Medication costs can sneak up on you. One day, you’re just managing your health; the next, you’re staring down bills that don’t quite add up. That’s where Medicare Part D comes in, offering prescription drug coverage—yet the catch is, not all plans are created equal, especially when it comes to cost and coverage.

Ever found yourself wondering, “How am I supposed to choose the right insurance plan that actually fits my budget and needs?” It’s a real headache. You want to avoid those unexpected co-pays or getting stuck with a plan that doesn’t cover your medications properly. And honestly, who has the time to sift through endless options trying to compare Medicare Part D plans cost coverage?

Here’s a little secret: comparing isn’t just about the monthly premium. There’s a whole dance between deductibles, formularies, tier levels, and out-of-pocket limits. Each piece plays a crucial role in how much you’ll really pay. A plan with a low premium might charge more when you fill a prescription, while a higher premium could save you money overall if your meds are covered well.

Imagine you’re picking a pair of shoes—not just style, but comfort and fit matter. Same with Part D plans. You need one that fits your health profile and financial comfort zone. So, to really make an informed choice, you need to get beyond just sticker prices and dig into what’s covered and what it’ll cost you through the year.

That’s why taking time to compare Medicare Part D plans cost coverage carefully can make a huge difference. It’s about peace of mind knowing that your prescriptions won’t be a surprise expense every month. And if this feels overwhelming, you’re not alone—that’s exactly why we’re here to help you navigate all these details with confidence and ease.

So let’s dive in and unravel the nuts and bolts of Medicare Part D plans. Ready to find the coverage that actually works for you? Let’s get started.

TL;DR

Choosing the right Medicare Part D plan isn’t just about the monthly premium—it’s the whole picture: deductibles, copays, and what meds are covered. Compare Medicare Part D plans cost coverage carefully to avoid surprise expenses and find a plan that fits your health and budget comfortably.

Need help? Taking time now to compare saves stress and money later.

1. Understanding Medicare Part D Plans: Basics and Benefits

Let’s be honest: the world of Medicare Part D can feel like a maze. You’ve got monthly premiums, deductibles, copays, and coverage rules swirling around. But understanding the basics isn’t just about decoding jargon—it’s about finding a plan that genuinely fits how you live and what you need.

So, what exactly is Medicare Part D? Simply put, it’s a Medicare-sponsored program that helps cover prescription drug costs. It’s optional but pretty important since skipping it might mean paying a late enrollment penalty later on according to official Medicare resources.

Here’s what you really need to know about Part D plans:

- There are two main types of Part D plans. You can pick a stand-alone prescription drug plan (PDP) if you have traditional Medicare or get drug coverage bundled with a Medicare Advantage plan (MA-PD). Think of it like choosing from a menu: either get the drugs-only dish or a full combo with other medical coverage.

- Costs go beyond just the monthly premium. Besides your monthly payment, there’s usually a deductible where you pay full price before coverage kicks in, plus copays or coinsurance for each prescription. And those costs can add up differently depending on your medications and usage.

- Coverage and formularies vary. Each plan has its own list of covered drugs—called a formulary—and sometimes requires prior authorizations or step therapy. It’s a bit like picking a phone plan where your favorite apps (or drugs) might be covered differently.

Curious if financial help is available? Many people qualify for the Extra Help program, which dramatically lowers premiums and out-of-pocket costs. If your income is below a certain level, you might pay little to nothing for your prescriptions—this can be a game-changer for affordability as reported by KFF’s detailed Medicare Part D analysis.

What about the yearly changes? Plans update their costs and formularies every year, so the plan that worked last year might not be the best fit now. That’s why it’s smart to compare Medicare Part D plans cost coverage annually rather than just stick with the same one.

Wondering how the costs actually break down in 2026?

- The base premium averages around $39, but your actual premium can be higher or lower depending on the plan and where you live.

- The deductible is about $615, after which you usually pay 25% of your drug costs until you hit an out-of-pocket limit of $2,100, then catastrophic coverage kicks in, meaning you pay very little or nothing for the rest of the year.

- High-income enrollees might pay an extra surcharge on top of the basic premium.

These details matter because two plans might have similar premiums but wildly different costs once you factor in deductibles, copays, and coverage limits. It’s like comparing two cars not by the sticker price but how much gas they gulp and repairs they need.

Bottom line? Knowing the basics of Medicare Part D plans is the foundation before you dive into comparing every cost and coverage detail. It’s worth tackling this now rather than facing surprise drug bills later. To start, check out official plan options on Medicare’s plan comparison tool and consider talking to an expert who knows the ins and outs.

2. Comparing Premium Costs Across Medicare Part D Plans

Let’s face it: premiums are the first thing that jump out when you start to compare Medicare Part D plans cost coverage. But here’s the kicker—not all premiums are created equal. You might find one plan boasting a low monthly cost, only to discover the deductible or copays quietly driving up your total spending way more than you expected.

So, how do you get a clear picture? Here are some eye-opening ways to look at it more like a pro:

1. Understand the Base Premium vs. Your Plan’s Premium

There’s a national average base premium set yearly—$36.78 in 2025—but remember, your actual plan’s premium will vary. It’s a bit like the sticker price on a car versus the price after add-ons and dealer fees. Some plans add charges based on extra benefits or specific drug coverages, while others focus on budget-friendly basics.

Want to see the full breakdown? The Kaiser Family Foundation explains how premiums are calculated in detail, along with recent changes that keep increases capped around 6% per year.

2. Don’t Forget the Late Enrollment Penalty

This is a sneaky cost that catches a lot of people off guard. If you don’t sign up for Part D when you’re first eligible and don’t have creditable drug coverage elsewhere, you could face an extra charge on your monthly premium. It adds 1% for each month you delayed. So, skipping it might mean a low premium today but a higher cost later.

3. Compare Stand-Alone Prescription Drug Plans vs. Medicare Advantage Plans

Here’s an eye-opener: Medicare Advantage plans that include drug coverage often have lower premiums for Part D than stand-alone drug plans. That’s partly thanks to how they use rebates to lower or even eliminate your monthly premium. In 2024, many Medicare Advantage enrollees paid little to nothing for drug coverage, while stand-alone plan premiums averaged higher. Curious? Check out official Medicare details on Medicare.gov’s Part D costs overview.

Sometimes, the cheapest plan upfront might cost you more in the long run because of differences in deductible, copays, and coverage phases. You know that feeling when you think you’re saving, but the bills at the pharmacy say otherwise? Yeah, it’s like that.

It’s smart to think about how much medicine you take yearly. Are you on many drugs, or just a couple? Plans vary in how they cover commonly used prescriptions versus rare meds. So, shed some light on your own drug list before deciding.

Ready for a quick visual guide on making sense of these costs? This video breaks it down in a way that’s easy to digest:

Before you get overwhelmed, remember: comparing Medicare Part D plans cost coverage isn’t a one-shot deal. Plans and your health needs evolve. So fall open enrollment? Take a fresh look. And if you ever feel stuck, reaching out to an expert can save loads of confusion and money down the road.

Want to get started smart? Grab your prescription list, note your budget for premiums, and explore the options side by side. It’s a bit like shopping for shoes—you want the right fit, not just the lowest price.

3. What You Need to Know About Deductibles and Copayments

Ever paid a medical bill and thought, “Wait, why am I paying this again?” If so, you’re not alone. Deductibles and copayments can feel like a maze when you’re trying to compare Medicare Part D plans cost coverage. They’re those out-of-pocket costs that sneak up before your insurance really kicks in.

1. What Exactly Is a Deductible?

Your deductible is basically the amount you pay each year before your Medicare Part D plan starts chipping in. Think of it like the “entrance fee” to your insurance benefits. For example, if your deductible is $480 (a common benchmark), you’ll be footing the full cost of your prescriptions until you hit that.

Here’s the catch — not all Part D plans have the same deductible. Some plans might have zero deductible, meaning coverage starts immediately, while others might ask you to pay more upfront. It’s a crucial detail because if you’re on expensive meds, a high deductible could hit your wallet hard early in the year.

2. Copayments: The Fees That Show Up After Deductibles

Once that deductible is behind you, copayments (or coinsurance) come into play. These are typically fixed amounts you pay for each prescription. It might be $10 for a generic drug or $50 for a brand-name one. Some plans charge a percentage, not a flat rate, so costs can vary.

Imagine this: You grab your monthly medicine, and at the counter, you pay a small fee — that’s your copay. Simple, right? But that simplicity varies by plan and drug tier. That’s why comparing copay structures is just as important as looking at the premiums.

3. How Deductibles and Copays Affect Your Overall Costs

It’s easy to get tangled up in premiums when you shop for plans, but the real expense often lies in those deductibles and copays. For example, a plan with a low premium but a high deductible might feel cheap at first but cost more long-term if you need lots of medication.

Plus, some plans have a coverage gap phase (aka the donut hole) that impacts what you pay out-of-pocket at certain points in the year. Knowing these cost phases can help you avoid surprise bills.

4. Quick Tips to Make These Numbers Work for You

- List your meds and see what each plan’s deductible and copay mean for those drugs.

- If you can, look for plans with no or low deductibles to avoid big upfront costs.

- Don’t forget to check if your plan offers extra help programs if you qualify — some help with premiums, deductibles, and copays.

So, does it feel a bit less confusing now? When you sit down to compare Medicare Part D plans cost coverage, keep your eyes peeled on those deductibles and copays. They can make a world of difference in what you actually pay throughout the year, not just the monthly premium.

And hey, if this still feels overwhelming, remember Life Care Benefit Services is here to help. We specialize in breaking down these details so you don’t have to.

4. Coverage Limits and the Donut Hole Explained

Let’s be honest: Medicare Part D cost details can feel like a maze. You’re trying to understand your coverage, but then you hit terms like “donut hole” and coverage limits that just add to the headache. If you’ve been scratching your head over what that means for your wallet, you’re not alone.

Here’s the deal. Starting in 2025, the infamous Part D donut hole – or coverage gap – is officially gone. That’s right, it’s been eliminated. Before, this donut hole was the tricky middle ground where your plan stopped paying the usual amount, and you ended up footing a bigger chunk of your drug bills. I’m guessing that’s not the kind of surprise anyone wants.

What happened to the donut hole?

Think about it this way: Up until the end of 2024, once your combined drug costs (yours plus your plan’s) hit a certain limit, you entered the donut hole. During this phase, you generally had to pay about 25% of the cost for your covered medications, while the plan paid the rest. Not terrible, but definitely more than the earlier coverage phase.

And this coverage gap could stretch on until you hit the catastrophic coverage spending threshold. Fun fact: in 2024, after spending around $8,000 out of pocket, you moved out of the donut hole and into catastrophic coverage, where drug costs became much more manageable.

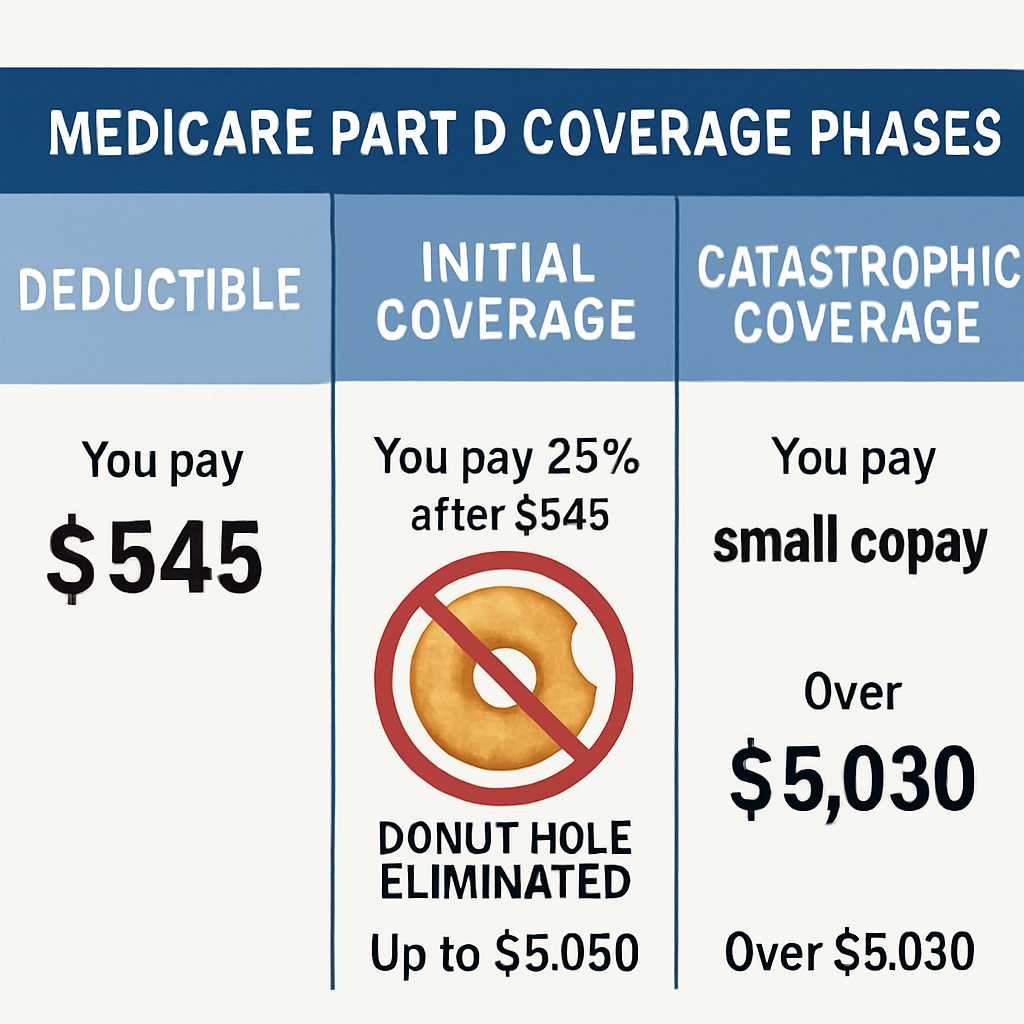

But now? The donut hole is history. As of January 1, 2025, the structure is simpler, with three main phases: the deductible phase, the initial coverage period, and catastrophic coverage. Medicare Interactive breaks down these phases clearly, and understanding them can save you from surprise costs.

So, what do these phases mean for you in real terms?

- Deductible phase: You pay full price for your drugs until you hit your plan’s deductible. This amount varies by plan, so knowing it upfront helps manage your expectations.

- Initial coverage period: After the deductible, your plan starts sharing drug costs with you, usually through copays or coinsurance.

- Catastrophic coverage: Once your out-of-pocket spending hits a certain level—think about $2,000 in 2025—you enter this phase where your plan covers nearly all drug costs for the rest of the year.

That’s a huge relief compared to past years when crossing the donut hole meant more stress and higher bills. The National Council on Aging explains this shift in detail and offers tips on how to use this new structure to your advantage.

Here’s a little pro tip: when you compare Medicare Part D plans cost coverage, don’t just look at monthly premiums. Scope out these limits and phases, especially how close the deductible and initial coverage phases are relative to your typical drug spending. Sometimes a plan with a higher premium but lower deductible and better cost sharing saves you serious cash.

And hey, if you’re still sweating over how to navigate all this, that’s completely normal. The good news? You’re not in this alone. Life Care Benefit Services specializes in untangling Medicare Part D’s confusing web so you get coverage that fits your needs and your budget. Understanding your coverage limits means less surprise bills and more peace of mind.

Bottom line? Getting clear on coverage limits—especially with the donut hole gone—puts you in the driver’s seat of your Medicare Part D plan. It’s about making these plans work for you, not the other way around.

So next time you’re comparing plans, ask yourself: How does this plan’s deductible and coverage phases line up with my medication needs? Knowing the answer is half the battle.

5. Comparing Formularies: Which Drugs are Covered?

It’s easy to get tangled up when comparing Medicare Part D plans cost coverage, especially when formularies—the list of drugs each plan covers—look like a tangled menu of medical terms. But here’s the thing: not all formularies are created equal, and which drugs they cover could make or break your budget and health.

So, why should you care about formularies? Well, imagine this: You pick a plan that looks affordable but skips or puts your essential medication on a “non-preferred” tier. Next thing you know, you’re staring down much higher out-of-pocket costs or even having to pay full price if the drug’s off the formulary. That can hit hard, especially if you rely on specialty or brand-name drugs.

1. Formularies Aren’t One-Size-Fits-All

Every Medicare Part D plan has its own formulary, meaning they choose which drugs to cover and how they’re tiered. Some cover a wide range of brand-name and generic meds, while others narrow their list to negotiate better prices. Plans must cover at least two drugs in each therapeutic category, but beyond that, there’s a lot of variation.

This means your usual prescriptions could be slapped with higher costs or not included at all. So, always check if your meds—even specific brands or generics—are listed and where.

2. Watch for Specialty Drugs and High-Cost Medications

Specialty drugs—those pricey treatments costing hundreds or thousands monthly—are a different beast. Even if they’re on the formulary, they’re often placed in higher tiers with coinsurance, meaning you pay a percentage of the cost, not a flat copay.

And if a specialty drug you need isn’t covered? Well, you might end up paying huge costs out of pocket, unless you can switch to a therapeutic alternative or get an exception approved. It’s a headache nobody wants.

3. Use the Medicare Plan Finder for Real Answers

The Medicare Plan Finder tool lets you plug in your prescriptions and compare which plans actually cover them—and how much you’ll pay. Handy, right? It reflects the latest formulary info, cost sharing, and even pharmacy preferences in your area.

But remember, the Plan Finder isn’t perfect: it doesn’t predict new prescriptions after enrollment or show all alternatives. Still, it’s a solid starting point to make sure your meds are covered and to choose the right Medicare Part D prescription plan that fits your needs.

Here’s a quick breakdown to make this easier:

| Factor | What to Look For | Why It Matters |

|---|---|---|

| Formulary Inclusion | Check if your exact drugs are listed | Makes sure your meds are covered; off-formulary means bigger bills |

| Tier Placement | Preferred vs. non-preferred or specialty tier | Impacts your out-of-pocket costs; higher tier = higher cost share |

| Utilization Management | Prior authorization, step therapy rules | May require extra approvals or trying other meds first |

Let me throw a quick tip your way: If your medication isn’t on the formulary of the plan you want, talk to your doctor about alternatives or ask your plan about exceptions. Sometimes, switching a drug or getting prior approval can save you thousands.

And if all this formularies stuff sounds overwhelming, don’t sweat it. You can lean on experts who specialize in navigating these tricky waters. At Life Care Benefit Services, we help you compare Medicare Part D plans cost coverage so you don’t miss the right drugs and get stuck paying too much. After all, it’s not just about price—it’s about peace of mind.

Curious how a formulary mismatch might mess with your budget? Some drugs cost up to 10 times more if they’re off the formulary. Think about that next time you glance over plan options.

For a deeper dive into plan details that suit your meds, check out the official Medicare site, or scour research like the Kaiser Family Foundation analysis that breaks down cost differences when drugs aren’t covered or are placed on pricey tiers.

Bottom line? When you compare Medicare Part D plans cost coverage, don’t just eyeball the premiums. Dive into the formulary details—knowing which drugs are covered and understanding their cost tiers puts you in control. Because covering the drugs you need is what really counts.

And hey, if this all still feels like a maze, just reach out. We’re here to help.

Sometimes souls need a little music to untangle the mind. While this isn’t exactly about music, choosing the right Medicare plan can feel just as complicated. We get it.

6. Additional Perks and Support Services to Consider

Choosing a Medicare Part D plan isn’t just about premiums and drug lists. Ever noticed how the little extras can actually make a big difference?

Let’s talk perks and support services that you might overlook but will definitely want in your corner.

Extra Help Program: When Budgeting Gets Tough

Money worries can sneak up on anyone, especially when medicine costs start piling up. That’s where the Extra Help program steps in — it’s designed for folks with limited income and resources to lower, or even cover, those Part D costs like deductibles and copays.

The best part? You can apply anytime, whether you’re just enrolling or already have a plan. Just gather some financial docs and give them a call at 1-800-772-1213 to set up an appointment.

Think of this as a safety net — there when you need it, keeping your prescriptions manageable without breaking the bank.

Medication Therapy Management: Your Safety Net for Complex Meds

If you’re juggling multiple medications for chronic conditions, you might qualify for Medication Therapy Management (MTM) services. Here’s the deal: a pharmacist or healthcare provider reviews your meds to spot potential interactions, make sure you’re taking them correctly, and help you navigate side effects.

This isn’t just paperwork. It’s like having a coach who watches your back so you can avoid harmful drug combos or mistakes.

MTM programs come at no extra cost if you qualify, which makes them a no-brainer benefit. Want to know if you’re eligible? Reach out to your Part D plan provider and ask. More details are available at the official Medicare site on safety management programs.

Drug Management Programs: Keeping Risky Medications in Check

Here’s one you might not expect—but it’s important for your safety. Some plans have drug management programs that monitor the use of opioids and benzodiazepines, especially if you’re getting these meds from multiple providers.

These programs make sure you’re not at risk for dangerous side effects like overdose or interactions with other drugs. They might limit coverage to certain pharmacies or doctors and always notify you before doing so.

It can feel a bit intrusive, but really, it’s about keeping you safe and avoiding medical mishaps. And if you disagree with a decision? There’s an appeal process—you’re never left out in the cold.

So, why do these perks matter?

Because when you compare Medicare Part D plans cost coverage, it’s easy to fixate on numbers. But these support services influence your real-world experience, your peace of mind, and how smoothly your medications fit into your life.

And let’s be honest: no one wants surprises at the pharmacy counter or last-minute headaches trying to get prescriptions approved.

Before you pick a plan, take a moment to explore these extras. Could one of these perks save you money, time, or stress down the line?

It might just be the difference between a plan that works for you and one that doesn’t.

Conclusion: Making an Informed Choice to Protect Your Health and Finances

Choosing the right Medicare Part D plan isn’t just about grabbing the lowest price tag. It’s about understanding what protecting your health truly means—without your wallet taking a hit you weren’t ready for.

Think about those moments when you’re juggling multiple prescriptions or counting on timely refills. Missing a detail in your plan could mean last-minute pharmacy surprises or paying more than you expected. And nobody wants that stress on top of everything else.

So, what’s the secret? It’s taking a little extra time to compare Medicare Part D plans cost coverage thoughtfully. Look beyond premiums. Peek at copays, drug formularies, and those support perks that smooth out the whole process.

And if it feels overwhelming, you’re not alone. That’s exactly why having reliable advice from folks like the team at Life Care Benefit Services can make a world of difference. We help you break down the jargon, point out what truly matters, and match you with a plan that fits your unique needs.

Ready to take charge and avoid surprises? Start by listing your medications, noting your preferred pharmacies, and then let’s explore your options together. Because protecting your health and finances doesn’t have to be a guessing game—it’s a smart choice you can make today.

Frequently Asked Questions About Comparing Medicare Part D Plans Cost Coverage

Feeling a little lost trying to compare Medicare Part D plans cost coverage? That’s completely normal. It’s like walking into an ice cream shop with a hundred flavors—exciting, but overwhelming.

What’s the first thing I should look at when comparing Medicare Part D plans?

Great question. Don’t just glance at the monthly premium and call it a day. Your plan’s drug formulary—basically, the list of covered medications—needs to match up with your specific prescriptions. Otherwise, you might pay more or, worse, find your meds aren’t fully covered.

How do copays and deductibles play into the total cost?

This trips a lot of folks up. Here’s what I mean: the monthly premium is just one piece. Deductibles are what you pay before your plan starts sharing costs, and copays or coinsurance are the amounts you pay when picking up meds. A plan with a low premium could have high copays, which quickly adds up if you need multiple prescriptions.

Can I use any pharmacy with my Medicare Part D plan?

Turns out, no. Some plans have preferred pharmacies offering lower prices, but if you go somewhere else, your costs could spike. If you have a pharmacy you trust or find convenient, double-check if it’s in the plan’s network before locking anything in.

What about coverage gaps—should I worry?

Ah, the dreaded “donut hole.” It’s a coverage gap that can cause your out-of-pocket costs to jump. While recent changes have softened its sting, it’s still something to watch out for because costs can sneakily increase mid-year if your spending hits certain levels.

Can I switch plans mid-year if I find a better option?

Here’s the kicker: usually, no. Medicare Part D plans generally lock you in during specific enrollment periods, so it pays to do your homework ahead of time. But there are exceptions—like qualifying life events—so it’s worth checking with a pro.

How do I avoid surprises or hidden costs?

The trick is detailed preparation. List all your medications with dosages, note your preferred pharmacies, and check each plan’s formulary and cost structure carefully. Sometimes, talking it through with a knowledgeable advisor (like at Life Care Benefit Services) can save you from nasty surprises down the road.

What’s the best way to make the final decision?

Honestly? Balance. You want a plan that’s affordable overall—not just a cheap monthly premium. Think about your health needs, budget, and the convenience of pharmacies. When you do that, comparing Medicare Part D plans cost coverage stops being a headache and starts feeling like you’re actually in control.

Ready to dive deeper into these questions and find the plan that really fits you? Reach out to the folks at Life Care Benefit Services. They’ll guide you through the details without jargon or pressure.