, you often get a tax break today because your contributions may be deductible. This means less income to report on your tax return right now, which can feel like a sweet deal if you want to lower your tax bill today.

The tradeoff? When you pull money out in retirement, those distributions are taxed as ordinary income. So, you’re deferring the tax burden to later.

On the flip side, Roth IRA contributions are made with money you’ve already paid taxes on, so no deductions here. But the real win comes later—qualified withdrawals (that’s after age 59½ and five years of account age) are completely tax-free. You get to keep the whole pot, including the growth your investments made over the years, without Uncle Sam taking a cut (source).

Think about it like this: if you expect to be in a higher tax bracket when you retire than you are now, the Roth’s tax-free growth and withdrawals could save you thousands. But if you’re hoping to reduce taxes today because you’re in a higher bracket now than you’ll be later, a traditional IRA might make more sense.

Withdrawal Rules and Required Minimum Distributions (RMDs)

Another key difference is how and when you have to take the money out. Traditional IRAs require you to start taking a required minimum distribution (RMD) by age 73 (for those turning 72 after 2022), whether you need the money or not. Miss that deadline? The IRS can hit you with a penalty that’s… well, steep.

Roth IRAs? No RMDs during your lifetime. That’s a huge advantage if you want to let your money keep growing or pass it down to heirs (source).

Also, withdrawing contributions from a Roth IRA is penalty- and tax-free any time, which can be handy if life throws you a curveball. Though, pulling out earnings early may trigger taxes and penalties unless you qualify for exceptions—think buying your first home or education expenses.

Contribution Limits and Spousal Rules

Good to keep in mind: the total amount you can stash in all your IRAs combined (traditional plus Roth) is capped each year. For 2025, that limit is $6,500 if you’re under 50 ($7,500 if 50 or older). You don’t get a free pass to double-dip.

What if one spouse doesn’t work outside the home? Spousal IRAs have your back here, letting a nonworking spouse contribute, based on the working spouse’s income. This can seriously boost a family’s retirement readiness.

Which One Fits You?

Still thinking, “This all sounds great, but how do I really decide?” It boils down to your tax picture today, your expectations for retirement income, and whether you value tax breaks now or later. Maybe you want some money locked away and tax-free forever (hello, Roth), or you need that instant tax relief (that’s traditional IRA).

Remember: choosing isn’t forever. You can even have both types, giving you flexibility come retirement to decide where to pull money from.

Feeling a little overwhelmed? That’s completely normal. If you want help tailoring a plan that fits your life, reach out to experts who get the details right.

Comparing IRA vs Roth IRA: Contribution Limits, Taxes, and Withdrawal Rules

Choosing between a traditional IRA and a Roth IRA can feel like walking a tightrope without a net. You’re juggling contribution limits, tax implications, and withdrawal rules—all while trying to picture which one will serve you better decades down the road. Let’s break it down in the most straightforward way possible.

Contribution Limits: They’re Basically the Same, But Watch the Details

First off, both traditional and Roth IRAs share a combined contribution limit. For 2025, that’s $6,500 a year if you’re under 50, and $7,500 if you hit 50 or older—kind of like a little bonus for your “been-there-done-that” status. But here’s the catch: that’s the total across both accounts if you decide to have both.

That means if you throw $4,000 into a Roth IRA, you can only put $2,500 into a traditional IRA that year. No doubling up. And if your income climbs above certain thresholds, your ability to contribute to a Roth starts to phase out, especially if you’re filing jointly and pulling in a good salary. Meanwhile, traditional IRA contributions might still be allowed, but the tax deductibility can be limited, mainly if you or your spouse is already covered by a workplace retirement plan. This gets a little messy, but it’s worth digging a bit deeper or asking an expert for your specific situation.

If you didn’t know, there’s no age cap on making contributions anymore. So, even if you’re a spry 75-year-old, you can still put money in either type—lovely news, right? The IRS lays out the nitty-gritty details on contribution limits here, which is a great resource when you want to double-check the latest numbers.

Taxes: When Do You Want to Deal With Uncle Sam?

Okay, taxes—the elephant in the retirement room. With a traditional IRA, your contributions often come out of pre-tax dollars or can be tax-deductible, giving you that instant relief on your tax bill now. That’s like a pat on the back when you file your taxes each year. But the catch? When you pull that money out in retirement, it’s fully taxable as ordinary income.

Contrast that with the Roth IRA, and you’ll see a flip. Contributions come from money you’ve already paid taxes on—so no deduction now. But the sweet part? Your earnings grow tax-free, and when you finally withdraw qualified distributions, you pay zero taxes. Nada. Zilch. It’s like planting a tree that you don’t have to share fruit taxes with later.

This difference boils down to when you expect to be in a higher tax bracket. If you think taxes will hit you harder in retirement, Roth IRA’s logic is pretty clear. But if you want to ease your tax burden today, a traditional IRA might feel more comfortable. You’ve got options—and you can even mix and match!

Withdrawal Rules: Knowing When and How You Can Tap In

This is where things get interesting because the timing of withdrawals really affects how much you end up with in your pocket—or how many penalties you dodge.

Traditional IRAs have required minimum distributions (RMDs), starting at age 73 (as of 2025). That means the IRS gently nudges you to start pulling money out whether you want to or not, with taxable consequences. It’s not exactly the freedom dance you might have hoped for.

Roth IRAs? No RMDs for the original account owner. You can let your investments grow as long as you want. And because you paid taxes upfront, you can withdraw your contributions anytime, tax- and penalty-free. Earnings are a different story, though—they’re only tax- and penalty-free if you’re at least 59½ years old and have met the five-year holding rule. If you take earnings out too early, you might face taxes and a 10% penalty, unless you qualify for exceptions like buying your first home or covering education costs.

One quick nugget to remember: if you take money from your traditional IRA before 59½, you’re usually looking at taxes plus a 10% penalty. That’s a tough pill unless it’s a true emergency. Roth IRAs offer more flexibility here, letting you tap into your contributions anytime without penalties. That’s peace of mind when life throws curveballs.

If you’re thinking, “Sounds complicated,” you’re not alone. Here’s a little visual aid to clear things up:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Limits (2025) | $6,500 under 50, $7,500 50+ | Same as Traditional IRA, subject to income limits |

| Tax Treatment | Contributions may be tax-deductible; withdrawals taxed on distribution | Contributions made with after-tax dollars; qualified withdrawals tax-free |

| Withdrawal Rules | Penalties before 59½; required minimum distributions start at 73 | Contributions withdrawable anytime tax-free; earnings tax-free if 59½+ and 5 years held; no RMDs |

Whew. That’s a lot, right? But here’s the thing: understanding these differences helps you control your money instead of letting tax surprises sneak up on you. The Charles Schwab Roth IRA guide offers some great insights if you want to explore withdrawal specifics in greater depth.

Still with me? Great. Because here’s one last crucial piece: avoid excess contributions at all costs. If you go over your IRA contribution limit, the tax penalty is 6% per year on the excess amount. It’s like throwing money away—not fun.

Don’t want to worry? Double-check your contributions every year and think about how your income and retirement goals shift. And, if you’re feeling unsure, there’s no shame in reaching out to someone who really knows this stuff, like a retirement specialist at Life Care Benefit Services.

In the end, the best choice depends on your personal tax situation and retirement plans. Are you someone who prefers tax breaks today or freedom from taxes in retirement? Think about your expected income in retirement, your current tax bracket, and how soon you might need to withdraw funds.

As we dive deeper into this IRA vs Roth IRA retirement planning guide, keep these core differences top of mind. They’re the foundation for making a smart, tailored decision that fits your life today and tomorrow.

Assessing Your Eligibility and Choosing the Right IRA Type

So you’ve got your eyes on retirement savings, but which IRA fits you best? Let’s pause for a sec and talk about something that trips up a lot of folks—eligibility. Not everyone qualifies for every IRA type, and understanding where you stand can save you from surprises down the road.

First, let’s talk income because it’s kind of the gatekeeper here. If you’re looking at a Roth IRA, your Modified Adjusted Gross Income (MAGI) plays a starring role in determining if—and how much—you can contribute. For 2025, single filers earning less than $150,000 can contribute the full amount, which tops out at $7,000 or $8,000 if you’re 50 or older. But as your income edges toward $165,000, that contribution limit starts shrinking until it phases out completely. Married couples filing jointly enjoy a higher threshold, with full contributions allowed up to $236,000. Anything between $236,000 and $246,000? Your contribution gets tapered down. Beyond that, you’re out of luck—at least for direct Roth IRA contributions. For these specifics, Vanguard’s Roth IRA income limits guide breaks it down clearly.

What if you make too much for a Roth IRA but still want those sweet tax-free withdrawals someday? There’s a sneaky workaround called a backdoor Roth IRA. It involves putting money into a traditional IRA first, then converting it—sort of like sneaking in the back door when the front door is locked. But beware, the tax details here aren’t trivial, so talking to a pro before trying this can save you headaches.

Now, here’s a little kicker: traditional IRAs don’t have income limits for making contributions, which sounds great, right? But, if you or your spouse are covered by a workplace retirement plan, the ability to deduct your contributions on your taxes might start fading as your income climbs. And those deductions can be a big reason to choose a traditional IRA in the first place. So, if you’re aiming for that immediate tax break, you’ll want to check whether you qualify for this deduction each year.

Thinking about age? Good—because Roth IRAs don’t have age limits when it comes to contributing. Whether you’re 25 or 75, as long as you have earned income and meet the income requirements, you’re good to go. On the flip side, traditional IRAs stop contributions once you hit 72. This difference alone can sway your choice depending on your retirement timeline.

Let’s step back for a second and consider your bigger picture. Are you someone who’d rather get a tax break today and pay tax when you withdraw? Or do you prefer to pay taxes on your contributions now, then enjoy tax-free money in retirement? Your current tax bracket and what you expect to be paying later on are key here.

So, how do you make sense of all this? Start by calculating your MAGI, which you can find on your tax return—and remember, some deductions are added back in for this calculation, like student loan interest or foreign income exclusions. The IRS has a helpful guide to figure this out in IRS Publication 590-A. Once you know your MAGI, matching it up with the contribution limits becomes less daunting.

Finally, here’s a practical tip: don’t try to go it alone if this feels overwhelming. Retirement planning can be a puzzle, but it doesn’t have to be a solo mission. Life Care Benefit Services offers tailored advice that can help you navigate these eligibility waters and select the IRA that really fits your unique financial story. After all, making the right choice is about more than numbers—it’s about your peace of mind in retirement.

Ready to find your perfect IRA match? Take a deep breath, gather your income info, and dive into this planning a step at a time. Because in this IRA vs Roth IRA retirement planning guide, your best move will always be the one that feels right for you.

For more on the nitty-gritty of contribution amounts and income limits, check out the IRS’s official Roth IRA contribution guidance. It’s technical, but knowing is half the battle.

Step-by-Step: How to Open and Manage an IRA or Roth IRA Account

Opening an IRA or Roth IRA might feel like stepping into a maze—there’s paperwork, rules, and a fair share of “what-ifs.” But I promise, it’s more straightforward than it seems once you break it down. Let’s walk through this together, step by step, so you can stop stressing and start building that nest egg for the future.

Step 1: Choose the Right IRA Type for You

First thing’s first: decide between a traditional IRA and a Roth IRA. Remember, the traditional IRA generally lets you contribute pre-tax income and pay taxes later, while the Roth IRA uses after-tax dollars but offers tax-free withdrawals in retirement. Your choice depends on your current tax situation and what you expect in retirement.

Not sure which fits best? Think about your current versus expected future income and tax rate. And hey, it’s okay if you’re still a bit fuzzy here—that’s where experts can help. Speaking of help, you can get some additional support through Life Care Benefit Services’ retirement planning insights that guide you beyond just opening accounts.

Step 2: Pick a Reputable Financial Institution

You’re going to be trusting this place with your long-term savings, so don’t rush. Banks, credit unions, brokerage firms, and mutual fund companies all offer IRAs. Some invest in stocks, bonds, or mutual funds, while others might focus on CDs or other savings vehicles.

Look for low fees, good customer service, and investment options that align with your comfort level. Remember, the reputation and reliability of your financial institution matter just as much as the IRA type.

Step 3: Gather Your Info and Complete the Application

This probably sounds like the least fun part—getting all your personal information in order. You’ll need your Social Security number, driver’s license or ID, employment details, and bank account info for funding your account.

Many institutions let you apply online, which speeds things up a lot. It’s usually straightforward—take a deep breath and power through the fields. Don’t be shy about reaching out to customer service if anything’s confusing; these folks deal with this every day.

Step 4: Fund Your Account

Here’s where some feel that pinch. You can start with a lump sum if you like, or set up automatic monthly contributions—either way works, though automating your deposits builds habits that stick. Remember contribution limits for 2024: up to $6,500 if you’re under 50, or $7,500 if you’re 50 or older.

If money is tight, start small. Even a few bucks can grow over time. You can always increase your contributions when your budget allows.

Step 5: Choose Your Investments

Now the fun part: picking where your money goes. Depending on your IRA provider, you might have a menu of funds, stocks, bonds, or ETFs. If you’re new, consider diversified options like index funds or target-date retirement funds that adjust investments for your age.

No need to feel overwhelmed—most providers offer tools or advice to guide your choices. And if you’re itching to learn more about investment choices, the IRS’s official Individual Retirement Arrangements page breaks down eligible investments and rules clearly.

Step 6: Monitor and Manage Your Account Regularly

It’s tempting to set and forget, but a quick check-in every few months works wonders. Markets shift, life circumstances change, and you might find new opportunities or need tweaks.

Rebalancing your portfolio—shifting asset percentages back to your target—can keep your risk in check. Also, keep an eye on contribution limits and deadlines so you don’t miss out on adding more.

And think about naming a beneficiary for your IRA, so your hard-earned savings wind up where you want if life takes an unexpected turn.

Step 7: Understand Withdrawals and Tax Implications

Withdrawals can get tricky. Traditional IRAs require you to start minimum distributions at 73, while Roth IRAs don’t have required minimum distributions during your lifetime. Pulling money early could mean taxes and penalties.

It’s smart to learn these rules now so when retirement—or emergencies—arrive, you’re not caught off guard. Detailed guidance on this is available on the IRS retirement plan pages, a solid resource for staying compliant.

So, what should you do next? If this feels overwhelming, don’t sweat it. Reach out to Life Care Benefit Services for personalized guidance tailored to your family’s future. Getting started is the hardest part—the rest is just tending the garden.

Incorporating Retirement Planning with Life Insurance and Mortgage Protection

It’s easy to get caught up in the numbers when planning for retirement—the dollars you want to save, the accounts you open, the tax strategies you juggle. But have you thought about how life insurance and mortgage protection play into the bigger retirement picture?

Here’s the thing: your retirement plan isn’t just about what you stash away in IRAs or 401(k)s. It’s also about shielding yourself and your family from surprises that could drain those savings faster than you expect. And honestly, mixing in life insurance and mortgage protection with your strategy can feel like adding a seatbelt and airbags to your financial car—sometimes you don’t notice them until you really need them.

Why Blend Retirement Planning with Life Insurance?

Think about the peace of mind life insurance offers. It’s more than just a payout for beneficiaries when you pass—it can also build cash value that you tap into during retirement. Indexed Universal Life Insurance (IUL), for example, combines death benefit protection with a cash account that grows, often linked to stock market indexes but shields you from losses.

This kind of policy can complement your IRA vs Roth IRA retirement planning guide by offering a non-traditional source of retirement funds. The cash value can be accessed via loans or withdrawals, often tax-free, which might provide flexibility if you hit a rough patch or want to fund unexpected expenses.

Plus, it’s permanent coverage. Unlike term life that ends after a certain period, permanent policies like IUL stay with you for life—helping protect your loved ones while also doubling as a financial tool.

Don’t Forget Mortgage Protection

Here’s a curveball: many people retire while still paying off a mortgage. Carrying that debt into your golden years can put serious strain on your budget. Mortgage protection insurance steps in here by ensuring that if something happens to you, your home won’t be a burden to your family’s retirement.

It’s not just about the mortgage, either. Protecting your home investment helps secure the equity you’ve built up—equity that might become part of your retirement nest egg or be tapped in emergencies.

Balancing debt with retirement assets is tricky, and it requires forward thinking. Borrowing against home equity or using mortgage protection insurance smartly can help you avoid financial pitfalls in retirement, letting you enjoy those years without as much worry.

So, How Do You Bring It All Together?

First, recognize that these tools—IRA or Roth IRA accounts, life insurance with cash value, mortgage protection—aren’t standalone islands. They’re connected parts of your financial ecosystem.

Begin by assessing your current debts, insurance coverage, and retirement savings. Are your life insurance benefits enough to cover your mortgage and other expenses? Could your cash value life policy cushion withdrawals from retirement accounts, easing tax liabilities or market dips?

Working with an expert, like those at Life Care Benefit Services, can really help. They’ll tailor a strategy balancing life insurance, mortgage protection, and retirement investing that fits your unique situation.

Remember, incorporating these elements isn’t about complicating your finances. It’s about building resilient, flexible planning that helps you and your family breathe easier. Want to explore how your retirement plan can include these vital layers of protection? The Consumer Financial Protection Bureau offers helpful tools that highlight why balancing debt and protection matters as you age.

And for a deeper dive on life insurance strategies that grow alongside your retirement needs, check out the benefits of Indexed Universal Life Insurance. With flexible premiums, tax advantages, and access to cash value, it might just be the missing piece in your IRA vs Roth IRA retirement planning guide.

Bottom line: retirement planning is more than savings and investment returns. It’s about protecting what you have—and what you hope to leave behind. Don’t let mortgage debt or unexpected losses catch you off guard when you’re meant to be enjoying this next chapter. Let’s make sure your plan truly safeguards your future.

FAQs About IRA vs Roth IRA for Homeowners, Teachers, and Small Business Owners

If you’re juggling a mortgage, lesson plans, or running your own small business, questions about IRAs and Roth IRAs can pile up fast. Let’s clear some of the fog with answers to the most common concerns tailored just for you.

Q: Can I contribute to a Roth IRA if I’m already funding a 401(k) through my job or business?

Short answer: yes, you can. You’re allowed to chip away at both accounts in the same year, which is great if you want to supercharge your retirement stash. But watch out for income limits on Roth IRA contributions — if you’re making a good chunk, your eligibility might shrink or vanish.

Q: What if I’m a teacher paying off a mortgage—does a traditional IRA or Roth IRA make more sense?

Honestly, it depends on what you expect your tax picture to look like in retirement. If you think you’ll pay lower taxes later, a traditional IRA’s up-front deduction feels nice. But if you’re leaning toward Roth, paying taxes now means your withdrawals in retirement are tax-free—extra helpful when you’re managing fixed expenses like your home.

Q: As a small business owner, can I open an IRA or Roth IRA for myself—and what about employees?

You can definitely open your own IRA or Roth IRA. For employees, though, IRAs aren’t the typical go-to for group retirement plans. Instead, options like SEP IRAs or SIMPLE IRAs might be better suited for small businesses. These let you help your team save while enjoying some tax perks yourself.

Q: How do the withdrawal rules differ between traditional IRAs and Roth IRAs?

Here’s where it gets important. Traditional IRAs generally make you start taking Required Minimum Distributions (RMDs) at age 73, whether you’re ready or not. Roth IRAs? No RMDs during your lifetime, which is like having the freedom to let your money keep growing on your terms, especially if you’re worried about passing assets to heirs.

Q: What if I’m paying mortgage protection insurance—does that affect my IRA or Roth contributions?

Mortgage protection insurance and IRA contributions play different roles, but both support your financial health. The insurance guards your home if something unexpected happens, while IRAs grow your retirement nest egg. They don’t impact each other directly, but snagging both can give you peace of mind at different life angles.

Wondering if you should prioritize one over the other? It’s worth talking to a pro who can look at your full picture—debt, income, and retirement goals—and help you build a strategy that fits.

Q: Can I convert my traditional IRA to a Roth IRA if my tax situation changes?

Absolutely. Many folks do a Roth conversion when they’re in a lower tax bracket, maybe after retiring but before taking Social Security. Just remember, you’ll owe income tax on the amount converted, so timing and size matter.

Q: Are there penalties if I withdraw from my IRA or Roth IRA early?

Generally, yes, unless you qualify for exceptions like first-time home purchase, certain education expenses, or disability. Roth IRAs have some flexibility—you can pull out contributions (not earnings) anytime without penalty. But dipping into retirement accounts early should be a last resort because it can really dent what you have down the line.

Still have questions? Life Care Benefit Services specializes in crafting personalized retirement and insurance solutions that actually make sense for your unique situation. Don’t hesitate to schedule a consultation—sometimes a quick chat untangles more than you expect.

Conclusion: Take Charge of Your Retirement Planning Today

Look, retirement planning can feel like one of those things you keep pushing down the to-do list. But here’s the truth: the sooner you take charge, the more options you’ll have later. We’ve walked through the ins and outs of the IRA vs Roth IRA retirement planning guide, and if you’re still wondering which path fits your life, you’re not alone.

Think about it this way—your retirement isn’t just a number in an account; it’s the freedom to live your days on your terms. Whether you’re leaning toward the tax-deferred comfort of a traditional IRA or the tax-free future a Roth IRA offers, the real win is starting now. Waiting might cost you more than just money; it could eat into your peace of mind.

So, what should you do next? Take a little time to map out your current finances honestly. Where are you now, and where do you want to be? Don’t be shy about talking to a pro—Life Care Benefit Services specializes in personalizing retirement and insurance plans that actually fit your world, not a cookie-cutter mold.

And remember, this isn’t a set-it-and-forget-it deal. Your retirement strategy should grow with your life—your goals, your tax picture, even your health. Revisit your plans regularly, tweak what’s needed, and stay curious.

You’ve got this. Ready to take the first step? Schedule a consultation with Life Care Benefit Services. Sometimes that one conversation is all it takes to untangle your options and get you moving forward with confidence.