Term life and whole life insurance are two of the most popular choices for securing your family’s future.

But what do they really offer? How do you decide which fits your needs?

Here’s a comprehensive term vs whole life insurance comparison to guide your decision.

Some are budget-conscious, opting for lower premiums and temporary coverage.

Some desire lifelong security with guaranteed cash value buildup.

Some want flexibility now but might secure permanent coverage later.

Some aim to balance cost and benefits by combining both policy types.

Let’s dive right in.

What Are Term and Whole Life Insurance?

To understand their differences, first, grasp the basics of each.

Term life insurance covers you for a specific period — usually 10, 20, or 30 years — paying a death benefit only if you pass during that term. It’s straightforward and typically the most affordable option. If you outlive the term, coverage ends, and there’s no payout or accrued value.

Contrast that with whole life insurance, a permanent policy that lasts your entire life as long as premiums are paid. It carries a guaranteed death benefit and includes a cash value component that accumulates over time, growing at a fixed rate. You can borrow against or withdraw this cash value, though this might reduce your death benefit.

Some whole life policies even pay dividends, enhancing your policy’s value. These are called “participating policies” from mutual life insurance companies.

Both types serve different purposes, dependent on your financial goals and obligations.

How Do Term and Whole Life Differ?

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Cost | Generally much cheaper premiums | Significantly higher premiums |

| Duration | Temporary, fixed period (10, 20, 30 years) | Permanent, life-long coverage |

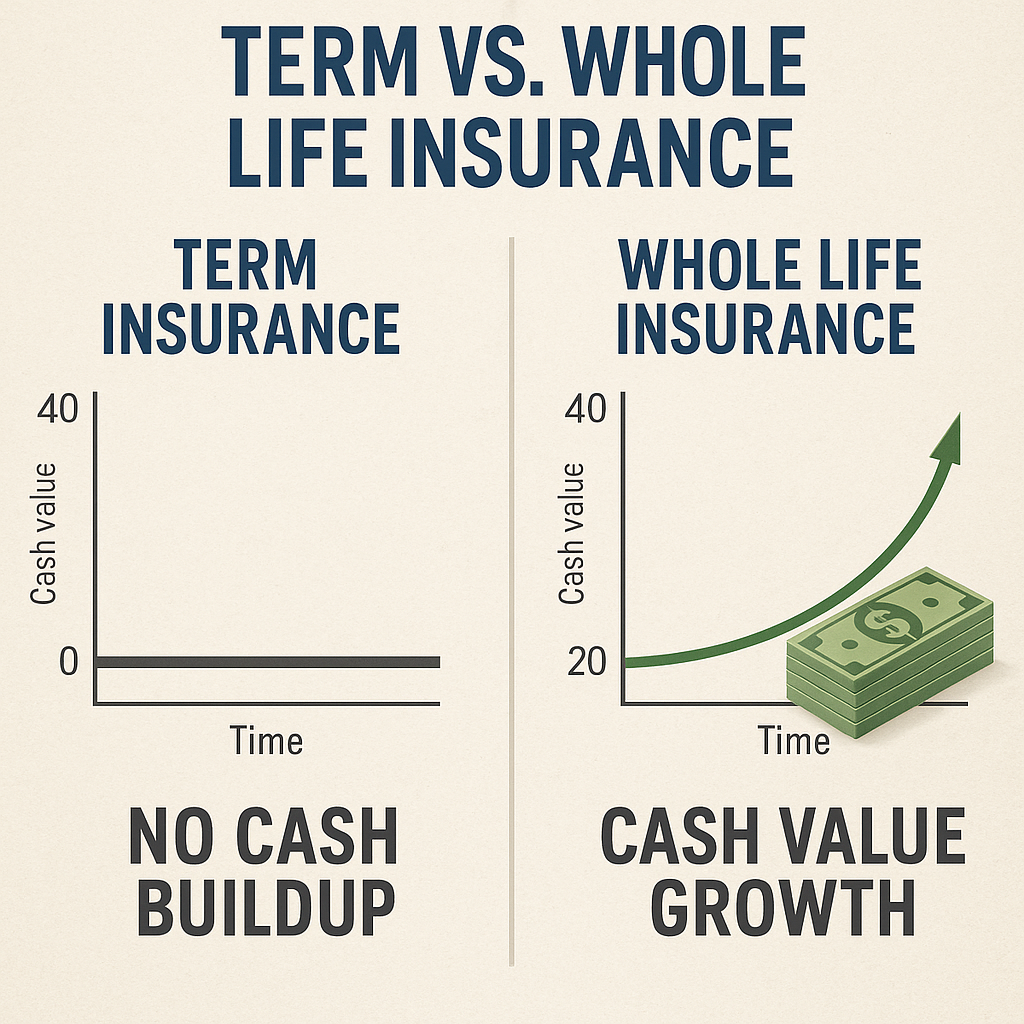

| Cash Value | No cash value or savings component | Builds guaranteed cash value over time |

| Flexibility | Can convert to permanent (sometimes) | Fixed premiums and coverage |

| Death Benefit | Paid only if death occurs during term | Guaranteed lifetime payout |

| Use Case | For specific short- to mid-term needs (e.g. mortgage, child support) | For lifelong protection and financial planning |

These differences clarify why someone might choose one over the other depending on life stage and financial priorities.

Who Should Consider Term Life Insurance?

If you want affordable coverage just to protect short- to medium-term financial obligations, term life is your pick.

Think of new families, young homeowners or small business owners. Term life helps cover mortgage protection, income replacement, or college funding until those obligations end.

Because it’s affordable, you can often buy a larger death benefit amount without breaking your budget.

Here’s a quick example:

- A 30-year-old might buy a 20-year term policy matching the mortgage duration.

- If they outlive 20 years, protection ends but ideally by then, financial obligations have lessened.

This makes term life insurance a budget-friendly, purpose-driven solution.

Some policies allow conversion to whole life if your needs change, giving extra flexibility without new underwriting.

Who Should Look at Whole Life Insurance?

Whole life insurance is best for those seeking lifetime protection and financial benefits beyond death benefit.

If you have lifelong dependents, such as children with disabilities, or want to build a guaranteed cash value that could be used in retirement planning, whole life is worth considering.

It also appeals to those who can afford higher premiums and want the security of a guaranteed payout anytime they pass away.

Many also appreciate that whole life premiums remain level throughout life, avoiding surprises due to age or health changes.

Whole life isn’t just insurance; it can be a part of a financial strategy, helping with:

- Final expenses

- Estate planning

- Supplementing retirement with cash value loans (careful not to reduce death benefit)

Note: For those maximizing retirement accounts but still wanting tax-advantaged savings, whole life can be an alternative.

Wondering how to balance protection and cost? Some savvy financial planners recommend buying a large term policy for income replacement and a smaller whole life policy for cash value growth and permanent coverage.

How Much Does Term vs Whole Life Insurance Cost?

Cost is often the deciding factor. Term life insurance generally has much lower premiums because it doesn’t build cash value and only covers a fixed term.

To put numbers on it, average annual premiums for $500,000 coverage vary widely based on age and gender (assuming excellent health and non-smoker):

| Age & Gender | 20-year Term Life | Whole Life |

|---|---|---|

| 20-year-old Woman | $177 | $2,695 |

| 20-year-old Man | $216 | $3,014 |

| 40-year-old Woman | $282 | $5,860 |

| 40-year-old Man | $334 | $6,387 |

| 60-year-old Woman | $1,651 | $14,635 |

| 60-year-old Man | $2,351 | $16,698 |

These figures highlight the vast premium difference for the same base death benefit.

Because whole life premiums are high, it’s critical to ensure affordability over the long term to avoid policy lapse.

What Benefits Does Cash Value Add to Life Insurance?

One key benefit exclusive to whole life and other permanent policies is the cash value component.

How does it work?

- A part of your premium goes toward building this cash value.

- Cash value grows tax-deferred at a guaranteed rate. Some policies pay dividends increasing it further.

- You can borrow against your cash value for emergencies, education expenses, or supplementing retirement income.

- Surrendering the policy returns the cash value but ends coverage and payout to beneficiaries.

This feature effectively makes whole life insurance part protection, part savings.

However, borrowing or withdrawing from cash value impacts your death benefit and could have tax implications if not managed carefully.

Can Term Life Be Converted to Whole Life?

Many term life policies include a conversion option allowing you to switch to a permanent policy without new health exams.

This offers flexibility: start with affordable term coverage, convert later when permanent coverage or cash value benefits become important.

Conversion terms vary, including deadlines after which conversion is no longer possible.

Consult your agent about these options to maximize coverage and cost effectiveness over your life.

When Does Term Life Expire and What Happens Then?

Term life ends when the period lapses — say 10, 20, or 30 years.

If you haven’t passed away during this time, beneficiaries receive no benefit.

At expiration, you may renew (usually at higher premiums), buy a new policy, or convert to whole life if available.

Term life’s temporary nature is ideal for covering financial obligations expected to diminish over time.

Looking for affordability without the frills? Term life is typically your best bet.

Which Type of Life Insurance Best Fits Your Needs?

Choosing between term vs whole life insurance depends on your financial situation, goals, and dependents.

Use this tailored checklist:

- Are you on a budget looking to cover debts or income replacement temporarily? Term life is likely sufficient.

- Do you want lifelong coverage with a savings component and can pay higher premiums? Consider whole life insurance.

- Do you have lifelong dependents or estate planning needs? Whole life may be beneficial.

- Unsure but want to keep options open? Buy term with a conversion option.

- Want to balance protection and building cash value? Combine a larger term policy with a smaller whole life policy.

Financial advisors often recommend term for most needs, supplemented by a whole life policy for long-term financial planning or final expenses.

How Do Insurers Set Premiums for Term and Whole Life Insurance?

Premium rates are based on several factors including age, health, gender, and policy specifics.

- Term life premiums are lower because of the time-limited coverage and no cash buildup risk for insurers.

- Whole life premiums are higher due to permanent coverage and guaranteed cash value growth.

- For whole life, insurers factor in investment returns to determine the cost and guaranteed rate of growth.

- Smoking status and health history greatly influence premiums for both.

Choose a policy that balances both affordability and adequate coverage.

Can Term Life Insurance Cover Mortgage and Other Debts?

Yes, term life is often used specifically for mortgage protection and other debts that fade over time.

The policy length matches debt duration, providing peace of mind that loans are covered if death occurs during the term.

This targeted use prevents overpaying for lifelong coverage you don’t need.

Whole life insurance, by contrast, is usually viewed as a tool for broader financial strategies rather than specific debts.

What Are the Tax Implications of Term Vs Whole Life?

Both term and whole life insurance death benefits are generally income tax-free to beneficiaries.

Whole life’s cash value growth is tax-deferred, which can create tax-efficient savings over time.

However, borrowing from cash value that isn’t repaid may trigger tax consequences.

Term life policies have no cash value, so there’s no tax-deferred accumulation but no tax risk on death benefit either.

Consult a tax advisor for your specific situation, especially when using whole life policies as a financial tool.

What Riders and Customizations Are Available on These Policies?

Both term and whole life policies can be customized with riders—add-ons that enhance coverage or flexibility.

- Term life riders may include conversion, waiver of premium on disability, or accelerated death benefits.

- Whole life riders often feature accelerated benefits, long-term care coverage, or additional paid-up insurance.

- These options allow you to tailor a policy to your evolving needs and health.

How Do Life Insurance Options Fit Into Retirement and Health Planning?

Life insurance is increasingly linked with broader financial wellness strategies.

Whole life insurance’s cash value can supplement retirement income tax-efficiently, though it should not replace core retirement savings.

Term life is a foundational protection tool, but its lack of investment features means you’ll need other savings vehicles.

Some innovative policies, including Indexed Universal Life (IUL), blend permanent protection with growth potential tied to market indices—but that’s beyond traditional whole life scope.

For families, small business owners, seniors, and individuals, life insurance coordinates with health insurance, mortgage protection, and retirement plans offered by agencies such as Life Care Benefit Services with tailored solutions.

Important Considerations Before Buying

Before committing, ask yourself these questions:

- How long do I need coverage?

- What can I comfortably afford monthly or annually?

- Do I want my policy to build cash value?

- Are my beneficiaries financially dependent on me for the long term?

- Do I want investment-like features in my insurance?

- Would I benefit from conversion options to permanent life?

- How does the insurance fit with existing health plans and retirement options?

Answering these clarifies your choice and ensures you get the right policy for your peace of mind.

How to Get the Best Deal on Life Insurance?

Shop around and compare quotes from multiple insurers.

Work with independent agents who can help find policies suited to your budget and needs from a range of carriers.

Consider your health and lifestyle too; getting coverage early while healthy can drastically reduce premiums.

Regularly review your policy to update coverage if life circumstances change.

Using internal resources like this resource can help you explore insurance solutions tailored for families and small business owners.

How Do Term Life and Whole Life Support Small Business Owners?

Small business owners have unique needs. Term life can cover business loans or key person insurance temporarily.

Whole life, especially permanent policies, can help with succession planning or funding buy-sell agreements.

Integration with group health insurance and disability plans makes comprehensive coverage viable for protecting both personal and business interests.

Tailored solutions from agencies like Life Care Benefit Services ensure your business and family have the right safety nets.

A Quick Glance Table for Term vs Whole Life Insurance Comparison

| Criteria | Term Life | Whole Life |

|---|---|---|

| Coverage Period | Specified term (10-30 years) | Lifetime |

| Premium Amount | Lower, varies by term length and age | Higher, fixed premiums |

| Cash Value Growth | None | Yes, guaranteed growth + possible dividends |

| Policy Flexibility | May convert to permanent | Limited flexibility, but steady |

| Best For | Temporary financial obligations, budget-conscious buyers | Lifelong dependents, estate planning, retirement strategy |

| Death Benefit | Paid if death during term | Guaranteed payout, anytime |

Common Questions About Term Vs Whole Life Insurance

Does term life insurance build any cash value?

No. Term life provides coverage but no cash savings or borrowing features. For cash value growth, choose permanent insurance like whole life. (Verified with sources as of 2025-09-28)

Can I convert my term policy to whole life later?

Many term policies allow conversion within specific timeframes without additional health screenings. Always check your policy details.

What happens if I outlive my term life policy?

Coverage ends, and no death benefit is paid. You can renew, buy new coverage at higher rates, or convert to whole life if available.

Are whole life premiums guaranteed?

Yes, whole life policies generally have level premiums that do not increase over time, unlike term policies that may increase upon renewal.

Who benefits most from whole life insurance?

Those seeking lifetime coverage, a cash value component, and estate or retirement planning benefits often find whole life fitting.

Are you clear on which insurance type aligns with your financial goals? This clarity is vital to choosing the right coverage.

What Makes Life Care Benefit Services Unique for Your Insurance Needs?

As an independent agency with access to over 50 top-rated insurance carriers, Life Care Benefit Services specializes in affordable, tailored solutions that safeguard your family and business futures.

Whether it’s life insurance with living benefits, indexed universal life (IUL), group health insurance for small businesses, mortgage protection, or retirement planning, their personalized approach ensures comprehensive financial security.

Partner with us to explore options that fit your budget and evolving needs — a smart, expert step toward peace of mind.

Summary: Making the Right Choice in Term vs Whole Life Insurance Comparison

Term life insurance offers an affordable, temporary safety net for defined periods — perfect for covering debts and income replacement.

Whole life insurance supplies lifelong protection with the added benefit of cash value buildup, ideal for long-term planning or dependents needing care beyond temporary horizons.

Cost, duration, cash value, and personal goals dictate the best choice.

Many people benefit from combining term and whole life policies or converting term to whole life when their needs evolve.

Use the checklists and comparisons here to guide your decision making.

For more insights on insurance and financial planning that suits families, individuals, and businesses, explore Life Care Benefit Services’ offerings.

Frequently Asked Questions

Is term life insurance the cheapest option?

Generally yes. Term life is more affordable due to shorter coverage duration and no cash value accumulation, making it appealing especially to younger, healthy individuals.

Can whole life insurance act like an investment?

Partially. Whole life builds cash value at a guaranteed rate, and dividends may enhance this. But it is primarily a protection product, not a high-return investment.

What happens if I miss a whole life premium payment?

Missing premiums can cause the policy to lapse, resulting in loss of coverage and cash value. Many policies allow premium grace periods or automatic premium loans.

Are term life policies renewable after expiration?

Many policies offer renewal but at higher rates due to increased age and possible health changes. Reviewing options before renewal can save costs.

Does debt or mortgage protection require whole life insurance?

Usually, term life suffices for debt coverage due to the temporary need matching loan terms. Whole life is more aligned with ongoing financial responsibilities.

What’s Your Next Step?

Tell us in the comments: How will you apply this to your life insurance planning? For personalized advice, explore Life Care Benefit Services’ tailored solutions for families and businesses!

Understanding these differences can profoundly impact your financial security. If you want to know more about related financial topics like mortgage protection or retirement planning, check out this helpful resource for more expert tips.