Ever stared at your retirement spreadsheet and thought, “maybe there’s a smarter way to grow my money while keeping my family protected?”

If you’ve heard the buzz around indexed universal life (IUL) and wonder “is indexed universal life a good investment,” you’re not alone. A lot of homeowners, teachers, and small‑business owners are asking the same thing.

Here’s the deal: IUL isn’t a magic stock pick, but it does blend life‑insurance protection with a cash‑value component that can earn interest linked to market indexes—without the risk of direct market loss.

Think about it this way: you pay a regular premium, your policy stays in force, and a portion of that premium builds cash that can grow when the S&P 500 or another index climbs. If the market dips, a floor protection usually keeps the crediting rate at 0 % rather than dragging your cash value into the red.

Sounds nice, right? But the real question is whether that blend fits your financial goals.

We’ve seen families use IUL to supplement a mortgage‑payoff plan, teachers to lock in a tax‑advantaged retirement boost, and small‑business owners to create a legacy fund that survives a market crash.

At the same time, the upside isn’t unlimited—most policies cap the credited interest, and the cost of insurance can rise as you age. That’s why the “goodness” of the investment really hinges on three things: your time horizon, your need for a death benefit, and how comfortable you are with policy fees.

So, if you’re looking for a vehicle that offers both protection and a modest, market‑linked growth path, IUL could be a solid piece of a diversified plan. If you’re after aggressive growth, you might lean toward a pure investment account instead.

Bottom line: there’s no one‑size‑fits‑all answer. The key is to line up the IUL features—cap rates, participation percentages, and cost structure—with what matters most to you right now.

Ready to see if an IUL aligns with your budget and future goals? Let’s dive deeper and figure out the numbers that make sense for your family.

TL;DR

Indexed universal life blends death‑benefit protection with modest market‑linked cash growth, making it a solid option if you value tax‑advantaged savings and a safety net.

But if aggressive returns are your priority, a traditional investment account may outperform, so weigh your time horizon, fee tolerance, and death‑benefit needs before deciding.

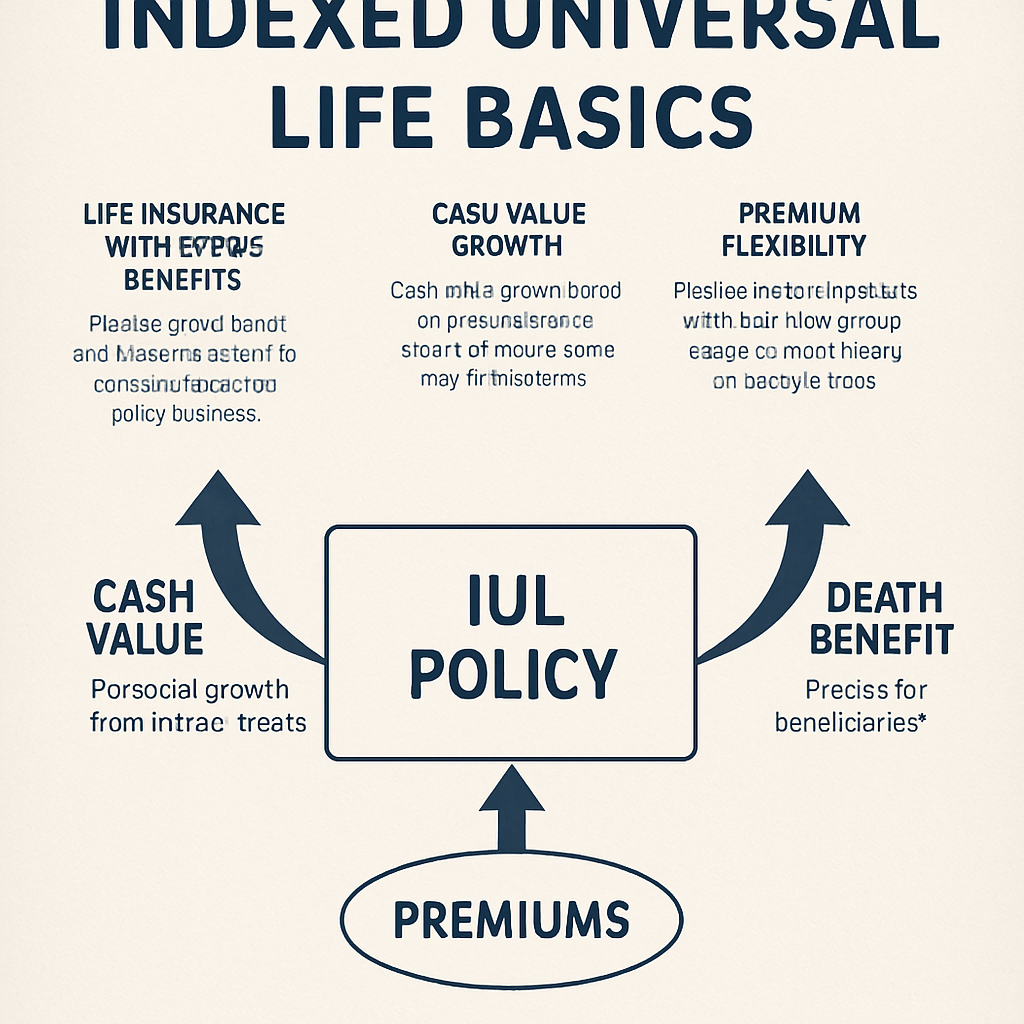

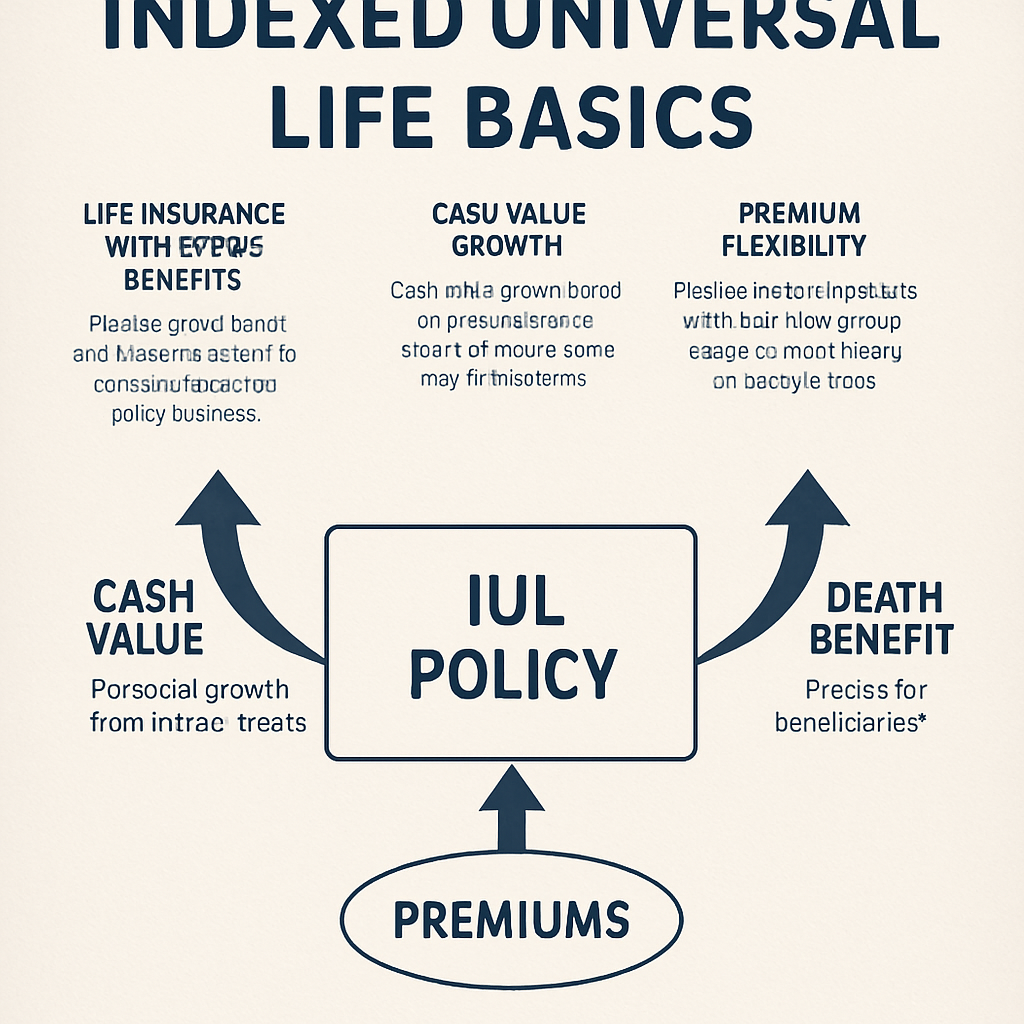

Understanding Indexed Universal Life (IUL) Basics

When you first hear “indexed universal life,” it can feel like a buzzword mash‑up. You’re wondering, “Is this really a good investment, or just another insurance gimmick?” Let’s unpack the mechanics so you can decide if it belongs in your financial toolbox.

At its core, an IUL is a permanent life‑insurance policy that does two things: it guarantees a death benefit for your loved ones, and it builds cash value that can grow based on the performance of a market index—usually the S&P 500. The twist? Your cash isn’t directly invested in the stock market. Instead, the insurer credits interest using a formula that links to the index, while a floor (often 0 %) protects you from negative market moves.

How the crediting works

Imagine the S&P 500 climbs 12 % in a year. Your policy might credit you 10 % (the participation rate) up to a cap of, say, 9 %. If the market drops 8 %, the floor means you still earn 0 %—your cash value doesn’t shrink, but you also don’t earn anything that year.

This “participation × cap + floor” combo creates a middle ground between a traditional whole‑life policy (which offers a modest, guaranteed interest) and a variable universal life (which can swing wildly with the market). It’s why many families see IUL as a “safe‑ish” way to tap market upside without the downside.

Key components you need to know

- Premium flexibility: You can adjust how much you pay each month, within policy limits, to fund more cash value or keep the death benefit steady.

- Cost of insurance (COI): This fee rises as you age, so the longer you hold the policy, the more you need to allocate to cover it.

- Cap rate & participation rate: These numbers dictate the ceiling on your credited interest and how much of the index gain you actually capture.

- Policy loans & withdrawals: You can tap the cash value while you’re alive, usually tax‑free, but borrowing reduces the death benefit.

So, does the IUL answer the “is indexed universal life a good investment” question? It depends on three personal factors: your time horizon, your need for a death benefit, and how comfortable you are with policy fees.

Time horizon matters

If you’re looking at a 10‑year window, the caps may limit your upside enough that a regular brokerage account could outperform after fees. But over a 20‑30‑year span, the floor protection and tax‑deferred growth often give IUL a competitive edge, especially if you plan to use the cash for retirement or a mortgage payoff.

Think about it this way: you’re building a safety net that grows while you sleep. Even if the market staggers, you’re not losing cash value—just missing out on that year’s gains.

Death benefit vs. investment focus

If protecting your family is a priority, the death benefit adds real value that pure investments can’t replace. The cash value is a bonus, not the sole purpose. Some families treat the IUL as a “dual‑purpose” vehicle: a life‑insurance foundation that later morphs into a retirement supplement.

One friend of mine, a teacher, kept his policy for 15 years. He never needed the death benefit, but he was able to borrow against the cash value to fund a home renovation without tapping a traditional loan.

Fees and policy costs

Every IUL comes with administration fees, COI, and often a surrender charge if you exit early. Those costs can eat into your returns if the policy isn’t funded adequately. That’s why it’s crucial to run the numbers with a qualified advisor.

For a deeper dive on budgeting your premium and understanding the cost structure, check out our step‑by‑step guide to how indexed universal life works. It walks you through the math and shows where hidden fees might hide.

Bottom line: IUL isn’t a miracle investment, but it can be a smart piece of a diversified plan when you value downside protection, tax‑advantaged growth, and a death benefit. Pair it with other retirement vehicles, keep an eye on the caps, and treat the policy as a long‑term partnership rather than a quick win.

How IUL Provides Living Benefits and Retirement Savings

Living Benefits Overview

Imagine you’re looking at your retirement plan and thinking, “What if I could tap into my policy while I’m still alive, without paying income tax?” That’s the core promise of the living‑benefit feature built into an indexed universal life (IUL) policy. It blends a death benefit with a cash‑value engine you can borrow against, turning the policy into a flexible savings tool.

The first living benefit most people notice is the ability to take policy loans. Because the cash value grows tax‑deferred, the loan is generally tax‑free as long as the policy stays in force. You’re essentially borrowing from yourself, not from a bank, and the interest you pay goes back into the policy’s cash pool.

But there’s a catch you need to keep in mind: every dollar you borrow reduces the death benefit until you repay it. Think of it like using a credit card with a built‑in safety net – you get cash now, but you’re borrowing against the protection you promised your family.

Another living benefit is the partial withdrawal option. After the policy has built enough cash, you can make a withdrawal up to the amount of your basis (the premiums you’ve paid) without triggering a taxable event. It’s a handy way to supplement a gap year, fund a child’s tuition, or cover unexpected medical costs.

How the Cash Value Becomes Retirement Income

So, how does all this translate into retirement savings? Picture a 30‑year‑old teacher who funds an IUL with a modest premium each month. The cash value is credited to an index—say the S&P 500—with a floor of 0 % and a cap of 8 %. In strong market years, the policy might earn 6 % after the cap, while in down years it simply earns 0 % instead of losing money.

Over a 30‑year horizon that steady, upside‑only growth can add up to a sizable nest egg. Because the growth is tax‑deferred, you don’t see a tax bite each year like you would with a traditional brokerage account. When you reach retirement age, you can start taking loans or withdrawals to fund your lifestyle, all while the death benefit stays in place for any loved ones you still want to protect.

One real‑world example: a small‑business owner in his 40s used an IUL to replace a traditional 401(k) rollover. He kept the policy funded just enough to cover the cost of insurance, letting the cash value ride the index for two decades. When he turned 60, he began borrowing $20,000 a year to supplement his Social Security checks, and the policy’s death benefit remained enough to cover his mortgage for his spouse.

Practical Tips to Keep Your IUL Healthy

What about the downside? If you underfund the policy, the cost of insurance (COI) can eat into the cash value, and the policy could lapse. That’s why a disciplined premium schedule is essential—think of it like a regular contribution to a retirement account. Set up automatic payments, review the illustration annually, and adjust if your income changes.

A quick tip: aim to keep the loan balance below 25 % of the cash value. That buffer helps preserve the death benefit and ensures the policy stays in good standing. It also gives you room to let the cash keep growing, which can boost the amount you can safely withdraw later.

Finally, consider the synergy with other retirement vehicles. An IUL can act as a tax‑free bucket for emergency expenses, letting your 401(k) and Roth IRA stay fully invested for long‑term growth. By diversifying across tax‑deferred, tax‑free, and taxable accounts, you reduce the risk that a market dip will force you to sell investments at an inopportune time.

Comparing IUL to Traditional Whole Life and Term Life

So, you’ve seen how an IUL can grow cash value while still protecting your loved ones. But the real question is how it stacks up against the two more familiar policies you probably hear about at every insurance seminar.

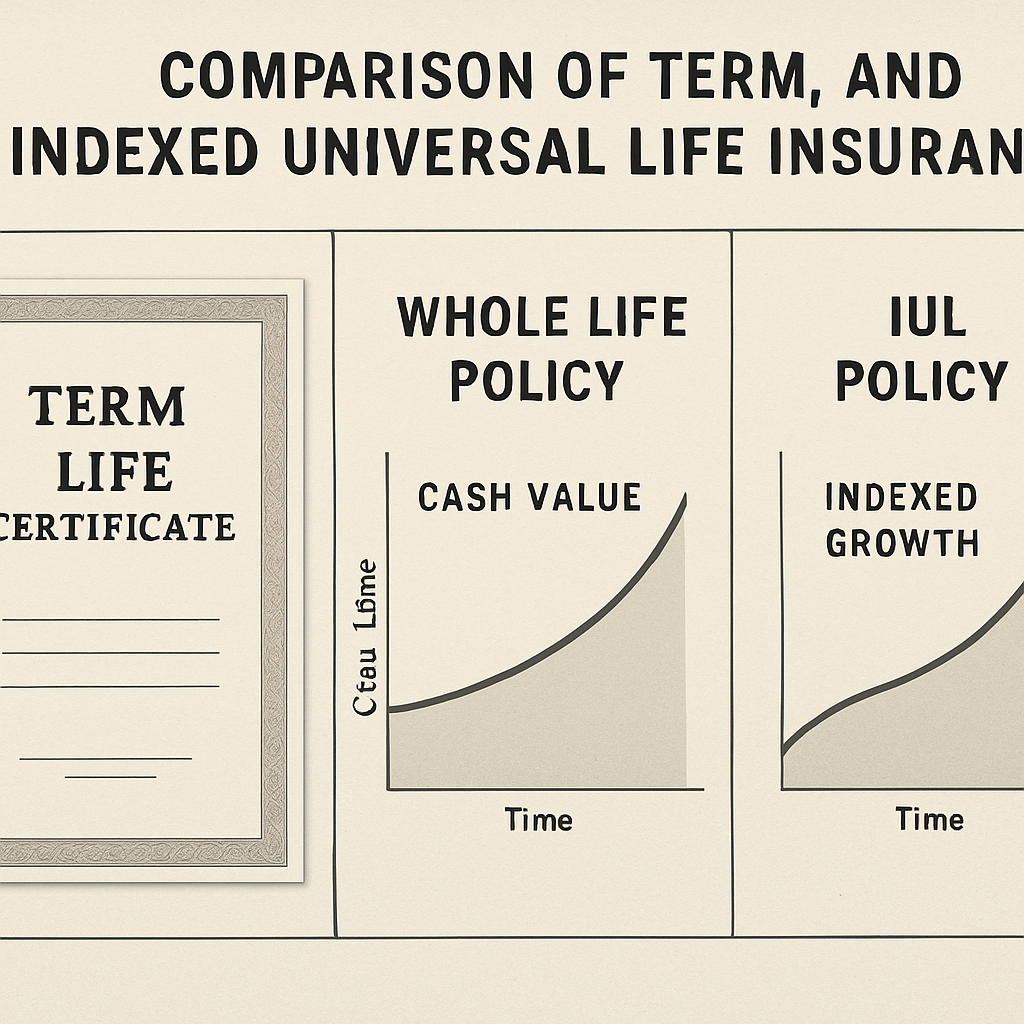

Let’s be honest: term life feels like the “cheap coffee” of insurance—straightforward, low‑cost, and designed just to cover a specific need. Whole life, on the other hand, is more like a “premium espresso”—it’s pricier, guarantees a small but steady return, and builds cash value from day one.

Indexed universal life tries to be the “iced latte with a dash of flavor.” It blends the affordability of term with the cash‑value component of whole life, but adds a market‑linked growth twist. The big question? Does that hybrid actually give you better bang for your buck?

Term Life: Pure Protection, No Savings

Term policies usually cover you for a set period—10, 20 or 30 years. You pay a level premium, and if you outlive the term, the coverage simply expires. There’s no cash value, no loan options, and no death‑benefit boost after the term ends.

Because there’s no savings engine, the cost per $1,000 of coverage can be a fraction of what whole or indexed policies charge. That makes term a solid choice if your primary goal is to replace an income for a few decades while you’re still paying off a mortgage or raising kids.

Whole Life: Guaranteed Cash, Higher Price

Whole life is truly “permanent.” The policy never lapses as long as you keep up the premiums, and a portion of each payment goes into a cash‑value account that earns a modest, guaranteed interest rate—often around 2‑3 %.

The trade‑off is a steep premium. You’re essentially paying for both insurance and a low‑yield savings vehicle, which can feel like over‑paying when you compare it to the potential market returns you could capture elsewhere.

Indexed Universal Life: Flexibility Meets Floor Protection

IUL policies let you adjust premium amounts (within limits) and choose how much of the cash value is tied to an index like the S&P 500. If the index climbs, you capture a portion of that gain—usually up to a cap of 8‑10 %—but a floor (often 0 %) protects you from negative years.

That means you can enjoy upside potential without the fear of losing cash value, something whole life can’t promise. At the same time, because you’re not locked into a single, high premium, the cost can sit somewhere between term and whole life, depending on how aggressively you fund the policy.

| Feature | Term Life | Whole Life | Indexed Universal Life (IUL) |

|---|---|---|---|

| Duration | Fixed term (10‑30 yr) | Lifetime | Lifetime (flexible) |

| Cash Value | None | Guaranteed growth (2‑3 %) | Index‑linked growth, cap & floor |

| Premium Cost | Lowest | Highest | Mid‑range, adjustable |

| Loan/Withdrawal | Not available | Limited, may affect death benefit | Tax‑free loans, withdrawals up to basis |

| Death Benefit | Level for term only | Guaranteed, may increase with cash | Guaranteed, can fluctuate with cash use |

Now, think about your own timeline. Are you in your 30s, looking to lock in cheap coverage for the next 20 years? Term might win on price, but you’ll miss out on any cash‑value upside. If you’re already comfortable with a higher premium and want a hands‑off, guaranteed savings track, whole life could be your safety net.

Indexed universal life tries to be the “iced latte with a dash of flavor.” Wait, we already covered that—sorry! But if you want the ability to grow a retirement bucket, take tax‑free loans, and still have a death benefit that adapts as your needs change, the IUL often lands in the “sweet spot.” Just remember: the upside isn’t unlimited. Caps and participation rates vary by carrier, so you’ll need to read the illustration carefully.

Here’s a quick sanity check: calculate the total cost of insurance (COI) and any rider fees for each option, then compare that to the projected cash‑value growth you expect from the index. If the IUL’s projected net gain exceeds the extra premium you’d pay over term, you’re probably looking at a good investment.

And don’t forget the human side of it. How comfortable are you with the idea of your policy’s cash value fluctuating within a bounded range? Do you value the ability to tap into that cash for a home renovation or unexpected medical bill without a credit check? Those “soft” benefits often tip the scales toward IUL for families who want flexibility without exposing themselves to market loss.

Bottom line: there’s no universal winner. The best fit depends on your budget, your need for guaranteed protection, and how much you value a living‑benefit component. Take a moment to map out your goals, run the numbers, and then decide which piece feels like the right puzzle piece for your financial picture.

Is IUL Right for Homeowners, Teachers, and Small Business Owners?

So, you’re a homeowner juggling mortgage payments, a teacher balancing student loans and a retirement plan, or a small‑business owner wearing every hat in the shop. Does an indexed universal life (IUL) policy actually fit into that mix, or is it just another fancy sales pitch?

Homeowners: Protect the Roof and Build a Backup Fund

Picture this: a sudden roof leak forces you to dip into savings you’d rather keep for vacations. With an IUL, the cash‑value you’ve been growing can be borrowed tax‑free, giving you a quick, no‑credit‑check lifeline.

The key is discipline – you keep paying enough premium to cover the cost of insurance (COI) and let the cash sit behind a 0 % floor and, say, an 8 % cap. Over 20‑30 years that “upside‑only” growth can become a sizable emergency bucket.

But ask yourself: can you afford the slightly higher premium compared to a plain term policy? If the answer is yes, the added flexibility often outweighs the cost for homeowners who value both protection and a safety net.

Teachers: A Tax‑Advantaged Retirement Boost

Many teachers are stuck with modest 403(b) contribution limits and unpredictable pension reforms. An IUL offers a tax‑deferred growth engine that can sit alongside a 403(b). When the market climbs, your policy might credit you 6‑8 % after caps – a nice supplement without the volatility of a direct stock account.

Because the death benefit stays in place, you also get a legacy component for your family. If you ever need to fund a child’s tuition or cover a sudden medical bill, you can take a loan against the cash value and keep the policy alive.

Just remember: the policy’s COI rises with age, so you’ll need to keep the premium steady. Most teachers find that setting up automatic monthly contributions makes the whole thing feel like another paycheck deduction – painless and powerful.

Small Business Owners: Legacy and Employee Benefits

Running a boutique bakery or a tech startup means you’re always looking for ways to protect your company’s future. An IUL can serve two purposes: personal wealth accumulation and a supplemental key person insurance.

Imagine you fund an IUL for yourself and name your business as a contingent beneficiary. If something happens, the cash‑value can help cover a loan, buy out a partner, or fund a buy‑sell agreement without forcing the business to liquidate assets.

On the flip side, the premium needs to fit within your cash flow. Many owners start with a modest face amount and let the cash value grow, then increase the death benefit later as the business expands.

How to Decide If It’s Right for You

First, ask: are you comfortable with a policy that’s part insurance, part investment? If the idea of a capped upside feels limiting, you might lean toward a traditional investment account.

Second, run the numbers. Compare the total COI plus any rider fees to the projected net gain after caps. If the net gain comfortably exceeds the extra cost over a term policy, the IUL could be a good investment for you.

Third, think about your cash‑flow horizon. If you plan to keep the policy for 20+ years, the floor protection and tax‑deferred growth usually start to shine.

Quick Checklist

- Do you need a death benefit now or later?

- Can you afford a premium that’s higher than term but lower than whole life?

- Are you okay with a cap on upside in exchange for a 0 % floor?

- Will you use the cash value for emergencies, retirement, or business succession?

If you answered “yes” to most of those, the IUL is probably worth a deeper look. It isn’t a magic money‑making machine, but for homeowners, teachers, and small‑business owners who crave protection plus a flexible, tax‑advantaged savings engine, it often answers the question, “is indexed universal life a good investment?”

Ready to see how an IUL could fit your unique situation? Let’s talk about your goals, run a personalized illustration, and figure out if the numbers line up with the life you’re building.

FAQ

What exactly is an indexed universal life (IUL) policy?

An IUL is a permanent life‑insurance contract that gives you a death benefit while also building cash value tied to a market index, like the S&P 500. The cash isn’t directly invested in stocks; the insurer credits interest based on the index’s gains, applying a participation rate, a cap, and a floor (often 0 %). This lets you enjoy upside potential without risking loss of cash value during market downturns.

Is indexed universal life a good investment for someone in their 30s?

It can be, especially if you plan to keep the policy for 20‑30 years. Young buyers benefit from the 0 % floor, which protects early cash‑value growth, and the tax‑deferred compounding can outpace a traditional savings account. However, you need to fund the policy enough to cover the cost of insurance (COI) and any fees. Pairing the IUL with other retirement vehicles creates a diversified, long‑term strategy.

How does the cash‑value growth in an IUL compare to a regular brokerage account?

In an IUL, growth is limited by a cap—often 8‑10 %—but you never see negative returns because of the floor. A brokerage account can earn more in a strong market, but it also bears full market risk and is taxed on gains each year. If you value downside protection and tax‑deferred growth, the IUL’s “upside‑only” profile may feel more comfortable, even if the raw numbers are lower.

Can I use an IUL’s cash value to fund my mortgage or a home‑repair emergency?

Yes. Most IULs allow policy loans or partial withdrawals up to the amount of premiums you’ve paid (your basis). Loans are tax‑free as long as the policy stays in force, but they reduce the death benefit until repaid. A common rule of thumb is to keep loan balances below 25 % of the cash value to preserve the policy’s health and keep the death benefit robust.

What are the main fees I should watch out for with an IUL?

The biggest cost drivers are the cost of insurance (COI), which rises with age, and any rider fees you add for extra benefits. There are also administrative charges and, sometimes, surrender charges if you exit early. To avoid eroding returns, make sure your premium covers the COI comfortably and leaves extra room for cash‑value accumulation.

How does an IUL differ from whole‑life insurance?

Whole‑life offers a guaranteed, usually 2‑3 % interest on cash value, with higher, fixed premiums. An IUL provides flexible premiums and the chance to capture higher market‑linked returns, though those returns are capped. Whole‑life’s cash value grows predictably, while an IUL’s growth depends on index performance and policy design. If you want potential upside and can tolerate caps, the IUL may be a better fit.

What should I ask my advisor before buying an IUL?

Start with the basics: ask for a clear illustration that shows projected cash value, COI, caps, and participation rates over a 20‑year horizon. Inquire about how premium flexibility works, what the floor is, and whether there are any riders you really need. Also, request a comparison of total costs versus a term policy plus a separate investment vehicle. The answers will help you decide if the IUL truly meets your financial goals.

Conclusion

If you’ve made it this far, you probably still wonder: is indexed universal life a good investment for you? The short answer is “yes, if the pieces line up.”

We’ve seen that the upside‑only growth, tax‑deferred cash value, and built‑in death benefit can fill the gap between a cheap term policy and a pricey whole‑life plan—especially for homeowners, teachers, and small‑business owners who need flexibility.

But the flip side is real: caps, rising cost of insurance, and the need to fund the policy consistently. If you can afford a premium that covers the COI and still leaves room for growth, the IUL often outperforms a pure investment account over a 20‑plus‑year horizon.

So, what’s the next step? Grab a personalized illustration, ask your advisor about caps, participation rates, and rider fees, and run a simple cost‑vs‑benefit check. If the numbers look healthy, schedule a quick call with Life Care Benefit Services—we’ll walk you through the details and help you decide if the IUL fits your financial puzzle.

Remember, no single product solves everything. Pair an IUL with a Roth IRA, a 401(k), or an emergency fund, and you’ll have a diversified safety net that feels both secure and growth‑oriented today.