You’ve probably heard the term floating around but never really stopped to ask, “What is accelerated death benefit life insurance exactly?” It’s one of those insurance features that sounds kind of mysterious until you get how it might actually step in when life throws curveballs.

Here’s the thing: life insurance is usually about protecting those you love after you’re gone. But what if you suddenly face a serious illness and need help with costs while you’re still here? That’s where accelerated death benefits come into play. Instead of waiting for your policy’s eventual payout, this feature lets you access a portion of the death benefit early—when you need it most.

Imagine getting financial support to cover medical bills, long-term care, or even simply making ends meet when faced with a terminal or qualifying chronic illness. It’s like having a safety net attached to your life insurance, giving you some breathing room during tough times. But how does it really work? And what does it mean for your policy in the long run?

Understanding this isn’t just insurance talk—it’s about peace of mind for you and your family. You want to know you’re covered, not just for after you’re gone, but also while you’re living, especially if unexpected health issues arise. That’s why more folks are asking about these kinds of living benefits.

It might sound too good to be true, or maybe confusing at first, but don’t let that stop you. Learning what accelerated death benefit life insurance entails can change how you plan ahead. It’s worth seeing if your current or future policy includes this rider, or if adding it makes sense. Need a clear breakdown or help figuring out your options? We’ve put together some straightforward advice not far from this point—right in our guide on reviewing life insurance policies that might just clear the fog.

So, let’s dive in and unpack how this feature works, why it matters, and how it could really be a game-changer for protecting your family’s future—both now and down the line.

TL;DR

Wondering what is accelerated death benefit life insurance? It’s a feature that lets you access part of your life insurance cash if you face a serious health challenge, giving you breathing room when you need it most.

Think of it as a financial lifeline before the unexpected happens, easing stress and protecting your family’s future. It’s worth checking if your policy offers this—because peace of mind matters now, not just later.

What Is Accelerated Death Benefit Life Insurance? Definition and Basic Concepts

Ever felt like life insurance is something you only understand when the worst is already on your doorstep? You’re not alone. The idea of accessing your life insurance payout before you actually pass away can sound a bit odd at first. But here’s the thing—an accelerated death benefit (ADB) lets you tap into your life insurance money if you’re hit with a serious health crisis. It’s like having a financial tool that kicks in when you need it most.

So, what exactly is accelerated death benefit life insurance? At its core, it’s a feature—or sometimes an add-on rider—that lets you receive part of your life insurance death benefit early if you’re diagnosed with a qualifying illness. Usually, this means you’re facing a terminal or severe chronic condition. This benefit can help cover medical bills, daily care, or anything else life throws your way during tough times.

Think about it like a lifeboat thrown to you in a storm you didn’t expect. Instead of waiting for the full death benefit to go to your family after you’re gone, you get a portion upfront while you’re still alive. This can ease financial pressure and help you focus on what matters most: your health and your loved ones.

How Does It Work?

Here’s the deal: when you qualify for accelerated benefits, your insurance company will pay you a lump sum or sometimes payments over time, depending on your policy. You don’t have to jump through crazy hoops—usually, a doctor’s diagnosis proving a terminal illness or a qualifying condition is enough. Keep in mind, though, this early payout isn’t free money. It comes out of your total death benefit, so when the time comes, your beneficiaries will get less.

Would you be surprised to learn many companies don’t charge extra for this rider? That’s right—some include it at no additional cost, so it’s just part of your overall policy. Others might have a small fee or slightly higher premiums if you add it on. Either way, it’s worth knowing because it could save you from dipping into savings or going into debt when life throws a curveball.

Why Would You Need This?

Imagine this: You’re diagnosed with a terminal illness. Suddenly, medical bills pile up, and maybe you can’t work like before. An accelerated death benefit can help bridge that financial gap. You can use that money however you want—paying medical bills, modifying your home, traveling with your family, or even just covering everyday expenses so you’re not stressed about money.

Not everyone plans for the unexpected, but if you worry about out-of-pocket expenses or have a family history of serious illness, this feature is a smart safety net. It’s not just about dying; it’s about living a little better when life gets rough.

What Are Some Important Things to Know?

First, every insurance company has different rules on qualifying illnesses and how much of your death benefit you can access early—sometimes it’s up to 50%, sometimes a little less. Sometimes, policies pay out once you’re documented as terminally ill with a life expectancy of 12 to 24 months.

Second, using the accelerated death benefit might affect your eligibility for government benefits like Medicaid, so it’s a good idea to check with a financial advisor or insurance professional before you tap into it.

And lastly, keep an eye on possible fees or interest deductions. Some policies deduct fees or adjust the amount you receive to cover what the insurer loses by paying early.

Want to understand whether your policy offers this feature or think about adding it? Talk to an insurance agent who can walk you through your options and maybe even recommend policies that come with this rider built-in.

Whether you’re planning ahead or trying to make sense of a new diagnosis, knowing how accelerated death benefits work can be a game-changer. The Alabama Department of Insurance has some solid info on rules and consumer protections if you want to dive deeper. For a wider look at how these living benefits can ease financial stress, check out this guide on NerdWallet.

So yeah, accelerated death benefit life insurance isn’t just about preparing for the end. It’s about grabbing a lifeline when you need it, so you can focus on the present without worrying about what’s next.

Eligibility Criteria and Common Situations for Accelerated Death Benefits

Have you ever wondered what it really takes to tap into accelerated death benefits? It’s more than just having a life insurance policy; there are specific triggers that unlock this financial lifeline when life throws a curveball.

So, what exactly are these eligibility criteria that decide if you can access these benefits early? The key factor here is the diagnosis of a qualifying event — usually a serious, life-altering medical condition.

What Qualifies as a “Qualifying Event”?

You’ll often hear about terminal illness riders when discussing accelerated death benefits. Typically, insurers require that the insured has a medical condition resulting in a drastically limited life expectancy, often defined as 6 to 24 months, depending on the policy specifics. Think about it this way: if your doctor tells you that time is short and costly care is essential, that’s when accelerated benefits can come into play.

This doesn’t just mean any illness. Conditions like advanced cancer, end-stage kidney failure, or severe neurological damage from a stroke are what insurers commonly accept. Some policies even recognize situations requiring ongoing care in a nursing home or similar institution — permanent confinement there could qualify you for benefits as outlined by insurance regulations in states like Ohio.

On top of terminal illnesses, other qualifying events might include chronic illnesses that massively reduce your ability to perform daily activities — like bathing or dressing without help — or severe cognitive impairments such as dementia. It’s important to carefully check your policy language because what counts can vary from company to company.

How Do You Prove You’re Eligible?

Here’s the catch: you’ll need solid medical proof to access accelerated death benefits. This usually means submitting documentation from your healthcare provider confirming the diagnosis and prognosis. It’s a process, but insurers are obligated to provide claim forms quickly after a request to make this as smooth as possible.

Some policies may require you to notify beneficiaries or assignees, too, which can feel a bit awkward but is part of the process to ensure everyone is on the same page about the payout adjustments.

Common Real-Life Situations Where Benefits Are Used

Picture this: Someone finds themselves with a harsh diagnosis. Maybe it’s advanced heart disease requiring surgery, or perhaps they’re facing the financial strain of specialized home care. This is the kind of moment where accelerated death benefit life insurance becomes a lifeline — money upfront to pay medical bills, settle debts, or even just snag a little peace of mind.

Another example: long-term nursing home care. Many policies recognize continuous confinement in an eligible institution as qualifying for accelerated benefits. This means if you or a loved one need skilled nursing care and expect to stay there long term, tapping into your policy early can lighten the financial load.

Not every policy covers all these scenarios equally. Some have strict rules about how much you can accelerate — anything from 25% up to the full death benefit in rare cases. And keep in mind, whatever you take out now will reduce what’s left for your beneficiaries later.

Wondering if this affects your taxes or government benefits? It can. Accelerated death benefits might be taxable or impact eligibility for programs like Medicaid. It’s wise to chat with a financial advisor or tax professional before making a move — here’s a detailed explanation of the accelerated death benefit rider that breaks it down well.

So, is your policy likely to include accelerated death benefits? Newer life insurance policies often come with this rider built-in at no extra charge, which is a huge plus. But if you’ve got an older policy, or one without this feature, you can explore adding it — just expect some premium increase. It’s that peace of mind: knowing you can access funds if the unexpected happens.

Want to dive into the nitty-gritty? State insurance departments, like Ohio’s regulations, offer comprehensive rules about eligibility and insurer obligations that can help you understand what to expect based on where you live.

To wrap it up: accelerated death benefits kick in during some very tough times — when you’re facing serious illness or long-term care needs. Before you decide to use it, know what qualifies, how to prove it, and what it might mean for your coverage down the line. If you’re unsure, a quick call to your insurance agent can clear things up and help you get the coverage that really fits your situation.

How Accelerated Death Benefit Life Insurance Fits into Retirement and Mortgage Protection Planning

Ever thought about how life insurance can actually help you while you’re still here? It’s not just about providing for your family after you’re gone. That’s where accelerated death benefit life insurance really shines—especially when you’re juggling retirement plans or trying to keep your mortgage secure.

Here’s the thing: retirement is supposed to be relaxing, right? But the reality? Medical bills, long-term care, or even an unexpected health crisis can seriously derail your vibe. So, wouldn’t it be great if you had a backup plan that’s already in place, quietly working for you?

That’s exactly what accelerated death benefits are designed for. Think of them like an early financial safety net. When you’re diagnosed with a qualifying illness or need long-term care, you can tap into part of your life insurance death benefit to help cover those costs. It’s like getting a head start on accessing your money without waiting for something permanent to happen.

A Piece of the Puzzle for Retirement Planning

Most folks building retirement plans focus on 401(k)s, IRAs, and maybe some pension benefits. But have you considered how your life insurance policy fits into this big picture? Using an accelerated death benefit rider can create a cushion for unexpected expenses that your regular retirement savings might not cover.

For example, if you suddenly need nursing home care or extensive medical treatments, the accelerated death benefit can provide monthly payouts, often calculated as a percentage of your policy’s face value. That kind of cash flow can help you avoid dipping into retirement savings prematurely, which might be invested in the market and vulnerable to downturns. Protecting those accounts means you’re more likely to have steady income throughout your golden years.

And here’s something to chew on: these benefits are usually tax-free. That’s a real win because medical expenses and care costs rarely come with any breaks. You can explore the details with resources on using life insurance to pay for long-term care that break down these specifics further.

Mortgage Protection Made Smarter

Owning a home is a cornerstone of financial security for many families. But what happens if illness suddenly affects your ability to keep up with mortgage payments? If you’re relying solely on savings or unstable income, stress can pile up fast.

Accelerated death benefits can step in here too. Instead of your family scrambling to cover mortgage payments if something happens, you can access part of your life insurance benefit early. This helps keep your home safe and your mind at ease.

It’s worth noting: the amount you receive reduces the death benefit left to your beneficiaries. But many folks find this tradeoff worthwhile to avoid losing a house or going through foreclosure turmoil.

So, what’s the best way to balance these protections? Combining accelerated death benefit riders with specific mortgage protection life insurance policies can offer a layered defense. Each has a role, but together, they can cover gaps one alone might miss. For a step-by-step approach, check out our guide on how to secure a mortgage protection life insurance quote.

Is It Right for You?

I get it—life insurance details can feel like a maze. But consider this: what if accessing part of your death benefit while alive means you don’t have to sell off investments, postpone retirement, or sacrifice your home? That’s serious peace of mind.

Here’s a quick tip: review your current policies or talk with an expert to see if accelerated death benefits are included or can be added. Sometimes they’re built-in, sometimes they’re add-ons. Knowing what you have can make all the difference when life throws curveballs.

So, are you ready to protect your retirement and home with a smarter plan that works for you now and later? Let’s make sure your life insurance really fits your life. If you want, we can help you review your life insurance policy and explore options tailored to your retirement and mortgage protection needs.

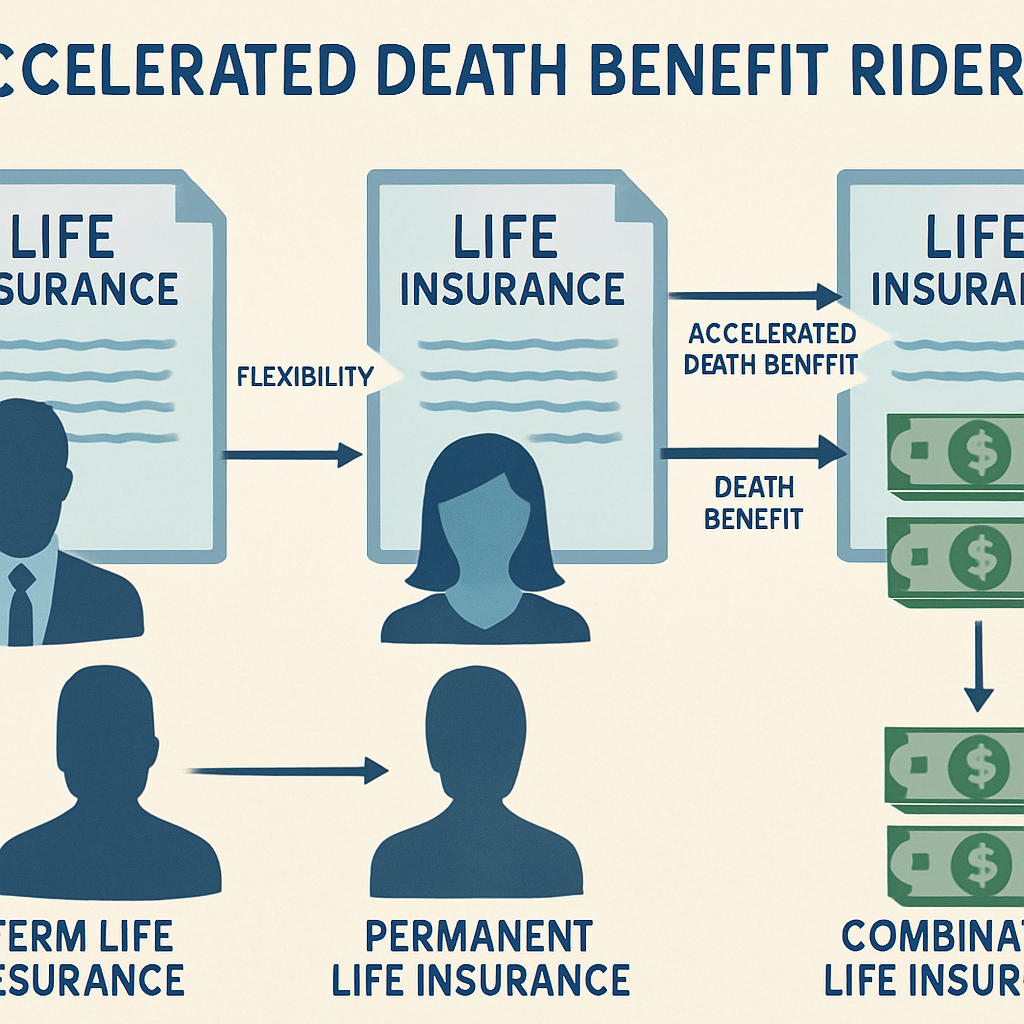

Comparing Accelerated Death Benefit Riders Across Different Life Insurance Products

Let’s be honest: life insurance is already complicated, and when you throw accelerated death benefit riders into the mix, it can feel like you’re trying to solve a puzzle with half the pieces missing.

But here’s the thing—knowing how these riders differ across life insurance products isn’t just a nice-to-have. It can make a massive difference when you actually need that extra help.

Living Benefits on Term Life Policies: Limited but Sometimes Present

Term life insurance is the straightforward, no-frills coverage many people start with. It’s designed to pay out if you pass away within the term, say 10, 20, or 30 years. Traditionally, term policies don’t accumulate cash value and aren’t built to offer living benefits. But in recent years, some carriers have started including accelerated death benefit riders as add-ons to term policies.

How does that work? Usually, it means if you’re diagnosed with a terminal illness and doctors give you a limited life expectancy—say under 24 months—you might be able to tap into a portion of your death benefit early. This can help cover those unexpected medical bills or replace lost income.

Just a heads up: these riders on term policies are often more stripped-down to keep premiums low. You probably won’t get chronic illness or critical illness options bundled in. The accelerated benefit is mainly for terminal conditions.

Permanent Life Insurance and Accelerated Death Benefits: More Flexibility and Features

Now, things get more interesting with permanent life insurance like whole life, universal life, and indexed universal life (IUL). Because these policies build cash value, they naturally lend themselves to having more sophisticated accelerated death benefit riders.

With these, you might find not just terminal illness riders but also chronic illness—and sometimes critical illness riders—that kick in if you can’t perform a few activities of daily living or face a severe cognitive impairment. Unlike term life, the benefit payments here can sometimes be structured as monthly installments to help cover ongoing care, not just a lump sum.

Plus, keep in mind that accessing these benefits will reduce your death benefit dollar for dollar. So if you take out money early, your beneficiaries get less when you pass. It’s the trade-off between getting a little help now and leaving a legacy later.

Indexed Universal Life (IUL): A Special Case

IUL policies deserve a special mention. These policies tie cash value growth to a market index but still offer downside protection. With living benefit riders, you can sometimes fund the rider cost via the policy’s cash value, which gives you more payment flexibility.

However, IUL riders may have specific conditions or waiting periods before benefits kick in. It’s worth digging into those details carefully.

Combination Products: Blending Life Insurance with Long-Term Care Benefits

Ever heard of long-term care insurance (LTCI) accelerated death benefit riders? These are kinda like hybrid policies. They combine life insurance with benefits that pay out if you need long-term care.

These riders usually come with more qualifying events—covering nursing home care, assisted living, home health care, or adult day care. They often pay monthly benefits over a defined period, like 48 months, and then sometimes an extension benefit if you need more care.

The catch? These are generally attached to permanent policies with cash value since the payout mechanism ties into policy value and death benefit reductions.

If you’re curious, these LTCI riders can fill the gap that standard accelerated death benefit riders might miss, especially for chronic conditions.

What About Group Life Insurance Accelerated Benefits?

If you’re fortunate enough to have group life insurance through work or an association, accelerated death benefits can be included, but remember, the coverage amount is often limited—like one or two times your salary.

The benefit is mostly the terminal illness rider variety. Group policies tend not to include the more complex chronic or critical illness riders because of the nature of group underwriting and simplified health requirements.

And coverage usually ends if you leave your job, so it’s not something to rely on long-term.

So… How Do You Choose?

There’s no perfect answer, because it boils down to your personal circumstances—your health, budget, and financial goals. But here’s a practical way to look at it:

- Term Life + ADB Rider: Affordable and good for short-term critical needs, mainly terminal illness.

- Permanent Life + ADB Riders: Versatile, with options for chronic and critical illness benefits, paying lump sums or monthly, and cash value to help fund rider costs.

- Combination LTCI Riders: For those who want long-term care coverage built into life insurance, with extended benefit periods.

- Group Life: Useful but limited and tied to your employment.

Looking deeper into the fine print is key because each insurer defines “qualifying events” differently. You want to make sure the triggers for accessing benefits match your actual risks.

Also, watch out for charges—some riders come with ongoing premiums, while others deduct costs from your cash value, affecting your policy’s longevity.

Confused yet? It’s perfectly normal. You don’t have to figure this out alone. Talking with an insurance specialist (like those at Life Care Benefit Services) can demystify what fits your life and budget.

Here’s a quick glance comparing key features:

| Feature | Term Life with ADB Rider | Permanent Life (Whole, UL, IUL) with ADB Riders | Combination LTCI Riders |

|---|---|---|---|

| Cash Value Accumulation | No | Yes | Yes |

| Types of Accelerated Benefits | Typically Terminal Illness only | Terminal, Chronic, Critical Illness | Long-Term Care (nursing home, assisted living, home care) |

| Benefit Payment Structure | Usually lump sum | Lump sum or monthly payments | Monthly payments over benefit period |

| Cost Impact | Separate rider premium | Rider premium or cost of insurance charges affecting cash value | Rider premiums or charges reducing cash value and death benefit |

| Common Use Case | Budget-conscious; straightforward terminal illness protection | Long-term planning with living benefits | Coverage for chronic care needs plus life insurance |

Before you get overwhelmed splashing from one product pool to another, just ask yourself—what do you want your life insurance to do for you while you’re still here?

If the answer includes helping with medical bills or care costs after a serious diagnosis, accelerated death benefit riders offer some smart options. Just pick the right life insurance product to attach them to.

For a deeper dive into which accelerated death benefit riders are a best fit for you and your family, schedule a consultation with Life Care Benefit Services. It’s the kind of conversation that could bring clarity to your insurance choices—and peace of mind.

Want to fact-check your options yourself? The Texas Department of Insurance consumer guide offers solid insights on life insurance and riders. For the technical side of riders, the Society of Actuaries detailed overview breaks down the nuances beautifully. And if you want a plain-English explanation of accelerated benefits, the Investopedia guide on accelerated death benefits is a handy read.

Applying for Accelerated Death Benefits: Step-by-Step Process and Tips

So, you’ve decided to tap into your life insurance’s accelerated death benefits. It’s a big step—a way to potentially ease some of the financial weight when facing tough health challenges. But the process? It might feel like a maze. Let’s walk through it, together, step by step.

Step 1: Review Your Life Insurance Policy and Rider

Start by digging into your life insurance documents. Find the section on accelerated death benefit riders. Not all policies have them, and the details vary a lot. What qualifies? How much can you access? Are there limitations? Don’t hesitate to call your insurer or agent for clarity.

Step 2: Get Proper Medical Certification

This is often the trickiest piece. Your insurer will want to see proof that you meet the eligibility criteria—usually certification from a licensed health care practitioner confirming a terminal or chronic illness. Documentation needs to be current and thorough. You know that moment when your doctor’s notes suddenly feel like paperwork from a different language? It helps to ask exactly what your insurer requires upfront.

Step 3: Submit the Formal Request

You’ll typically need to complete an application form—either provided by your insurance company or found online. This form might ask for details about your diagnosis, medical reports, and how much of your death benefit you wish to accelerate. Double-check everything. Small mistakes can stall the process.

Step 4: Wait for the Insurance Company’s Review

Patience, right? Your insurer will review your application alongside medical records. Sometimes they might ask for additional information. This waiting period varies but usually spans a few weeks. Pro tip: Keep in touch and ask for status updates. It’s your claim, so stay involved.

Step 5: Receive Funds and Understand Tax Implications

Once approved, you’ll get the funds—either as a lump sum or in payments, depending on your policy. But here’s a heads-up: some accelerated death benefits might affect your life insurance payout and could have tax considerations.

Don’t let that second part stress you out. According to the IRS, accelerated death benefits paid due to a terminal or chronic illness generally aren’t taxable, but it’s smart to double-check your situation with a tax professional or review the IRS guidelines yourself. You can find detailed information in the IRS instructions for Form 1099-LTC, which explain how these benefits are reported and taxed.

Tips to Make the Process Smoother

- Keep organized records. Store medical documents, policy details, and correspondence in one place. It’s a little peace of mind during a stressful time.

- Be proactive with your insurer. Don’t wait for them to call you—regular check-ins can speed things up.

- Use expert help. Life Care Benefit Services specializes in understanding how these benefits can work for you, offering personalized guidance.

- Fully understand policy limits. Some riders cap the amount you can access early or cut the death benefit by more than you expect.

Wondering if your claim might require additional paperwork or certifications? It’s common, especially with complex medical conditions. Being prepared to communicate openly between your doctor, insurer, and benefit advisors helps avoid surprises.

And don’t forget, while the core of “what is accelerated death benefit life insurance” revolves around helping you access funds early, the process behind the scenes matters just as much to get those dollars in your hands.

For a ready-to-follow checklist and more detailed insurer expectations, you might want to check the insurance department’s application checklist that outlines documentation insurers typically require. Knowing exactly what they want can save you days or weeks of back-and-forth.

Finally, if all this feels a little overwhelming, you’re not alone. Accelerated death benefits are powerful tools but require patience and a bit of savvy to navigate. Don’t hesitate to reach out for expert advice or to schedule a consultation with Life Care Benefit Services. We’ll help you figure out your next best move.

Common Misconceptions and Important Considerations Before Using Accelerated Death Benefits

Let’s be real for a second: accelerated death benefits sound pretty straightforward—get part of your life insurance payout early if you’re facing a terminal illness or certain qualifying situations. But the truth is, there’s a bunch of confusion swirling around them. You might be thinking, “Will it cost me a ton? Does it mean my family gets less? Is the process really as simple as signing a form?” Sound familiar?

Here’s something you should know: Many folks overestimate how expensive or complicated using accelerated death benefits can be. For instance, some people assume tapping into these funds will drain their entire policy or that it’s only for a handful of the sickest people—which isn’t quite right. Depending on your policy, the amount you can access early might be capped, and yes, it usually does reduce the eventual death benefit, but not always as drastically as you might fear.

And then there’s the paperwork—not just a signature and you’re done. Insurers often require medical proofs, doctors’ certifications, and sometimes additional documentation. It might feel like jumping through hoops when you just want some financial breathing room. But being ready and organized can help smooth this out.

Now, what if you’re worried about how this affects other benefits like Medicaid or if you’ll owe taxes? It’s a good question because these payouts can sometimes impact your eligibility for public assistance or have tax implications. That’s why it’s smart to chat with a financial or tax advisor before you apply, so you’re not caught off-guard later.

Is it the right move for you?

Here’s the kicker: using accelerated death benefits is a big decision, and it’s not the same for everyone. Some people tap these funds to pay for medical expenses, home care, or to simply ease financial stress during a tough time. Others worry about preserving the full death benefit for their loved ones. We get it—that tension is real.

That’s why before diving in, you want to:

- Review your policy and understand any limits on how much you can access.

- Consider the potential impact on heirs or dependents.

- Discuss your situation with an insurance expert who can guide you through the specifics.

Life Care Benefit Services is here to help clear up the fog—because knowing exactly what is accelerated death benefit life insurance means more than just the basics; it means understanding all the nuances before you step forward.

If this feels like a maze, don’t hesitate to reach out for personalized advice. And if you want to dig in deeper on common myths about life insurance and accelerated benefits, this life insurance myths and misconceptions guide by AAA does a great job debunking some widespread misunderstandings.

Plus, the New York Department of Financial Services offers detailed insurer expectations for accelerated death benefit payments, which is super helpful to peek at if you want to get familiar with the kind of paperwork and process that may lie ahead.

At the end of the day, accelerated death benefits can be a real lifeline—but only if you know the full story before using them.

Frequently Asked Questions (FAQ)

So, you’re wondering, what is accelerated death benefit life insurance really about? Let’s break down some common questions that tend to pop up when folks start exploring this option.

What exactly is an accelerated death benefit?

Think of it like this: it’s a feature in your life insurance policy that lets you tap into a portion of your death benefit while you’re still alive—if you face a qualifying serious illness or condition. Instead of waiting for your loved ones to get that financial help after you’re gone, you can access some funds now to help with medical bills, daily expenses, or whatever you need.

Who qualifies to use the accelerated death benefit?

It usually applies if you’re diagnosed with a terminal illness, or sometimes other critical conditions. The exact criteria can differ between policies, but typically, you need a prognosis that you have six months to a couple of years left, depending on the insurer. It’s not just based on feeling sick—it’s medically qualified. So, don’t assume you’d qualify without checking the details.

How much money can I access, and does it reduce the payout later?

Good question. You can usually access a percentage of your full death benefit, sometimes up to 50% or more, but it depends on your specific policy terms. Remember, any amount you take out early reduces the payout your beneficiaries eventually receive. It’s a trade-off—getting help now versus leaving a bigger legacy later.

Will using accelerated death benefits affect my premiums?

Most of the time, no. Your premiums tend to stay the same because you’re just drawing from the death benefit you already have. But, policies vary, so double-check with your insurer or advisor to see if there are any hidden costs or fees involved.

Are accelerated death benefits taxable?

Here’s a relief: in most cases, the money you get from accelerated death benefits isn’t taxable. It’s treated differently than other income since it’s an advance on your death benefit. But tax laws can be tricky, so it’s always smart to confirm with a tax professional, especially if you live in states with different rules or if you have other financial complexities.

How do I apply for accelerated death benefits?

Usually, you’ll need a written request and medical certification proving your qualifying condition. The insurance company will guide you through the paperwork. It’s not exactly a walk in the park, but it’s manageable—just be ready to share medical records and answer some questions.

Is this the right choice for me?

That’s the million-dollar question. Accelerated death benefits can feel like a lifeline during tough times, giving you breathing room when bills pile up or care costs spike. But it’s worth sitting down with someone who can run through the numbers and think about how it fits your family’s bigger picture—do you need immediate cash, or can you wait? Every situation’s unique.

If you’re feeling stuck or overwhelmed, definitely reach out for a no-pressure chat with an expert. Sometimes just talking it through helps spot the best path forward.

Conclusion: Key Takeaways and Next Steps to Protect Your Financial Future

Thinking about what is accelerated death benefit life insurance isn’t just about understanding a policy—it’s about preparing for life’s unexpected twists. Maybe you’re facing tough medical news or just planning ahead, the option to access your death benefit early can be a real lifesaver. But it’s not a free pass. It changes your life insurance in the background and needs to fit your unique financial puzzle.

Remember, this benefit can ease the financial crunch when medical bills stack up or when you need a bit of breathing room. Still, deciding to use it means weighing immediate relief against future protection for your loved ones. It’s not black and white.

So, what’s next for you? Don’t let overwhelm freeze you. Reach out for a friendly, no-pressure conversation with an expert who gets how life insurance really works—someone who can run the numbers with you and map out your best options.

At Life Care Benefit Services, that’s what we’re here for: making sure you’re not just covered, but covered in a way that actually helps when life gets complicated. Give us a call or request a quote today. Because peace of mind isn’t just about having insurance—it’s about knowing it’s there for you when you need it most.